Find Cheaper Houston, TX Car Insurance Rates in 2025

Enter your Texas Auto Insurance zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

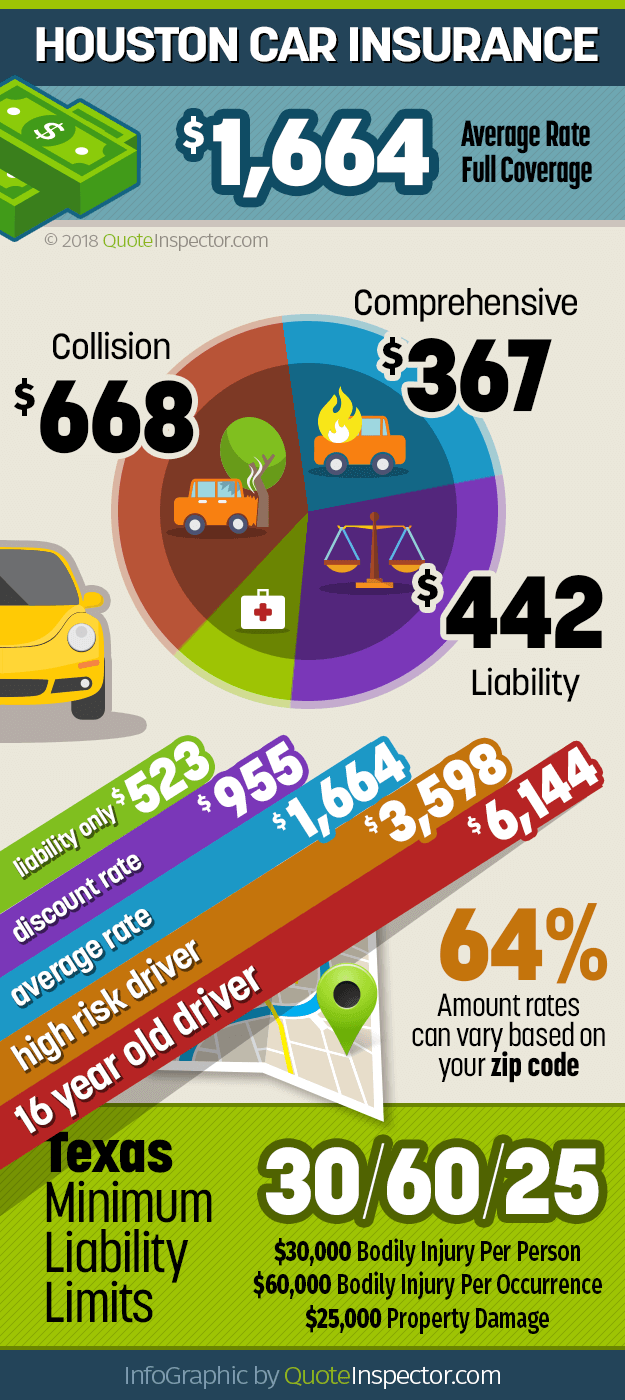

Car insurance rates in Houston range from an estimated low of $523 a year for a liability-only policy to well over $6,100 a year for a 16-year-old driver. The average estimated full coverage rate is $1,664 a year, or about $138 a month, and State Farm, Allstate, and GEICO are the most preferred companies in Houston.

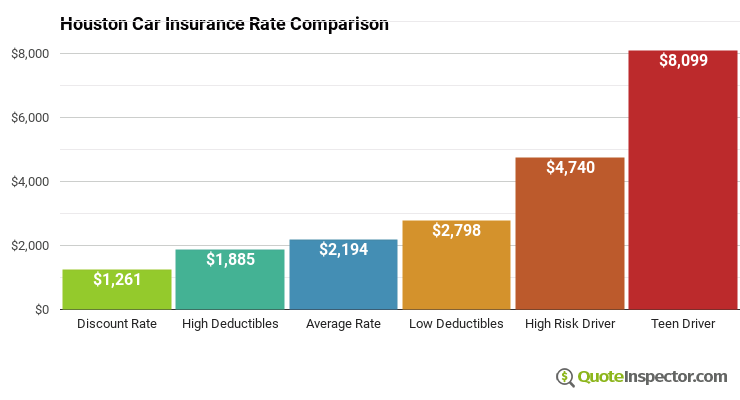

The chart below shows how much Houston drivers can expect to pay to insure an average vehicle with full coverage.

