Find Cheaper Philadelphia, PA Car Insurance Rates in 2025

Enter your Pennsylvania Auto Insurance zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

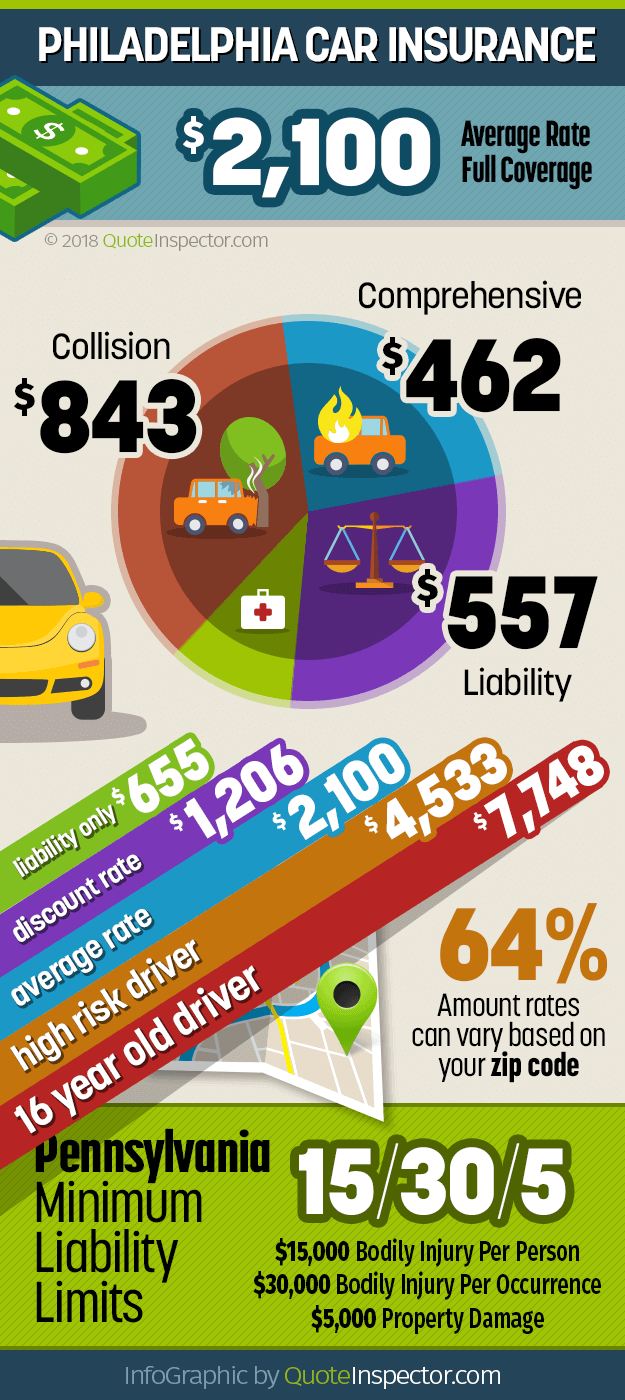

The average car insurance cost in Philadelphia is $2,100 per year. A liability-only policy costs about $55 a month, the cheapest discount rate is estimated at $1,206, and insuring a teenager could cost as much as $7,700. The cheapest companies for Philadelphia car insurance are Erie, USAA, and Travelers, but State Farm insurers the most vehicles.

A 40-year-old driver with a clean driving record insuring a car like a Toyota Camry or Ford Focus can expect to pay the averages shown below.

