Buick Lucerne Super Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

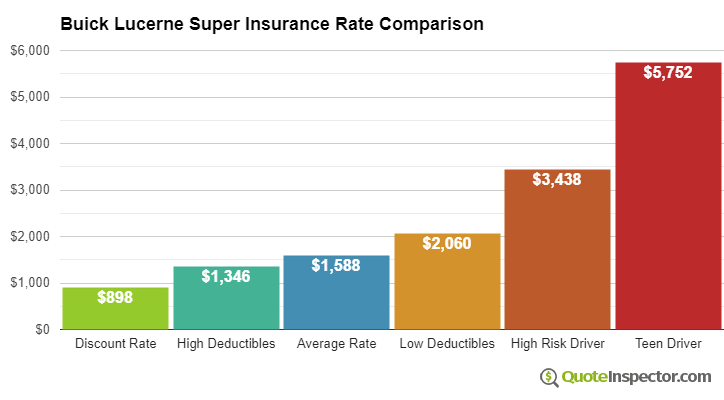

U.S. average insurance rates for a Buick Lucerne Super are $1,588 a year including full coverage. Comprehensive costs on average $368, collision costs $698, and liability coverage costs around $364. Just liability insurance costs as low as $430 a year, with coverage for high-risk drivers costing around $3,438. Teen drivers pay the highest rates at $5,752 a year or more.

Annual premium for full coverage: $1,588

Price estimates by type of coverage:

40-year-old driver, full coverage with $500 deductibles, and good driving record

Price Range for Insurance for this Buick Lucerne Trim Level

For a driver around age 40, Buick Lucerne Super insurance prices go from the low end price of $430 for just the minimum liability insurance to the much higher price of $3,438 for a high-risk insurance policy.

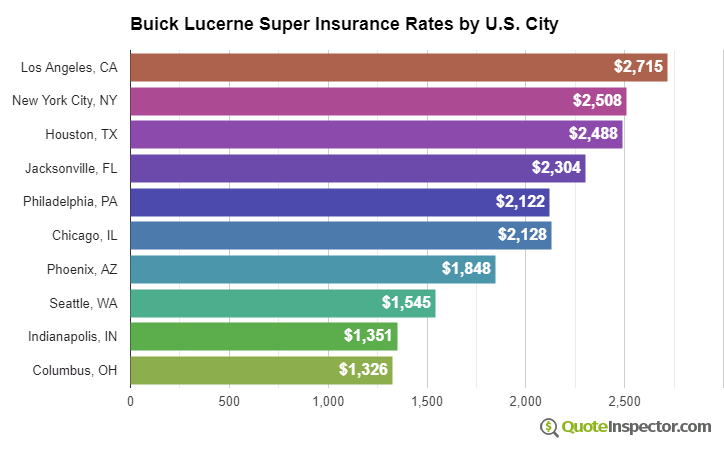

Geographic Price Range

Where you live has a large influence on car insurance rates. Rural areas have lower incidents of comprehensive and collision claims than larger metro areas.

The example below illustrates the difference between rural and urban areas on car insurance rates.

These price ranges highlight why everyone should compare prices based on a specific location, rather than using price averages.

Use the form below to get rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Recommended Companies for Cheap Buick Lucerne Super Insurance

Insurance rates for a Buick Lucerne Super are also quite variable based on the replacement cost of your Lucerne, your driving record and age, and policy deductibles and limits.

If you have some driving violations or you caused an accident, you are likely paying at a minimum $1,900 to $2,500 extra each year, depending on your age. Buick Lucerne Super insurance for high-risk drivers can be around 43% to 134% more than average. View High Risk Driver Rates

A more mature driver with a clean driving record and higher comprehensive and collision deductibles may only pay around $1,500 a year for full coverage. Prices are highest for teenage drivers, since even teens with perfect driving records can expect to pay upwards of $5,700 a year. View Rates by Age

The state you live in has a huge impact on Buick Lucerne Super insurance rates. A driver around age 40 might see prices as low as $1,060 a year in states like , Indiana, and North Carolina, or as much as $1,950 on average in Michigan, Montana, and Louisiana. Rates by state and city are shown later in the article.

Choosing high deductibles could cut prices by as much as $720 a year, whereas buying more liability protection will cost you more. Changing from a 50/100 bodily injury protection limit to a 250/500 limit will increase rates by as much as $327 more per year. View Rates by Deductible or Liability Limit

Since prices can be so different, the best way to figure out exactly what you will pay is to regularly compare prices and see how they stack up. Each insurance company uses a different rate calculation, so the rates may be quite different.