Discount Rates

The discount rate is the best rate available if you qualify for the bulk of the discounts offered by a company. This includes discounts for owning a home, bundling your homeowners and auto policy, having excellent credit, and being a safe driver with no at-fault accidents.

High Deductibles Save Money

Not everyone will qualify for that rate, however, so the more realistic rates are towards the middle of the chart. The high deductible rate, average rate, and low deductible rate, are identical coverage-wise except they use $1,000, $500, and $100 physical damage deductibles, respectively.

High Risk Drivers Pay More

If your driving record needs improvement, you may pay closer to the high-risk rate depending on the number and severity of the violations. Drivers with a few minor violations like speeding tickets won’t pay the full high-risk rate, but those with major violations like a DUI, reckless driving, hit and run, or driving on a suspended license will probably pay close to $3,600 a year.

Teenage Drivers Pay the Most

The most expensive drivers to insure (sorry parents) are the newly licensed teenagers. Statistics show that they are by far the most likely to be involved in an accident, and insurance companies charge accordingly. Paying over $6,000 a year for car insurance for a teenager is not money well spent, but there are ways to reduce that cost like insure for liability-only or buy the highest deductibles available.

The prices below break down the average cost of insurance by coverage type.

Annual premium for full coverage: $2,194

:

When computing these rates, we used a 40-year-old male driver with a clean driving record and rated him on an average passenger sedan like a Honda Accord. Comprehensive and collision deductibles were $500 and liability limits were 30/60, which means $30,000 of bodily injury coverage per person and $60,000 per occurrence. This is the minimum amount required by Texas state law, along with $25,000 of property damage liability.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Which Company has the Cheapest Car Insurance Rates?

We’re not sure if the words ‘cheapest’ and ‘car insurance’ can be used in the same sentence, but we wrote it like that regardless. If we told you which insurance company has the cheapest car insurance rates in Houston, we would probably be flat out wrong.

There are so many variables that go into calculating the price you pay, that without knowing every detail about you, your vehicle, your driving habits, and the amount of coverage you want, it’s just not possible to make any kind of accurate prediction.

The companies below are the largest in Texas, which doesn’t necessarily relate to which one is cheapest. The average rates for each one don’t tell the whole picture either, because we don’t know what types of risks each one prefers to insure. If a company insures a lot of high-risk or ‘non-standard’ drivers, their average rates will be much higher than a company that only insures perfect drivers with impeccable credit and spotless driving records.

With that said, here’s the list of the companies that write the most business in the state of Texas.

| Rank | Company | Market Share | Average Rate |

|---|---|---|---|

| 1 | State Farm | 18.09% | $1,480 |

| 2 | Allstate | 11.65% | $1,684 |

| 3 | Geico | 10.11% | $2,114 |

| 4 | Farmers Insurance | 9.82% | N/A |

| 5 | Progressive | 8.56% | $1,681 |

| 6 | USAA | 7.65% | $1,106 |

| 7 | Home State | 4.03% | $2,113 |

| 8 | Texas Farm Bureau | 3.61% | $1,223 |

| 9 | Liberty Mutual | 2.92% | $3,097 |

| 10 | Nationwide | 2.89% | $1,569 |

| Get Your Rates Go | |||

Source: National Association of Insurance Commissioners (NAIC) 2015 Market Share Report and The Zebra

Auto insurance in Houston is in a state of flux, as insurers are still reeling from the flooding caused by hurricane Harvey. With over an estimated one million total loss vehicles from flood water damage, that is a lot of claims to have to process and settle.