Annual premium for full coverage: $1,873

:

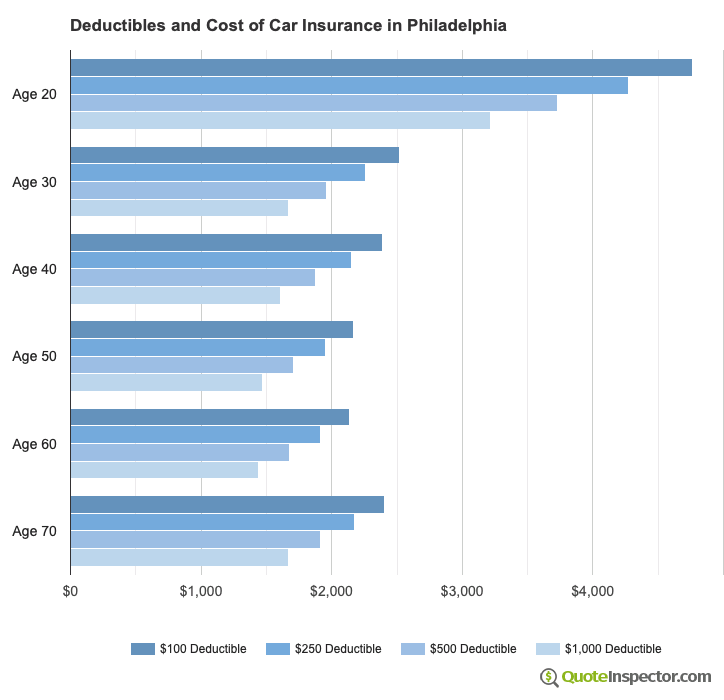

Average Car Insurance Cost in Philadelphia by Driver Age and Deductible

The averages above are calculated using $500 deductibles for both comprehensive and collision coverage. The chart below shows estimated rates for drivers age 20 to 70 and deductibles ranging from a low of $100 to a high of $1,000.

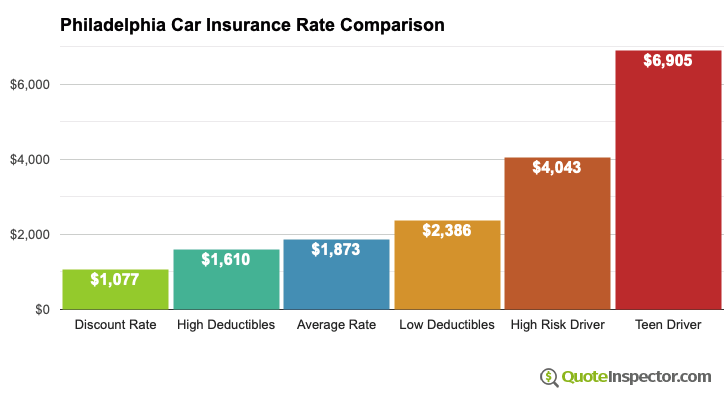

Philadelphia Car Insurance Rate Comparison by Policy Type

The risk profile of the driver rated on the policy has a significant impact on car insurance rates. The chart below shows average rates for a good driver who qualifies for multiple policy discounts, a driver who chooses low deductibles, the average rate, high deductibles, a high-risk driver, and a teen driver.

Average Car Insurance Cost in Philadelphia by Vehicle Make and Model

Every vehicle has distinct rating factors based on the cost of the vehicle, the cost to repair and the price of replacement parts, the performance level, and the statistical probability of liability claims. The chart below shows estimated insurance rates for the more popular vehicles sold in Philadelphia.

| Make and Model | Annual Premium | Monthly Premium |

|---|---|---|

| Chevrolet Silverado | $1,980 | $165 |

| Dodge Ram | $2,036 | $170 |

| Ford Escape | $1,562 | $130 |

| Ford Focus | $1,817 | $151 |

| Ford Fusion | $1,994 | $166 |

| Ford F-150 | $1,767 | $147 |

| GMC Acadia | $1,730 | $144 |

| GMC Sierra | $1,952 | $163 |

| Honda Accord | $1,756 | $146 |

| Honda Civic | $2,052 | $171 |

| Honda CR-V | $1,520 | $127 |

| Honda Pilot | $1,786 | $149 |

| Hyundai Sonata | $1,901 | $158 |

| Kia Optima | $1,938 | $162 |

| Nissan Altima | $1,932 | $161 |

| Nissan Rogue | $1,884 | $157 |

| Toyota Camry | $1,915 | $160 |

| Toyota Corolla | $1,873 | $156 |

| Toyota Prius | $1,739 | $145 |

| Toyota RAV4 | $1,772 | $148 |

| Get Rates for Your Vehicle Go | ||

Which companies are cheapest in for Philadelphia car insurance?

