Cheapest Car Insurance for Teen Drivers in 2025

Enter your Car Insurance Coverage FAQs zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jul 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

As parents, we all dread the day our teenager gets behind the wheel for the first time. We are not only worried for their safety, but also about when we get our first auto insurance bill after they are added as a rated driver.

Teen drivers are statistically horrible drivers, with 1 in 5 16-year-olds being involved in an accident. Distractions abound, from the radio, to their cell phones, to other teenage passengers all vying for their limited attention.

Here are some sobering facts about teen drivers:

- Seatbelts save lives but teens tend to not use them. Over 70,000 young people die or are injured every year due to lack of seatbelt use.

- Two-thirds of teen passenger deaths are in vehicles driven by other teenagers

- Over one-third of teen fatal crashes are speed related

- Almost 60% of teens admit to talking on their cell phone while driving

- Over one-third of teens admit to responding to text messages while driving

- One-fourth of teenage fatal accidents involve alcohol

With statistics like those, it’s no wonder car insurance companies charge the highest rates for 16-year-old drivers. Adding a teenager to a car insurance policy will instantly trigger a significant premium increase, and if you haven’t received your first bill yet, brace yourself.

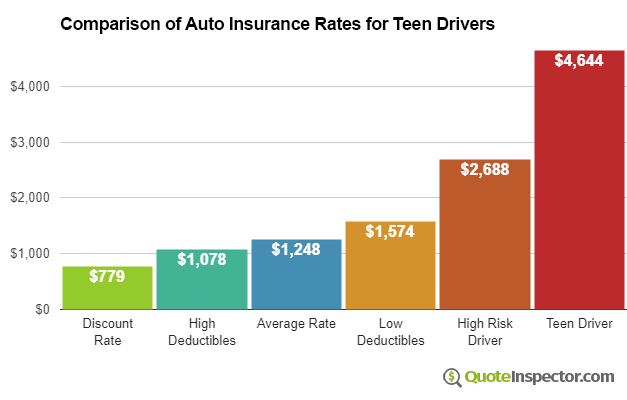

The chart below shows average full coverage insurance rates for different scenarios. Teenage drivers have by far the highest rates, even 73% higher than the average rate paid by high risk drivers.

How to Save on Car Insurance for Teen Drivers

Despite the gloom and doom, there are ways you can make the impact of adding a teen driver to your policy a little less stressful. The tips below can slash your teenager’s insurance bill by more than half, so read on and find the best ways to insure a teen for less.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Buy Liability-only Insurance

Some companies rate drivers on specific vehicles, while others use driver averaging, which means all drivers are rated proportionately on all vehicles. If your company rates drivers on specific vehicles, adding your teenager to your policy will only affect the cost of insurance on the vehicle they drive. If your company uses driver averaging, adding a teenager can raise the rates of all vehicles on the policy.

You can save a significant amount by purchasing your teen an older vehicle that does not require full coverage. By insuring your teen for liability-only, you can cut the premium by more than half. Even with driver averaging, the overall policy premium will be significantly less if you can avoid insuring your teen’s vehicle with full coverage.

Collision insurance is expensive for teen drivers, because they do tend to get in a lot of fender benders. Collision pays to repair your vehicle when it gets damaged by impact with another object or rollover. Comprehensive insurance is higher for teens, but not to the extent of collision.

Liability insurance is also expensive for teenagers, because they also tend to do a lot of damage to other property. Liability pays to repair damage caused to other property and also for any injuries that may be caused.

If you can avoid insuring your teen’s vehicle for comprehensive and collision, that is the best way to save on car insurance. When shopping for a car for your teen, keep this in mind. Junior may not end up driving the fancy sports car or 4×4 he really wants, but unless he’s paying the insurance bill, a 10-year-old sedan will get him to school just as well.

Raise Physical Damage Deductibles

If only buying liability insurance is not an option and physical damage coverage is needed, then take a look at increasing the comprehensive and collision deductibles for your teen’s vehicle. You can keep a lower deductible on mom and dad’s vehicles, while choosing a much higher deductible for your teen’s vehicle.

Higher deductibles can lower rates substantially, but keep in mind that if your teen does get into an accident, hit a deer, or have hail damage, you will need to pay more out of pocket to repair the damage with high deductibles.

Make Your Teen a Safer Driver

Another way to cut the cost of car insurance for teen drivers is to enroll them in a driver safety course. If their school does not offer a driver’s education program, check with area colleges and even online for programs that qualify for discounts with your insurance company.

