BMW X3 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

If you are here, you are probably wondering what the average insurance cost for a BMW X3 is or if BMWs are worth buying. BMW insurance rates can be expensive, but our guide will prepare you for average costs and show you how to find affordable BMW X3 insurance quotes.

Our guide goes over average rates, repair costs, crash ratings, and more, so you will have a good idea of ownership costs and how to secure cheap car insurance rates.

Before you buy BMW X3 auto insurance make sure you shop around.

If you want to jump right into finding the average car insurance cost for a BMW X3, enter your five-digit ZIP code into our FREE online tool above.

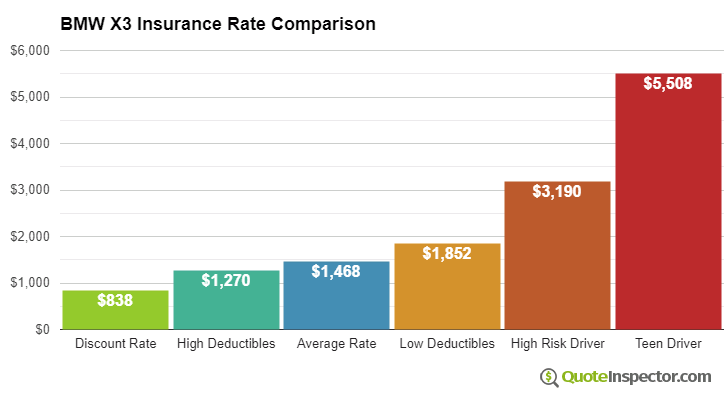

The average insurance rates for a BMW X3 are $1,468 a year with full coverage. Comprehensive costs on average $304 a year, collision costs $564, and liability coverage is estimated at $442. Liability-only coverage costs approximately $496 a year, with high-risk coverage costing around $3,190. Teens cost the most to insure at $5,508 a year or more.

Average premium for full coverage: $1,468

Policy rates by type of insurance:

Prices are based on $500 policy deductibles, bodily injury liability limits of 30/60, and includes uninsured/under-insured motorist coverage. Prices are averaged for all U.S. states and X3 trim levels.

Price Range Variability

Using a 40-year-old driver as an example, BMW X3 insurance rates go from as low as $496 for your basic liability-only policy to a high of $3,190 for a driver who has had serious violations or accidents.

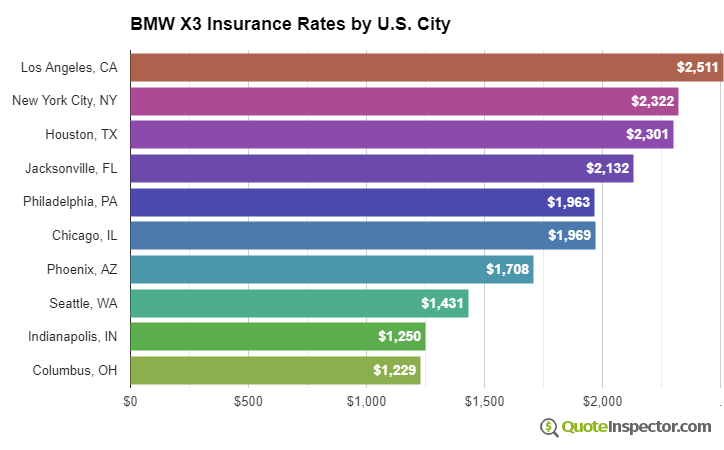

Urban vs. Rural Price Range

Living in a larger city has a large influence on auto insurance rates. Rural areas are shown to have a lower frequency of collision claims than cities with more traffic congestion.

The diagram below illustrates how rural and urban location affects car insurance rates.

The examples above demonstrate why it is important to get quotes based on a specific location and risk profile, rather than using averaged prices.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

More Rate Information

The chart below details estimated BMW X3 insurance rates for different risk profiles and scenarios.

