Audi R8 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Mar 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

How much does it cost to insure an Audi R8? Audi A8 insurance rates can be high, as the average annual cost is $2,488, but don’t let this trip you up. Managing your Audi A8 insurance costs can be done if you have the right information and tools.

Our guide goes over how to manage Audi A8 insurance costs by going over everything from average full coverage premiums to Audi A8 maintenance costs. Want to start finding Audi R8 insurance rates? Enter your ZIP code in our free tool above.

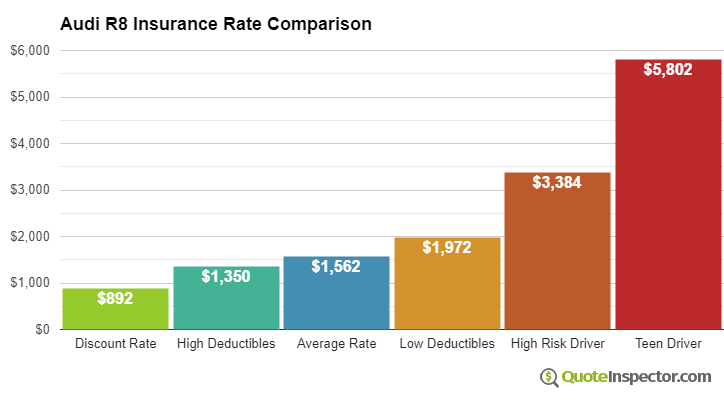

Average insurance prices for an Audi R8 are $1,562 every 12 months with full coverage. Comprehensive insurance costs around $342 each year, collision insurance costs $588, and liability coverage costs around $474. Liability-only coverage costs as low as $522 a year, and high-risk coverage costs $3,384 or more. 16-year-old drivers receive the highest rates at up to $5,802 a year.

Average premium for full coverage: $1,562

Rate estimates for individual coverage type:

Prices are based on $500 policy deductibles, 30/60 liability limits, and includes both medical and UM/UIM coverage. Rates are averaged for all U.S. states and R8 models.

Price Range by Coverage and Risk

Using a middle-aged driver as an example, prices range range from the cheapest price of $522 for basic liability insurance to a high rate of $3,384 for a driver required to buy high-risk insurance.

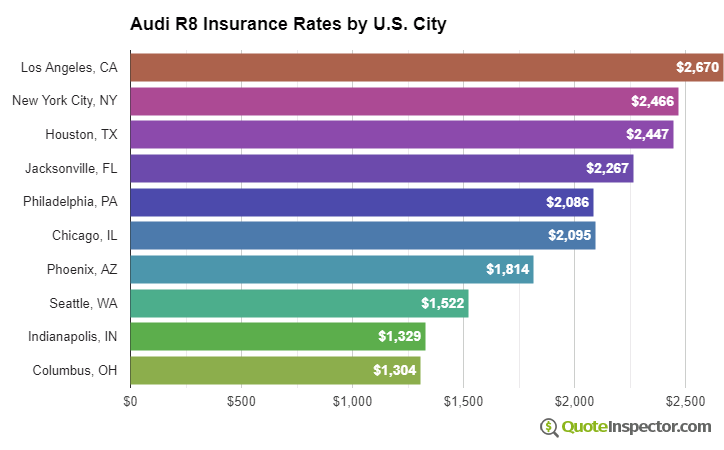

Price Range by Location

Where you live has a large influence on insurance rates. Areas with sparse population tend to have more infrequent collision claims than congested cities. The graphic below illustrates how where you live affects auto insurance rates.

These examples demonstrate why all drivers should compare prices for a specific zip code and their own driving history, rather than using rate averages.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Rate Comparisons

The chart below details average Audi R8 insurance rates for additional coverage choices and driver risks.

- The best full coverage rate is $892

- Using higher $1,000 deductibles will save about $212 annually

- The average price for a 40-year-old driver using $500 deductibles is $1,562

- Buying low deductibles for physical damage coverage costs an extra $410 each year

- Higher-risk drivers with multiple tickets or accidents could pay at least $3,384

- The cost to insure a teenage driver can be $5,802 or more

Car insurance rates for an Audi R8 can also vary considerably based on policy deductibles and limits, your driving record, and the trim level and model year.