Insurers will undoubtedly be raising rates this year due to the damage inflicted by the storm surge and flooding, and will probably have subsequent price increases in the coming years as underwriting losses are realized.

This will definitely shake up the market share rankings for the second through sixth companies in the table above, as the number one company, State Farm, as a pretty good market share lead in Texas.

Car Insurance Rates by Make and Model

One of the factors that plays a big part in determining how much you’ll pay for coverage in Houston is the type of vehicle you drive. Texans like trucks, of course, but unfortunately, most of the larger 3/4 and 1-ton trucks like the Ford F-250 and F-350, Silverado 2500HD and 3500HD, and the Dodge Ram 2500 and 3500, all have higher rates due to higher frequency of liability claims.

The table below shows estimated insurance rates for a variety of the more popular vehicles you’ll see while stuck in traffic on US-59 or I-10.

| Make and Model | Annual Premium | Monthly Premium |

|---|---|---|

| Chevrolet Silverado | $2,324 | $194 |

| Dodge Ram | $2,387 | $199 |

| Ford Escape | $1,836 | $153 |

| Ford Focus | $2,132 | $178 |

| Ford Fusion | $2,335 | $195 |

| Ford F-150 | $2,072 | $173 |

| GMC Acadia | $2,028 | $169 |

| GMC Sierra | $2,288 | $191 |

| Honda Accord | $2,054 | $171 |

| Honda Civic | $2,405 | $200 |

| Honda CR-V | $1,786 | $149 |

| Honda Pilot | $2,093 | $174 |

| Hyundai Sonata | $2,231 | $186 |

| Kia Optima | $2,275 | $190 |

| Nissan Altima | $2,267 | $189 |

| Nissan Rogue | $2,210 | $184 |

| Toyota Camry | $2,244 | $187 |

| Toyota Corolla | $2,194 | $183 |

| Toyota Prius | $2,046 | $171 |

| Toyota RAV4 | $2,075 | $173 |

| Get Rates for Your Vehicle Go | ||

How to Save Money on Houston Car Insurance

We covered a lot of data in this article, but the key takeaway is that you can lower your policy premium by taking a few proactive steps. This includes raising deductibles, driving safe and avoiding tickets, eliminating unneeded coverage, and not having kids (but seriously).

Here are the best ways to lower your car insurance rates in Houston.

- High deductibles cost less because you pay more in the event of a claim. If you have adequate savings, consider raising your deductibles as high as you feel comfortable. If your vehicle is getting older, consider dropping full coverage altogether.

- The type of vehicle you drive is in direct correlation to how high your rates are. If you’re due for a new car, consider skipping the uber high-performance model in favor of a more modest (and safe) sedan.

- If you tend to see red and blue lights in your rear-view mirror, lay off the gas pedal. If you do get a ticket, check into taking a defensive driver course that could prevent your car insurance company from every knowing about it.

- To save money when insuring your teen driver, don’t buy them a vehicle that requires full physical damage coverage. A 10-year-old vehicle will get them back and forth to school just fine.

- Many policy discounts are easy to miss, so ask your agent or company if there are any discounts that you should be getting, especially discounts for occupational or professional association memberships.

- If you own your home or even rent, chances are you have a homeowners or renters policy. If you bundle it with your auto insurance policy (buy from the same company), this often triggers a discount as much as 15%.

- Last but definitely not least, shop your policy around once a year. Price quotes are always free and you’d be surprised at how many companies sell car insurance in Houston that you have never even heard of.

Frequently Asked Questions

How much do car insurance rates in Houston, TX range from?

Car insurance rates in Houston, TX can range from an estimated low of $523 per year for a liability-only policy to well over $6,100 per year for a 16-year-old driver. The average estimated full coverage rate is $1,664 per year, or about $138 per month. State Farm, Allstate, and GEICO are the most preferred insurance companies in Houston.