- The cheapest rate after discounts is $838

- Choosing higher $1,000 deductibles can save around $1,270 annually

- The average rate for a good driver age 40 with $500 deductibles is $1,468

- Selecting low $100 deductibles for comp and collision coverage will increase the cost to $1,852

- Drivers with serious driving violations could pay upwards of $3,190 or more

- Policy cost for full coverage for a teenage driver may cost $5,508 each year

Insurance rates for a BMW X3 also range considerably based on your risk profile, the trim level and model year, and policy deductibles and limits.

Older drivers with no violations or accidents and high deductibles may only pay around $1,400 annually on average, or $117 per month, for full coverage. Rates are much higher for teenagers, where even good drivers should be prepared to pay upwards of $5,500 a year. View Rates by Age

Your home state plays a big part in determining prices for BMW X3 insurance rates. A good driver about age 40 could pay as low as $1,060 a year in states like New Hampshire, Ohio, and Utah, or have to pay at least $1,980 on average in Florida, Michigan, and New York.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,328 | -$140 | -9.5% |

| Alaska | $1,126 | -$342 | -23.3% |

| Arizona | $1,220 | -$248 | -16.9% |

| Arkansas | $1,468 | -$0 | 0.0% |

| California | $1,674 | $206 | 14.0% |

| Colorado | $1,404 | -$64 | -4.4% |

| Connecticut | $1,510 | $42 | 2.9% |

| Delaware | $1,662 | $194 | 13.2% |

| Florida | $1,838 | $370 | 25.2% |

| Georgia | $1,356 | -$112 | -7.6% |

| Hawaii | $1,056 | -$412 | -28.1% |

| Idaho | $994 | -$474 | -32.3% |

| Illinois | $1,094 | -$374 | -25.5% |

| Indiana | $1,106 | -$362 | -24.7% |

| Iowa | $990 | -$478 | -32.6% |

| Kansas | $1,396 | -$72 | -4.9% |

| Kentucky | $2,004 | $536 | 36.5% |

| Louisiana | $2,176 | $708 | 48.2% |

| Maine | $906 | -$562 | -38.3% |

| Maryland | $1,212 | -$256 | -17.4% |

| Massachusetts | $1,176 | -$292 | -19.9% |

| Michigan | $2,550 | $1,082 | 73.7% |

| Minnesota | $1,228 | -$240 | -16.3% |

| Mississippi | $1,760 | $292 | 19.9% |

| Missouri | $1,304 | -$164 | -11.2% |

| Montana | $1,578 | $110 | 7.5% |

| Nebraska | $1,158 | -$310 | -21.1% |

| Nevada | $1,762 | $294 | 20.0% |

| New Hampshire | $1,056 | -$412 | -28.1% |

| New Jersey | $1,642 | $174 | 11.9% |

| New Mexico | $1,300 | -$168 | -11.4% |

| New York | $1,548 | $80 | 5.4% |

| North Carolina | $846 | -$622 | -42.4% |

| North Dakota | $1,202 | -$266 | -18.1% |

| Ohio | $1,016 | -$452 | -30.8% |

| Oklahoma | $1,510 | $42 | 2.9% |

| Oregon | $1,346 | -$122 | -8.3% |

| Pennsylvania | $1,402 | -$66 | -4.5% |

| Rhode Island | $1,960 | $492 | 33.5% |

| South Carolina | $1,330 | -$138 | -9.4% |

| South Dakota | $1,240 | -$228 | -15.5% |

| Tennessee | $1,288 | -$180 | -12.3% |

| Texas | $1,770 | $302 | 20.6% |

| Utah | $1,088 | -$380 | -25.9% |

| Vermont | $1,006 | -$462 | -31.5% |

| Virginia | $880 | -$588 | -40.1% |

| Washington | $1,136 | -$332 | -22.6% |

| West Virginia | $1,346 | -$122 | -8.3% |

| Wisconsin | $1,016 | -$452 | -30.8% |

| Wyoming | $1,308 | -$160 | -10.9% |

Choosing higher comprehensive and collision insurance deductibles can save as much as $590 a year, while buying higher liability limits will cost you more. Moving from a 50/100 limit to a 250/500 limit will raise rates by up to $398 more each year. View Rates by Deductible or Liability Limit