The companies below are ranked by market share, with State Farm being the largest personal auto insurer in the state of Pennsylvania. Average rates are based on issued policy prices for the entire state, so rates for Philadelphia will be higher than the averages shown.

| Rank | Company | Market Share | Average Rate |

|---|---|---|---|

| 1 | State Farm | 20.11% | $1,186 |

| 2 | Erie Insurance | 13.32% | $808 |

| 3 | Allstate | 12.00% | $3,083 |

| 4 | Nationwide | 9.87% | $1,167 |

| 5 | Progressive | 8.90% | $1,443 |

| 6 | Geico | 7.00% | $1,134 |

| 7 | Liberty Mutual | 5.53% | $2,432 |

| 8 | Travelers | 3.57% | $795 |

| 9 | USAA | 3.14% | $801 |

| 10 | Farmers Insurance | 2.12% | N/A |

| Get Your Rates Go | |||

Source: National Association of Insurance Commissioners (NAIC) 2015 Market Share Report and The Zebra

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Cost in Philadelphia: The Bottom Line

The data in the tables and charts above should give you a good overview of rate differences when shopping for car insurance in Philadelphia. It’s important to note that every driver is different, and there are a lot of factors that determine the final price of your policy.

Rates in Pennsylvania are slightly higher than average for the northeast region, but if it’s any consolation, drivers in New York, Rhode Island, and Connecticut pay more. Philadelphia, being the sixth largest city in the U.S., has over 1.5 million residents living into an area of only 134 square miles. That’s nearly 11,700 people per square mile, which mean a lot of traffic congestion. More traffic equates to more accidents and claims, which means higher car insurance rates.

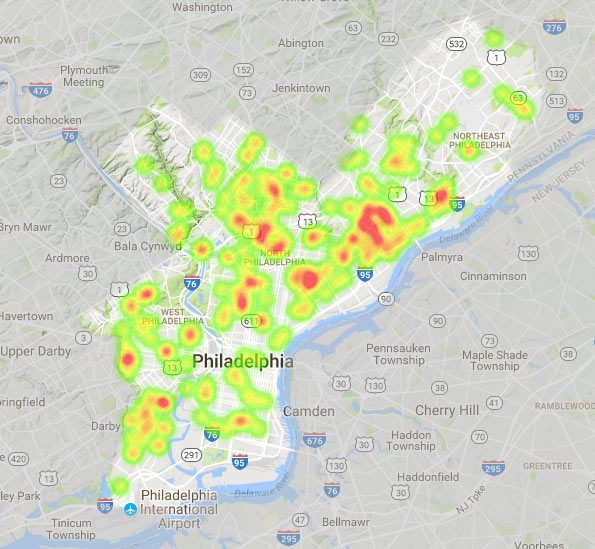

Auto theft is also a primary force behind higher car insurance rates in certain parts of Philadelphia. The heat map below shows the areas with higher incidents of auto theft for the start of 2018. If you live in the Frankford or Mayfair areas generally to the south of Roosevelt Boulevard, you are most likely paying a higher rate due to the increased likelihood of your car being stolen.

Heat map image from Philadelphia Inquirer Crime in Philadelphia

The following is a condensed list of the concepts illustrated by the charts and tables above.

- Average car insurance rates for full coverage are $175 a month

- Companies may offer policy discounts of over $1,200 to drivers who own a home, insure multiple vehicles, bundle their policies, are accident and claim-free, and quote early and online

- Teen drivers, particularly a 16-year-old, are very expensive to insure, costing as much as $645 a month for full coverage

- High-risk drivers with multiple minor violations or a major violation like a DUI, reckless driving, hit-and-run, or driving on a revoked license can expect to pay up to 115% more than a good driver

- Raising your policy deductibles from $100 to $1,000 can save on average $874 a year

- As drivers get older, car insurance gets cheaper, until about age 65 when rates start to increase again

- It’s important to carry adequate liability insurance, and increasing your limits from 30/60 up to 100/300 will cost about $250 a year. Increasing to 250/500 limits will cost an extra $613 a year.