What factors affect car insurance rates in Houston, TX?

Several factors can affect car insurance rates in Houston, TX. These include your driving record, age, the type of vehicle you drive, coverage limits, deductibles, and any applicable discounts. Insurance companies also consider factors such as the frequency of liability claims associated with certain vehicle makes and models.

Can I save money on car insurance in Houston, TX?

Yes, there are several ways to save money on car insurance in Houston, TX. Some strategies include raising your deductibles, maintaining a clean driving record, eliminating unnecessary coverage, and taking advantage of available discounts. Comparison shopping and obtaining quotes from multiple insurance companies can also help you find more affordable rates.

Which insurance company has the cheapest car insurance rates in Houston, TX?

Determining the insurance company with the absolute cheapest car insurance rates in Houston, TX is difficult without considering specific details about you, your vehicle, and your coverage preferences. The largest insurance companies in Texas may not necessarily be the cheapest. Rates can vary based on each company’s risk preferences and the types of drivers they insure.

How can I save money on car insurance as a high-risk driver in Houston, TX?

High-risk drivers in Houston, TX can still find ways to save money on car insurance. While high-risk drivers generally pay higher premiums, you can explore options such as raising your deductibles, maintaining a clean driving record going forward, and comparing quotes from different insurance companies to find the most affordable rates available to you.

How does the type of vehicle I drive affect car insurance rates in Houston, TX?

The type of vehicle you drive can have an impact on car insurance rates in Houston, TX. Some vehicles, particularly larger trucks and those with higher frequency of liability claims, may have higher insurance rates. Insurance companies take into account factors such as the likelihood of accidents, repair costs, and safety ratings when determining rates for specific vehicle makes and models.

What are some ways to lower car insurance rates in Houston, TX?

There are several ways to lower car insurance rates in Houston, TX. These include raising your deductibles, maintaining a safe driving record, opting for higher liability limits, eliminating unnecessary coverage, and taking advantage of potential discounts offered by insurance companies. It’s also beneficial to compare rates from different insurers to find the most competitive prices.

How do driver age and deductible levels affect car insurance rates in Houston, TX?

Driver age and deductible levels can impact car insurance rates in Houston, TX. Younger drivers, such as teenagers, typically pay higher premiums due to their higher likelihood of accidents. Choosing higher deductibles can lower your premiums but also means you’ll pay more out of pocket in the event of a claim. Insurance rates can vary based on these factors, and it’s advisable to consider your specific circumstances and coverage needs.

How can I compare car insurance rates in Houston, TX?

To compare car insurance rates in Houston, TX, you can use online resources and quote tools provided by insurance companies or independent websites. Enter your ZIP code and relevant information to obtain quotes from multiple insurers. This allows you to compare rates, coverage options, and potential discounts to find the most suitable and affordable car insurance for your needs.

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $8,099 |

| 20 | $5,065 |

| 30 | $2,296 |

| 40 | $2,194 |

| 50 | $2,002 |

| 60 | $1,968 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $2,798 |

| $250 | $2,517 |

| $500 | $2,194 |

| $1,000 | $1,885 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $2,194 |

| 50/100 | $2,311 |

| 100/300 | $2,456 |

| 250/500 | $2,835 |

| 100 CSL | $2,369 |

| 300 CSL | $2,689 |

| 500 CSL | $2,922 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $11,565 |

| 20 | $8,047 |

| 30 | $4,852 |

| 40 | $4,740 |

| 50 | $4,524 |

| 60 | $4,480 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $117 |

| Multi-vehicle | $113 |

| Homeowner | $31 |

| 5-yr Accident Free | $164 |

| 5-yr Claim Free | $141 |

| Paid in Full/EFT | $102 |

| Advance Quote | $109 |

| Online Quote | $156 |

| Total Discounts | $933 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates Now

Find companies with the cheapest rates in Houston