The chart above shows average Buick Lucerne Super insurance prices for different risks and coverage choices. The cheapest price with discounts is $898. Drivers who choose higher $1,000 deductibles will pay $1,346. The average price for a 40-year-old male driver using $500 deductibles is $1,588. Selecting more expensive $100 deductibles for collision and other-than-collision coverage could cost up to $2,060. High risk drivers could be charged at least $3,438. The rate for full coverage insurance for a teen driver can be as high as $5,752.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,434 | -$154 | -9.7% |

| Alaska | $1,218 | -$370 | -23.3% |

| Arizona | $1,320 | -$268 | -16.9% |

| Arkansas | $1,588 | -$0 | 0.0% |

| California | $1,810 | $222 | 14.0% |

| Colorado | $1,518 | -$70 | -4.4% |

| Connecticut | $1,634 | $46 | 2.9% |

| Delaware | $1,798 | $210 | 13.2% |

| Florida | $1,986 | $398 | 25.1% |

| Georgia | $1,466 | -$122 | -7.7% |

| Hawaii | $1,142 | -$446 | -28.1% |

| Idaho | $1,074 | -$514 | -32.4% |

| Illinois | $1,182 | -$406 | -25.6% |

| Indiana | $1,196 | -$392 | -24.7% |

| Iowa | $1,072 | -$516 | -32.5% |

| Kansas | $1,510 | -$78 | -4.9% |

| Kentucky | $2,166 | $578 | 36.4% |

| Louisiana | $2,352 | $764 | 48.1% |

| Maine | $980 | -$608 | -38.3% |

| Maryland | $1,310 | -$278 | -17.5% |

| Massachusetts | $1,270 | -$318 | -20.0% |

| Michigan | $2,760 | $1,172 | 73.8% |

| Minnesota | $1,328 | -$260 | -16.4% |

| Mississippi | $1,904 | $316 | 19.9% |

| Missouri | $1,408 | -$180 | -11.3% |

| Montana | $1,706 | $118 | 7.4% |

| Nebraska | $1,252 | -$336 | -21.2% |

| Nevada | $1,906 | $318 | 20.0% |

| New Hampshire | $1,146 | -$442 | -27.8% |

| New Jersey | $1,776 | $188 | 11.8% |

| New Mexico | $1,406 | -$182 | -11.5% |

| New York | $1,672 | $84 | 5.3% |

| North Carolina | $916 | -$672 | -42.3% |

| North Dakota | $1,302 | -$286 | -18.0% |

| Ohio | $1,096 | -$492 | -31.0% |

| Oklahoma | $1,632 | $44 | 2.8% |

| Oregon | $1,456 | -$132 | -8.3% |

| Pennsylvania | $1,516 | -$72 | -4.5% |

| Rhode Island | $2,118 | $530 | 33.4% |

| South Carolina | $1,440 | -$148 | -9.3% |

| South Dakota | $1,340 | -$248 | -15.6% |

| Tennessee | $1,390 | -$198 | -12.5% |

| Texas | $1,914 | $326 | 20.5% |

| Utah | $1,176 | -$412 | -25.9% |

| Vermont | $1,088 | -$500 | -31.5% |

| Virginia | $950 | -$638 | -40.2% |

| Washington | $1,226 | -$362 | -22.8% |

| West Virginia | $1,456 | -$132 | -8.3% |

| Wisconsin | $1,100 | -$488 | -30.7% |

| Wyoming | $1,416 | -$172 | -10.8% |

Rate Tables and Charts

Not your model?

Choose a different trim level below

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,752 |

| 20 | $3,672 |

| 30 | $1,668 |

| 40 | $1,588 |

| 50 | $1,448 |

| 60 | $1,422 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $2,060 |

| $250 | $1,842 |

| $500 | $1,588 |

| $1,000 | $1,346 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,588 |

| 50/100 | $1,661 |

| 100/300 | $1,752 |

| 250/500 | $1,988 |

| 100 CSL | $1,697 |

| 300 CSL | $1,897 |

| 500 CSL | $2,043 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $8,242 |

| 20 | $5,838 |

| 30 | $3,530 |

| 40 | $3,438 |

| 50 | $3,280 |

| 60 | $3,250 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $86 |

| Multi-vehicle | $82 |

| Homeowner | $22 |

| 5-yr Accident Free | $124 |

| 5-yr Claim Free | $103 |

| Paid in Full/EFT | $78 |

| Advance Quote | $81 |

| Online Quote | $114 |

| Total Discounts | $690 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area