Find Cheaper Minnesota Car Insurance Rates in 2025

Enter your Minnesota zip code below to view companies that have cheap auto insurance rates.

Average insurance rates in Minnesota for 2025 are $1,176 annually for full coverage. Comprehensive, collision insurance, and liability coverage cost around $262, $478, and $304, respectively. Minneapolis, Saint Paul, and Maplewood tend to have higher rates, and the two companies who insure the most vehicles in Minnesota are State Farm and Progressive.

Average rate for full coverage: $1,176

Premium estimates for individual coverage:

40-year-old driver, full coverage with $500 deductibles, and good driving record

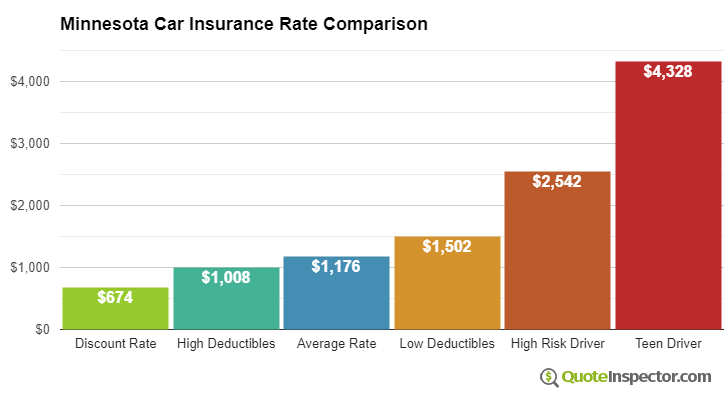

Average Price Range for Car Insurance in Minnesota

For a driver around age 40, Minnesota insurance prices range from the low end price of $360 for just liability coverage to a high rate of $2,542 for a high-risk insurance policy.

These price ranges show why all drivers should compare rates quotes for a specific zip code, rather than using rates averaged for all U.S. states.

Use the form below to get accurate rates for your location.

Enter your Minnesota zip code below to view companies that have cheap auto insurance rates.

Recommended Companies for Cheap Minnesota Insurance

Chart shows Minnesota auto insurance prices for various risks and coverage choices. The cheapest price with discounts is $674. Drivers choosing higher $1,000 deductibles will pay $1,008. The average price for a driver age 40 with no violations using $500 deductibles is $1,176. Using lower $100 deductibles for comprehensive and collision insurance will cost more, up to $1,502. If you have multiple accidents and violations you could be charged at least $2,542. The policy rate for full coverage insurance for a 16-year-old driver can climb as high as $4,328.

Car insurance rates in Minnesota are also quite variable based on the make and model of your vehicle, how you drive, and deductibles and policy limits.

The make and model of vehicle you drive has a significant impact on the price you pay for car insurance in Minnesota. Choosing to drive a lower-cost and safer model will be cheaper to insure because of lower cost for replacement parts and lower severity of accident injuries.

This table shows auto insurance estimates for the top vehicles insured in Minnesota.

| Make and Model | Premium | % to Avg |

|---|---|---|

| Chevrolet Silverado | $1,244 | 5.5% |

| Dodge Ram | $1,278 | 8% |

| Ford Escape | $978 | -20.2% |

| Ford Focus | $1,140 | -3.2% |

| Ford Fusion | $1,248 | 5.8% |

| Ford F-150 | $1,106 | -6.3% |

| GMC Acadia | $1,082 | -8.7% |

| GMC Sierra | $1,222 | 3.8% |

| Honda Accord | $1,096 | -7.3% |

| Honda Civic | $1,286 | 8.6% |

| Honda CR-V | $952 | -23.5% |

| Honda Pilot | $1,116 | -5.4% |

| Hyundai Sonata | $1,194 | 1.5% |

| Kia Optima | $1,218 | 3.4% |

| Nissan Altima | $1,212 | 3% |

| Nissan Rogue | $1,182 | 0.5% |

| Toyota Camry | $1,200 | 2% |

| Toyota Corolla | $1,174 | -0.2% |

| Toyota Prius | $1,094 | -7.5% |

| Toyota RAV4 | $1,108 | -6.1% |

| Get Rates for Your Vehicle Quote Now | ||

Annual estimated premium for full coverage, $500 deductibles, driver age 40 with clean driving record.

View additional vehicles

Your choice of car insurance company has an impact on price. In each state, every insurer has a slightly different rate calculation, and prices can range greatly based on indivdual risk characteristics.