If you have a few points on your driving record or tend to cause accidents, you may be forking out at a minimum $1,800 to $2,400 additional every year, depending on your age. A high-risk auto insurance policy ranges around 44% to 137% more than the average policy. View High Risk Driver Rates

Because rates have so much variability, the best way to find out exactly what you will pay is to get quotes and see how they stack up. Each auto insurer calculates rates differently, and rates will be varied from one company to the next.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2019 BMW X3 | $304 | $564 | $442 | $1,468 |

| 2018 BMW X3 | $292 | $524 | $452 | $1,426 |

| 2013 BMW X3 | $236 | $356 | $474 | $1,224 |

| 2008 BMW X3 | $180 | $224 | $468 | $1,030 |

| 2006 BMW X3 | $176 | $208 | $452 | $994 |

| 2005 BMW X3 | $160 | $198 | $446 | $962 |

| 2004 BMW X3 | $154 | $188 | $442 | $942 |

Rates are averaged for all BMW X3 models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Find Affordable BMW X3 Insurance

Finding cheaper rates on auto insurance takes avoiding accidents and claims, having a good credit history, not filing small claims, and insuring your home and auto with the same company. Set aside time to shop around every other policy renewal by getting rate quotes from direct companies like GEICO, Progressive, and Esurance, and also from local insurance agents.

The points below are a brief review of the ideas that were raised in the charts and tables above.

- Drivers under the age of 20 pay higher rates, as much as $459 each month including comprehensive and collision insurance

- Drivers with DUI or reckless driving convictions may be required to pay an average of $1,720 more each year to insure a BMW X3

- Increasing comprehensive and collision deductibles can save around $575 each year

- You may be able to save as much as $180 per year simply by quoting early and online

By getting multiple insurance quotes from BMW X3 car insurance companies, you can save almost $200 a year. However, poor driving records can raise your rates substantially.

Whether you are looking for 2005 or 2020 BMW X3 insurance rates, or maybe BMW X3 car insurance rates for an 18-year old, this guide can help.

To find out what else determines the price of car insurance, keep reading. The more you know, the more likely you are to find cheap BMW X3 car insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does the size and class of the BMW X3 affect liability rates?

What does liability insurance cover? Liability insurance is valuable coverage, as it protects you from being sued and criminal charges if you cause an accident. How? Liability insurance pays for the other driver’s medical bills and property damage bills. Since liability insurance is required in most states, not having it is breaking the law.

However, liability insurance can be expensive, depending on how risky your car is to insure. Typically, the riskiest cars to insure with liability insurance are cars prone to crashing or larger, heavier vehicles.

The BMW X3 is a midsize luxury SUV, though, so it probably won’t be plowing through other vehicles in a crash. In fact, according to the Insurance Institute for Highway Safety, the BMW X3 has better property damage liability losses than most midsize SUVs.

The property damage liability losses equal -37 percent, which is substantially better than average for a mid-size, luxury SUV. This is great news. It means you shouldn’t have a higher than average rate on your liability insurance for your BMW X3.

What does liability insurance cost for the BMW X3?

How much does insurance cost for a BMW? While your liability insurance likely won’t be expensive, we do want to give you an approximation of rates. To do this, we got sample rates from a Geico quote. Our quote is based on a 40-year-old male driver who lives in Pennsylvania, owns his 2020 BMW X3, has a clean driving record, and drives an average of 13,000 miles a year.

The first set of rates you are looking at is coverage level prices for bodily injury liability insurance.

- Low ($15,000/$30,000): $44.19

- Medium ($100,000/$200,000): $90.58

- High ($500,000/$500,000): $145.82

It will cost you roughly $101 to upgrade from low to high coverage. This may seem high, but these prices are for a six-month policy. Your monthly rate increase will, therefore, only be $17 a month.

