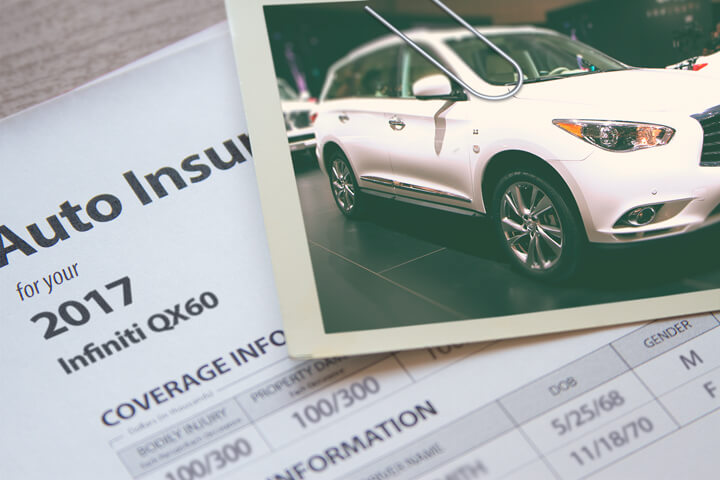

Infiniti Qx Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Finding cheaper auto insurance by quoting online is simple to do and at the same time you will probably save money. The critical component is to compare rates from all companies so you can get all your choices.

Finding the best direct price on auto insurance is challenging if you have never used online rate quotes. But don't be discouraged because there is an easy way to compare rates. To find the best auto insurance prices, there are several ways to compare rate quotes from auto insurance companies in your area. The fastest way to find competitive Infiniti Qx insurance quotes is to perform an online rate comparison. It is quite easy and can be accomplished by completing this short form.

Insurance rates on an Infiniti Qx will vary greatly subject to many criteria. Taken into consideration are:

- Traffic citations increase rates

- Your credit history

- The size of your community

- The number of annual miles

- Male drivers pay higher rates

- Low deductibles cost more

- Your vehicle's safety rating

- Your profession

- The amount of protection requested

- Whether you rent or own your home

One last important factor which can affect the rate you pay on your Infiniti Qx is the year of manufacture. Models that are a few years old have a reduced actual cash value so the cost to replace them can decrease annual premiums. But new Qx models may have options including adaptive headlights, anti-lock brakes, traction control, and a telematics system so those may give discounted rates.

Liability coverages

damages or injuries you inflict on things such as emergency aid, pain and suffering, and medical services. .

Collision coverage

an object or car. . , . .

Comprehensive (Other than Collision)

that is not covered by collision coverage. . you can receive from a comprehensive claim , .

UM/UIM (Uninsured/Underinsured Motorist) coverage

This . , . .

Coverage for medical payments

expenses doctor visits, EMT expenses, and X-ray expenses. . .

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2024

- Cheapest Jeep Insurance Rates in 2024

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Jeep Grand Cherokee Insurance

- Chevrolet Silverado Insurance

- Chevrolet Traverse Insurance

- Toyota Camry Insurance

- Toyota Rav4 Insurance

- GMC Sierra Insurance

- Honda CR-V Insurance

- Ford Focus Insurance

- Ford F-150 Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area