In Minnesota, auto insurance prices range from $654 with Travelers to as much as $3,503 with Liberty Mutual. Other companies like USAA, Farm Bureau Mutual, and Western National are neither the lowest or highest. That is probably not the prices you would have to pay, as your location in Minnesota, your motor vehicle report, and the vehicle you are insuring have to be factored in.

| Rank | Company | Market Share | Average Rate |

|---|---|---|---|

| 1 | State Farm | 24.89% | $1,238 |

| 2 | Progressive | 14.54% | $1,434 |

| 3 | American Family | 11.08% | $1,255 |

| 4 | Farmers Insurance | 7.01% | $1,379 |

| 5 | Allstate | 6.03% | $1,452 |

| 6 | Liberty Mutual | 3.63% | $3,503 |

| 7 | Geico | 3.00% | $2,157 |

| 8 | USAA | 2.85% | $815 |

| 9 | Auto Owners | 2.72% | $1,308 |

| 10 | Nationwide | 2.72% | $1,186 |

| Get Your Rates Quote Now | |||

Source: National Association of Insurance Commissioners (NAIC) 2015 Market Share Report and The Zebra

More mature drivers with no driving violations and higher comprehensive and collision deductibles may only pay around $1,100 every 12 months on average for full coverage. Prices are highest for teenage drivers, since even teens with perfect driving records will be charged as much as $4,300 a year. View Rates by Age

If you have some driving violations or you caused an accident, you could be paying at least $1,400 to $1,900 extra each year, depending on your age. Insurance for high-risk drivers is expensive and can cost around 44% to 133% more than the average rate. View High Risk Driver Rates

Opting for high physical damage deductibles can reduce prices by up to $500 a year, whereas increasing liability limits will increase prices. Going from a 50/100 bodily injury protection limit to a 250/500 limit will increase rates by as much as $273 extra every 12 months. View Rates by Deductible or Liability Limit

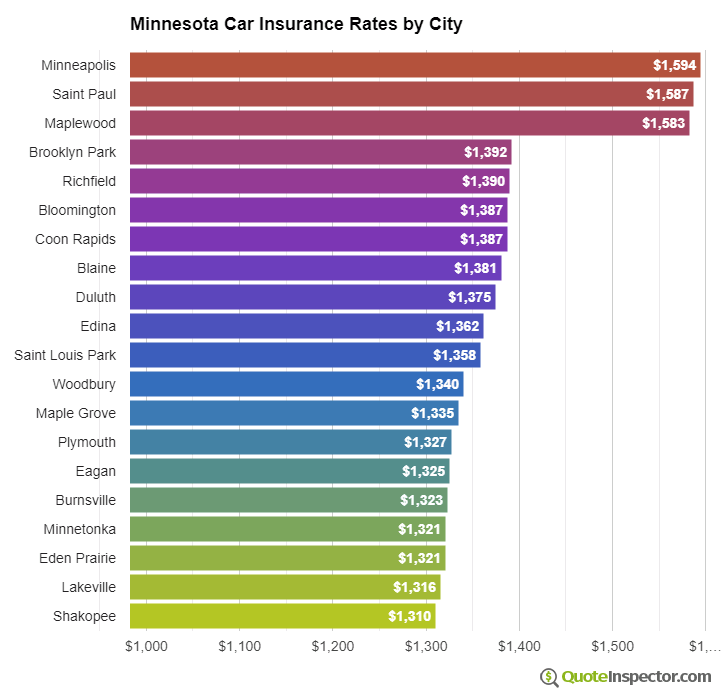

The area you live in also has a big influence on auto insurance rates. Areas with less crime and congestion may have rates around $900 a year, while Minneapolis and Saint Paul may have prices as high as $1,600. Even areas with close proximity in the same city can have a wide range of rates.

These price discrepancies demonstrate the significance of getting rates based on where you live in Minnesota.

Since prices can be so different, the only way to know your exact price is to do a rate comparison and see how they stack up. Every auto insurance company utilizes a different rate formula, so rate quotes may be quite different.

Minnesota Auto Insurance Articles

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $4,328 |

| 20 | $2,718 |

| 30 | $1,232 |

| 40 | $1,176 |

| 50 | $1,074 |

| 60 | $1,054 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,502 |

| $250 | $1,352 |

| $500 | $1,176 |

| $1,000 | $1,008 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,176 |

| 50/100 | $1,237 |

| 100/300 | $1,313 |

| 250/500 | $1,510 |

| 100 CSL | $1,267 |

| 300 CSL | $1,434 |

| 500 CSL | $1,556 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $6,186 |

| 20 | $4,316 |

| 30 | $2,602 |

| 40 | $2,542 |

| 50 | $2,422 |

| 60 | $2,402 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $63 |

| Multi-vehicle | $60 |

| Homeowner | $17 |

| 5-yr Accident Free | $88 |

| 5-yr Claim Free | $76 |

| Paid in Full/EFT | $55 |

| Advance Quote | $59 |

| Online Quote | $84 |

| Total Discounts | $502 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates Now