The monthly rate increases for property damage liability insurance are lower. As the rates below show, you can increase your low coverage to high for only $10 a month.

- Low ($5,000): $452.83

- Medium ($20,000): $486.20

- High ($100,000): $510.58

These prices aren’t bad, but you may be able to save more by shopping around at insurers for the average insurance cost for a BMW X3.

What are the safety features and ratings of the BMW X3?

The 2020 BMW X3 has some great safety features. If insurers offer vehicle safety discounts, you could certainly gain at least a small discount with the features included in the standard model. According to AutoBlog’s review, the following safety features are in the 2020 BMW X3.

- Features that prevent crashes: anti-lock brakes and stability control.

- Features that protect in crashes: front-impact airbags, side-impact airbags, overhead airbags, knee airbags, and seatbelt pretensioners.

- Features that prevent theft: vehicle intrusion alarm and ignition disable device.

The BMW X3 has all the airbags possible, which is great. It means that you are less likely to be injured. The 2019 BMW X3 also has a great crash test rating from the IIHS. It won the IIHS’s 2019 Top Safety Pick award (only for X3 models with optional front crash prevention and specific headlights).

The ratings below show the breakdown of the crash tests on the 2019 BMW X3.

- Small overlap front (driver-side): Good

- Small overlap front (passenger-side): Good

- Moderate overlap front: Good

- Side: Good

- Roof strength: Good

- Head restraints and seats: Good

Since good is the highest rating possible, the 2019 BMW X3 did great in all the various crash tests. The video below shows an example of one of the crash tests.

To see the BMW X3 crash test ratings from the National Highway Traffic Safety Administration, check out the table below.

BMW X3 Crash Test Ratings| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2020 BMW X3 SUV RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 BMW X3 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 BMW X3 M SUV AWD | N/R | N/R | N/R | N/R |

| 2020 BMW X3 30e xDrive SUV AWD | N/R | N/R | N/R | N/R |

| 2019 BMW X3 SUV RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 BMW X3 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 BMW X3 SUV RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 BMW X3 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 BMW X3 SUV RWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 BMW X3 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

A 5-star rating is the highest possible score given by the National Highway Traffic Safety Administration. Overall, the various BMW X3 models performed well.

Another factor insurers may look at is crash fatalities for SUVS in comparison to pickups and cars. The IIHS’s 2018 data showed that driver deaths per million vehicles were as follows:

- SUVs: 23 fatalities

- Pickups: 34 fatalities

- Cars: 48 fatalities

SUVs have the lowest driver fatality numbers out of the three types of vehicles. The next set of fatalities is for all occupant deaths per million vehicles.

- SUVs: 32 fatalities

- Pickups: 42 fatalities

- Cars: 69 fatalities

Why do SUVs consistently have lower fatality numbers? Generally, SUVs do better in crashes than cars and pickups, as they are usually larger and heavier. The next set of fatalities shows total SUV fatality numbers for 2018 by crash type.

- Frontal Impact: 2,784 fatalities

- Side Impact: 930 fatalities

- Rear Impact: 286 fatalities

- Other (mostly rollovers): 1,035 fatalities

The SUVs’ total fatalities (5,035) are fewer than car fatalities (13,138) but slightly more than pickup fatalities (4,369). Overall, the BMW X3’s great safety ratings, features, and SUV fatalities mean you should have lower rates on your car insurance.

What is the MSRP of the BMW X3?

Insurers usually use the manufacturer suggested retail price to calculate rates for collision and comprehensive coverages. Why? MSRP gives insurers an idea of how much repairs and replacement will cost after an accident. Since collision and comprehensive coverage pay for repairs for your vehicle, regardless of who caused the accident, it makes sense that these are the two coverages whose prices will be the most affected.

