Find Cheaper Phoenix, AZ Car Insurance Rates in 2025

Enter your Arizona Auto Insurance zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

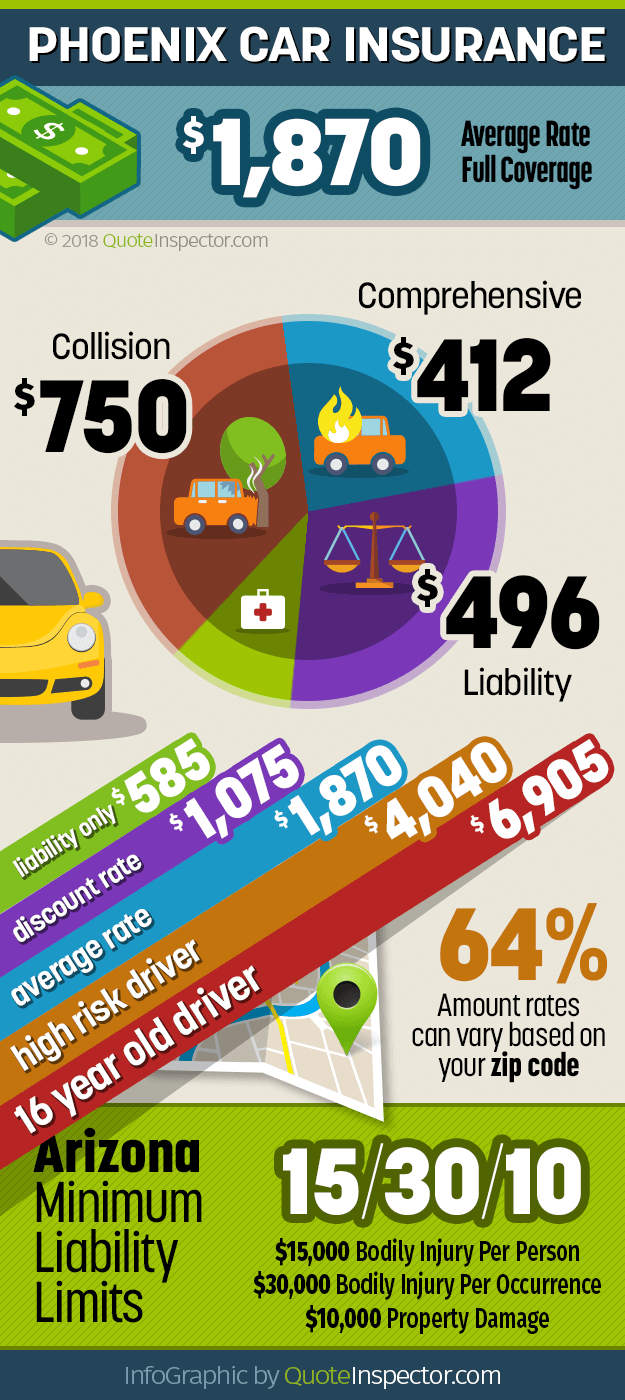

Phoenix Car Insurance rates average around $1,870 a year for full coverage, with comprehensive insurance costing $412, collision insurance costing $750, and liability insurance costing $496 for an average vehicle. Good drivers may find discount rates as low as $1,075, while higher risk drivers could see rates exceed $4,000 a year. State Farm, GEICO, and Progressive are the most popular auto insurers in Arizona, but The Hartford tends to have the overall cheapest rates.

If full coverage is not required, drivers could find liability-only coverage for as little as $48 a month, depending on the limits required. Arizona requires drivers to carry minimum bodily injury liability of $15,000 per person and $30,000 per accident, with minimum property damage liability of $10,000.

The information below details the average cost of car insurance, rates for high-risk and teen drivers, rates by vehicle make and model, average rates and discounts by company, and additional information.

Annual premium for full coverage: $1,630

:

Average rates are figured based on a 40-year-old driver with a good driving record, full coverage with $500 physical damage deductibles, 30/60/30 liability limits, and rated for an average passenger sedan.