- If your vehicle is getting older, it may be time to drop full coverage and buy just liability insurance. The cost of a liability-only policy in Philadelphia averages around $650 a year depending on the coverage limit. This saves $1,450 a year compared to buying full coverage.

- The cheapest companies tend to be Travelers, USAA, and Erie Insurance, but the only way to know which company has the best rate for you is to get rate quotes and compare.

- We recommend shopping your policy around every year, as companies file frequent rate changes. Minor changes in your personal risk profile (i.e. getting a speeding ticket or buying a home) can also significantly impact your Philadelphia car insurance rates.

Frequently Asked Questions

What is the average car insurance cost in Philadelphia?

The average car insurance cost in Philadelphia is $2,100 per year. This figure is based on various factors such as the driver’s age, driving record, type of coverage, and the vehicle being insured.

Which companies offer cheap car insurance rates in Philadelphia?

Some of the companies that offer cheap car insurance rates in Philadelphia are Erie, USAA, and Travelers. However, it is important to compare quotes from multiple companies to find the best rate for your specific needs.

How much does a liability-only policy cost in Philadelphia?

A liability-only policy in Philadelphia costs around $55 per month on average. This type of policy provides coverage for damages you may cause to others but does not cover your own vehicle.

How much can I save with a discount rate in Philadelphia?

The cheapest discount rate in Philadelphia is estimated at $1,206 per year. However, the actual savings may vary depending on the insurance company, your driving profile, and the discounts you qualify for.

How much does it cost to insure a teenager in Philadelphia?

The cheapest car insurance companies in Philadelphia, based on market share, are Erie, USAA, and Travelers. However, rates may vary depending on individual factors and coverage options.

How does the risk profile of the driver affect car insurance rates in Philadelphia?

The risk profile of the driver, including factors such as driving record, deductibles chosen, and the driver’s age, can significantly impact car insurance rates in Philadelphia. Good drivers who qualify for multiple policy discounts tend to have lower rates compared to high-risk drivers or teenagers.

How does the make and model of the vehicle affect car insurance rates in Philadelphia?

The make and model of the vehicle can influence car insurance rates in Philadelphia. Factors such as the cost of the vehicle, repair costs, performance level, and probability of liability claims are taken into account when determining insurance rates. Different vehicles have different rating factors, and insurance rates may vary accordingly.

How can I find companies with cheap auto insurance rates in Philadelphia?

To find companies with cheap auto insurance rates in Philadelphia, you can use online tools and comparison websites that provide quotes from multiple insurance companies. By entering your ZIP code and relevant information, you can compare rates and coverage options to find the most affordable option for you.

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $6,905 |

| 20 | $4,318 |

| 30 | $1,957 |

| 40 | $1,873 |

| 50 | $1,708 |

| 60 | $1,674 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $2,386 |

| $250 | $2,150 |

| $500 | $1,873 |

| $1,000 | $1,610 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,873 |

| 50/100 | $1,973 |

| 100/300 | $2,097 |

| 250/500 | $2,421 |

| 100 CSL | $2,023 |

| 300 CSL | $2,297 |

| 500 CSL | $2,496 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $9,859 |

| 20 | $6,863 |

| 30 | $4,138 |

| 40 | $4,043 |

| 50 | $3,856 |

| 60 | $3,822 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $100 |

| Multi-vehicle | $96 |

| Homeowner | $27 |

| 5-yr Accident Free | $140 |

| 5-yr Claim Free | $120 |

| Paid in Full/EFT | $87 |

| Advance Quote | $93 |

| Online Quote | $133 |

| Total Discounts | $796 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates Now

Find companies with the cheapest rates in Philadelphia