Most car insurance companies offer discounts for teenagers who have completed a qualifying driver safety program. This can often save parents 10% or more when adding them to their policy. Plus, the coursework provides them with important driver training that makes them safer behind the wheel. In parenting terms, this is definitely a win win.

Earn Good Grades and Save

If your teen gets good grades in school, most companies will reward parents with a discount on their rates. You will need to contact your agent or company and provide transcripts from your teen’s school showing their last grade report.

It’s important that your teen understands that how they perform in school can directly relate to other aspects of their life and even impact your pocketbook.

Let Your Teen Prove They’re a Good Driver

Many insurance companies are now using gizmos called ‘telematics’ devices, which are data recorders than plug into your vehicle’s onboard diagnostic port (OBD-II). These high-tech trackers allow companies to find out your driving characteristics like how fast you drive, how hard you brake, and the time of day when you drive.

The collected data is transmitted back to the insurance company via a wireless network, and if they determine your teen is a good driver, you may see discounts up to 30% on your policy premium.

Case Studies: Cheapest Car Insurance for Teen Drivers

Case Study 1: ReliableDrive Insurance

John, an 18-year-old high school graduate, was excited to start his college journey. However, he needed reliable and affordable car insurance to commute to campus. After thorough research, John came across ReliableDrive Insurance, known for its competitive rates for young drivers.

Case Study 2: SmartTeen Insurance

Sarah, a 17-year-old honor student, was looking for car insurance that would provide comprehensive coverage without burdening her parents financially. During her search, Sarah discovered SmartTeen Insurance, a company specializing in affordable insurance options for young drivers.

Case Study 3: DriveWise Insurance

Mark, a 19-year-old college student, needed car insurance that aligned with his budget and provided him with adequate coverage. While exploring different insurance providers, Mark came across DriveWise Insurance, known for its flexible and cost-effective options for young drivers.

It’s a Good Time for an Insurance Review

When adding a teenager to your policy, you may want to review your coverages with your company or agent. Teen drivers are a liability, and you should make sure you have adequate liability coverage on your policy. Even consider purchasing an umbrella policy that will provide additional liability coverage over and above what is provided by your personal auto policy.

Having a teenager is stressful, and having a teen driver multiplies that stress by several factors. Somehow our parents made it through our teen years, and now hopefully karma isn’t out for revenge.

Use our FREE quote tool to compare insurance rates now!

Frequently Asked Questions

How can I save on car insurance for teen drivers?

There are several ways to save on car insurance for teen drivers. You can consider buying liability-only insurance, which can significantly reduce the premium. Another option is to raise the physical damage deductibles for your teen’s vehicle. Enrolling your teen in a driver safety course and encouraging them to earn good grades can also lead to discounts. Additionally, some insurance companies offer telematics devices that track driving behavior, providing potential discounts for good driving habits.

Why are car insurance rates higher for teen drivers?

Car insurance rates are higher for teen drivers due to their statistical risk of accidents. Teenagers are considered inexperienced drivers and are more likely to engage in risky behaviors while driving, such as distracted driving or speeding. Insurance companies calculate rates based on the likelihood of a driver filing a claim, and the higher risk associated with teen drivers leads to higher premiums.

Is it possible to find cheap auto insurance rates for teen drivers?

While car insurance rates for teen drivers tend to be higher, it is still possible to find affordable options. Shopping around and comparing quotes from different insurance companies is a good strategy. Additionally, considering factors like buying liability-only insurance, raising deductibles, and taking advantage of discounts for good grades or completing driver safety courses can help reduce the cost of insurance for teen drivers.

What is liability-only insurance, and how can it help save money?

Liability-only insurance is a type of car insurance that covers damages and injuries caused by the insured driver to other people and their property. It does not provide coverage for the insured driver’s own vehicle. Opting for liability-only insurance for a teen driver can result in significant savings because it eliminates the need for expensive comprehensive and collision coverage, which are typically more expensive for teenagers due to their higher risk profile.

Should I review my insurance coverage when adding a teen driver to my policy?

Yes, it is recommended to review your insurance coverage when adding a teen driver to your policy. Teen drivers pose an increased liability risk, so ensuring that you have adequate liability coverage is crucial. It may also be worth considering purchasing an umbrella policy, which provides additional liability coverage beyond what is offered by your auto policy. Consulting with your insurance company or agent can help you make informed decisions about your coverage options.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Jeep Grand Cherokee Insurance

- Chevrolet Impala Insurance

- Ford F-150 Insurance

- Honda CR-V Insurance

- Toyota Corolla Insurance

- Dodge Ram Insurance

- Volkswagen Jetta Insurance

- Honda Accord Insurance

- Nissan Rogue Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area