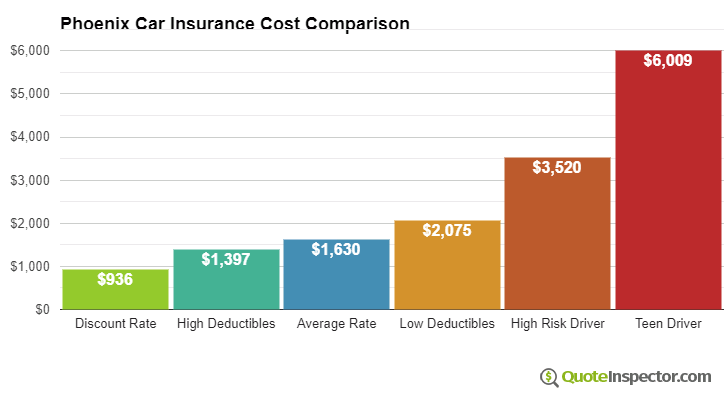

Price Range for Phoenix Car Insurance Rates

Drivers will find the cheapest rates for a liability-only policy, which is the minimum coverage required for any vehicle in Arizona. Adding full coverage (comprehensive and collision insurance) adds approximately $1,285 a year to the cost of a policy. Higher deductibles can lower this cost by around $260 a year, while lower deductibles could cost over $510 a year more.

Drivers with excessive minor driving violations or major violations like DUI, reckless driving, or driving on a suspended license, could pay as much as $180 a month more than the average good driver. They may be required to purchase insurance from a non-standard company, which specializes in high-risk car insurance.

Auto insurance prices can be significantly different based on exactly where you live in Phoenix. To get the most accurate assessment of how much coverage will cost, enter your zip code below for a list of companies that offer low online rates.

Enter your Phoenix zip code below to view companies that have cheap auto insurance rates.

Phoenix Car Insurance Rates by Vehicle Make and Model

The type of vehicle you drive has a significant impact on how much car insurance costs. Vehicles with more performance, higher price tags, or increased frequency of liability claims will cost more to insure. Lower-cost vehicles with excellent safety ratings generally have the best insurance rates in Phoenix.

| Make and Model | Annual Premium | Monthly Premium |

|---|---|---|

| Chevrolet Silverado | $1,728 | $144 |

| Dodge Ram | $1,775 | $148 |

| Ford Escape | $1,358 | $113 |

| Ford Focus | $1,582 | $132 |

| Ford Fusion | $1,730 | $144 |

| Ford F-150 | $1,534 | $128 |

| GMC Acadia | $1,504 | $125 |

| GMC Sierra | $1,694 | $141 |

| Honda Accord | $1,523 | $127 |

| Honda Civic | $1,786 | $149 |

| Honda CR-V | $1,322 | $110 |

| Honda Pilot | $1,551 | $129 |

| Hyundai Sonata | $1,660 | $138 |

| Kia Optima | $1,691 | $141 |

| Nissan Altima | $1,677 | $140 |

| Nissan Rogue | $1,644 | $137 |

| Toyota Camry | $1,663 | $139 |

| Toyota Corolla | $1,630 | $136 |

| Toyota Prius | $1,515 | $126 |

| Toyota RAV4 | $1,540 | $128 |

| Get Rates for Your Vehicle Go | ||

Phoenix Car Insurance Providers by Market Share and Average Price

State Farm insures the most vehicles in the state of Arizona, with over 17% of the written premium. GEICO and Progressive tend to be slightly cheaper on average than State Farm, and those two companies have a combined 23.1% of the Arizona auto insurance market.

Rates for these top ten companies are averaged for the entire state of Arizona, so since Phoenix has some of the higher rates in the state, average prices will be approximately 40% higher in that market.

| Rank | Company | Market Share | Average Rate |

|---|---|---|---|

| 1 | State Farm | 17.40% | $1,350 |

| 2 | Geico | 13.43% | $1,154 |

| 3 | Progressive | 9.67% | $1,141 |

| 4 | Farmers Insurance | 8.84% | $1,364 |

| 5 | Allstate | 8.67% | $2,170 |

| 6 | USAA | 7.20% | $1,102 |

| 7 | American Family | 5.78% | $1,449 |

| 8 | Liberty Mutual | 5.36% | $2,213 |

| 9 | The Hartford | 2.85% | $828 |

| 10 | CSAA | 2.12% | $1,201 |

| Get Your Rates Go | |||

Source: National Association of Insurance Commissioners (NAIC) 2015 Market Share Report and The Zebra

Drivers who qualify for multiple discounts could pay as much as 42% less than the average rates. The table below lists many types of discounts and which are available from each company.