- What is collision insurance and what does it cover? Collision coverage pays for repairs after collisions with other vehicles or objects (such as a mailbox).

- What is comprehensive coverage on a car insurance policy? Comprehensive coverage pays for repairs after animal collisions, weather damage, natural disasters, theft, and vandalism.

So what is the MSRP of the BMW X3? According to Kelley Blue Book (KBB), the prices of the 2020 BMW X3 are as follows:

- MSRP: $42,945

- Invoice Price: $40,510

- Fair Purchase Price: $39,543

- Fair Market Range: $37,811 to $41,274

The MSRP is a fixed price, but the other prices are constantly changing. The invoice price is the price sellers mark a car as, while the fair purchase price is the price most people are paying. Generally, the invoice price and fair purchase price are below the MSRP.

You may wonder if it is worth getting a used BMW to save some money, but insurance rates aren’t necessarily cheaper for an older vehicle. If the insurance loss history (claims paid) on your vehicle type is good, insurers will take this into consideration.

Unfortunately, the IIHS’s insurance losses by make and model for the BMW X3 aren’t great.

- Collision Insurance Losses: 25 percent (worse than average)

- Comprehensive Insurance Losses: 42 percent (substantially worse than average)

See more details about the BMW X3 insurance loss probability in the table below.

| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | 25% |

| Property Damage | -37% |

| Comprehensive | 42% |

| Personal Injury | -36% |

| Medical Payment | no data |

| Bodily Injury | no data |

The higher loss numbers mean you may have a slightly higher rate than other SUV owners. However, the BMW X3 also received better than average insurance loss ratios for property damage and personal injury.

The good news is that because the BMW X3 has great crash ratings, this will help cancel out the poor insurance losses and keep your rates at a reasonable level.

How much will it cost to repair my BMW X3?

Are BMW X3 expensive to run? How much is an oil change for a BMW X3? Repair costs for your BMW X3 will affect your average car insurance rates, so it is important to know what the average maintenance costs are for the BMW X3. The bad news is that RepairPal’s reliability rating for the BMW X3 was poor.

Its reliability rating is only 2.5 out of five, which means average maintenance costs are high. The average annual repair cost is $1,034 for the BMW X3, which includes maintenance like oil changes. This is higher than the average for luxury compact SUVs, which is $859.

The good news is that repair costs for dings and dents on your BMW X3 are normal. We got sample estimates for level two damage to a 2020 BMW X3 from InstantEstimator’s free tool.

- Front bumper: $413

- Rear bumper: $423

- Hood: $387

- Roof: $471

- Front door: $391

- Back door: $379

- Fender: $351

- Quarter panel: $363

The cost to repair the roof on a BMW X3 is higher than usual but not extremely high. These repair estimates are normal, but you can get lower rates by getting quotes from different repair shops.

Hopefully, our guide has also given you an idea of how much insurance costs for a BMW X3 and how to save on car insurance.

If you want to start finding average insurance costs for a BMW X3 today, just enter your ZIP code into our FREE online rate tool to get started.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,508 |

| 20 | $3,398 |

| 30 | $1,532 |

| 40 | $1,468 |

| 50 | $1,342 |

| 60 | $1,316 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,852 |

| $250 | $1,674 |

| $500 | $1,468 |

| $1,000 | $1,270 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,468 |

| 50/100 | $1,556 |

| 100/300 | $1,667 |

| 250/500 | $1,954 |

| 100 CSL | $1,601 |

| 300 CSL | $1,844 |

| 500 CSL | $2,021 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $7,862 |

| 20 | $5,418 |

| 30 | $3,256 |

| 40 | $3,190 |

| 50 | $3,046 |

| 60 | $3,020 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $79 |

| Multi-vehicle | $78 |

| Homeowner | $22 |

| 5-yr Accident Free | $109 |

| 5-yr Claim Free | $96 |

| Paid in Full/EFT | $68 |

| Advance Quote | $73 |

| Online Quote | $105 |

| Total Discounts | $630 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area