| Discount | Geico | Allstate | State Farm | Progressive |

|---|---|---|---|---|

| Bundled policies | Yes | Yes | Yes | Yes |

| Multi-vehicle | Yes | No | Yes | Yes |

| Theft prevention | Yes | Yes | Yes | Yes |

| Anti-lock brakes | Yes | Yes | Yes | No |

| Passive restraint | Yes | Yes | Yes | No |

| Daytime running lights | Yes | No | Yes | No |

| Newer vehicle | No | Yes | Yes | No |

| No accidents | Yes | Yes | Yes | Yes |

| Defensive driver | Yes | Yes | Yes | Yes |

| Active duty military | Yes | No | Yes | Yes |

| Employment | Yes | No | No | No |

| Full payment | Yes | Yes | No | Yes |

| Auto-pay | Yes | Yes | No | Yes |

| Loyalty | No | No | Yes | Yes |

| Early signing | No | Yes | No | No |

| Good grades | Yes | Yes | Yes | Yes |

| Student away from home | No | Yes | Yes | Yes |

| Homeowner | No | No | No | Yes |

| Seat belt usage | Yes | No | No | No |

| Get quote online | No | No | No | Yes |

| Teen driver | No | No | No | Yes |

| Government employee | Yes | No | No | No |

| Get Quotes Go | ||||

Five Steps to Lower Your Phoenix Car Insurance Rates

Everyone wants to pay less for insurance, and there are actions drivers can take to significantly lower their car insurance bill. These five steps can lower your car insurance rates by 50% or more.

- Buying full coverage increases cost more than anything else, so if your vehicle is getting close to 10 years old, it may be time to consider removing comprehensive and collision insurance entirely. Potential savings: $1,285 a year

- Qualifying for policy discounts is a great way to reduce the cost. Make sure you’re getting every discount you deserve, and take steps like bundling your home and auto policies to earn even more savings. Potential savings: $1,075 a year

- If full coverage is necessary, consider raising your policy deductibles to a higher level. Drivers generally save money in the long term by using higher deductibles, but only do so if you have adequate emergency funds set aside. Potential savings: $776 a year

- Being a safe driver is one of the best ways to prevent high rates. Drivers can go one step farther and take a defensive driving course or even allow your company to track your driving behavior using a telematics device. Potential savings: 30%

- The easiest way to instantly reduce your car insurance rates is to shop around and find a cheaper company. Phoenix drivers have a lot of choices when it comes to car insurance companies, and there is a very good chance you can find a lower rate simply by switching companies. Potential savings: 40% or more

Frequently Asked Questions

What is the average cost of car insurance in Phoenix, AZ?

The average annual cost for full coverage car insurance in Phoenix is around $1,870. Comprehensive insurance costs about $412, collision insurance costs $750, and liability insurance costs $496 for an average vehicle. However, rates can vary depending on factors such as driver age, driving record, and the type of coverage.

Can I find cheaper car insurance rates in Phoenix, AZ?

Yes, it’s possible to find cheaper car insurance rates in Phoenix. By comparing quotes from multiple insurance companies, you increase your chances of finding lower rates. Enter your Phoenix ZIP code to view companies that offer affordable auto insurance rates.

Which companies are popular for auto insurance in Arizona?

State Farm, GEICO, and Progressive are the most popular auto insurance companies in Arizona. State Farm has the largest market share in the state, but it’s worth comparing quotes from multiple companies to find the best rates for your specific needs.

Are there discounts available for car insurance in Phoenix, AZ?

Yes, many insurance companies offer various discounts that can help lower your car insurance rates. These discounts can include safe driver discounts, multi-policy discounts, and good student discounts, among others. Check with your insurance provider to see if you qualify for any discounts.

How does the type of vehicle affect car insurance rates in Phoenix?

The type of vehicle you drive can have a significant impact on your car insurance rates. Vehicles with higher performance, higher price tags, or higher likelihood of liability claims generally cost more to insure. On the other hand, lower-cost vehicles with excellent safety ratings tend to have lower insurance rates.

What are the requirements for car insurance in Arizona?

There are several steps you can take to lower your car insurance rates in Phoenix. These include maintaining a good driving record, choosing higher deductibles, qualifying for discounts, and comparing quotes from different insurance companies. By taking these steps, you may be able to significantly reduce your insurance premiums.

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $6,009 |

| 20 | $3,758 |

| 30 | $1,702 |

| 40 | $1,630 |

| 50 | $1,487 |

| 60 | $1,459 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $2,075 |

| $250 | $1,868 |

| $500 | $1,630 |

| $1,000 | $1,397 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,630 |

| 50/100 | $1,716 |

| 100/300 | $1,824 |

| 250/500 | $2,104 |

| 100 CSL | $1,759 |

| 300 CSL | $1,996 |

| 500 CSL | $2,169 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $8,582 |

| 20 | $5,972 |

| 30 | $3,601 |

| 40 | $3,520 |

| 50 | $3,357 |

| 60 | $3,326 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $87 |

| Multi-vehicle | $84 |

| Homeowner | $23 |

| 5-yr Accident Free | $122 |

| 5-yr Claim Free | $105 |

| Paid in Full/EFT | $76 |

| Advance Quote | $81 |

| Online Quote | $116 |

| Total Discounts | $694 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates Now

Find companies with the cheapest rates in Phoenix