Opting for high physical damage deductibles could cut rates by as much as $630 a year, whereas increasing liability limits will increase rates. Moving from a 50/100 liability limit to a 250/500 limit will cost as much as $426 extra every 12 months. View Rates by Deductible or Liability Limit

More mature drivers with no driving violations and higher deductibles may only pay around $1,400 a year for full coverage. Rates are highest for teen drivers, since even excellent drivers will be charged as much as $5,800 a year. View Rates by Age

If you like to drive fast or you were responsible for an accident, you may be forking out at least $1,800 to $2,500 extra per year, depending on your age. Insurance for high-risk drivers can be around 43% to 129% more than the average rate. View High Risk Driver Rates

Where you live has a huge impact on Audi R8 insurance rates. A driver around age 40 might see rates as low as $1,120 a year in states like New Hampshire, Ohio, and Utah, or at least $2,110 on average in Florida, Michigan, and New York.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,414 | -$148 | -9.5% |

| Alaska | $1,196 | -$366 | -23.4% |

| Arizona | $1,296 | -$266 | -17.0% |

| Arkansas | $1,562 | -$0 | 0.0% |

| California | $1,780 | $218 | 14.0% |

| Colorado | $1,494 | -$68 | -4.4% |

| Connecticut | $1,606 | $44 | 2.8% |

| Delaware | $1,768 | $206 | 13.2% |

| Florida | $1,954 | $392 | 25.1% |

| Georgia | $1,440 | -$122 | -7.8% |

| Hawaii | $1,122 | -$440 | -28.2% |

| Idaho | $1,056 | -$506 | -32.4% |

| Illinois | $1,164 | -$398 | -25.5% |

| Indiana | $1,176 | -$386 | -24.7% |

| Iowa | $1,054 | -$508 | -32.5% |

| Kansas | $1,486 | -$76 | -4.9% |

| Kentucky | $2,132 | $570 | 36.5% |

| Louisiana | $2,312 | $750 | 48.0% |

| Maine | $964 | -$598 | -38.3% |

| Maryland | $1,286 | -$276 | -17.7% |

| Massachusetts | $1,250 | -$312 | -20.0% |

| Michigan | $2,714 | $1,152 | 73.8% |

| Minnesota | $1,306 | -$256 | -16.4% |

| Mississippi | $1,870 | $308 | 19.7% |

| Missouri | $1,386 | -$176 | -11.3% |

| Montana | $1,678 | $116 | 7.4% |

| Nebraska | $1,232 | -$330 | -21.1% |

| Nevada | $1,874 | $312 | 20.0% |

| New Hampshire | $1,126 | -$436 | -27.9% |

| New Jersey | $1,744 | $182 | 11.7% |

| New Mexico | $1,384 | -$178 | -11.4% |

| New York | $1,644 | $82 | 5.2% |

| North Carolina | $900 | -$662 | -42.4% |

| North Dakota | $1,280 | -$282 | -18.1% |

| Ohio | $1,078 | -$484 | -31.0% |

| Oklahoma | $1,606 | $44 | 2.8% |

| Oregon | $1,430 | -$132 | -8.5% |

| Pennsylvania | $1,490 | -$72 | -4.6% |

| Rhode Island | $2,084 | $522 | 33.4% |

| South Carolina | $1,414 | -$148 | -9.5% |

| South Dakota | $1,320 | -$242 | -15.5% |

| Tennessee | $1,368 | -$194 | -12.4% |

| Texas | $1,882 | $320 | 20.5% |

| Utah | $1,156 | -$406 | -26.0% |

| Vermont | $1,070 | -$492 | -31.5% |

| Virginia | $936 | -$626 | -40.1% |

| Washington | $1,208 | -$354 | -22.7% |

| West Virginia | $1,430 | -$132 | -8.5% |

| Wisconsin | $1,082 | -$480 | -30.7% |

| Wyoming | $1,394 | -$168 | -10.8% |

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Audi R8 4.2 Quattro | $1,482 | $124 |

| Audi R8 4.2 Quattro | $1,482 | $124 |

| Audi R8 5.2 Quattro 10Cyl | $1,622 | $135 |

| Audi R8 5.2 Quattro 10Cyl | $1,622 | $135 |

Rates assume 2011 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2023 Audi R8 | $594 | $1,338 | $398 | $2,488 |

| 2022 Audi R8 | $574 | $1,306 | $416 | $2,454 |

| 2021 Audi R8 | $554 | $1,252 | $430 | $2,394 |

| 2020 Audi R8 | $524 | $1,208 | $442 | $2,332 |

| 2019 Audi R8 | $504 | $1,122 | $452 | $2,236 |

| 2018 Audi R8 | $484 | $1,056 | $456 | $2,154 |

| 2017 Audi R8 | $464 | $946 | $460 | $2,028 |

| 2016 Audi R8 | $434 | $870 | $460 | $1,922 |

| 2015 Audi R8 | $418 | $816 | $464 | $1,856 |

| 2014 Audi R8 | $408 | $762 | $474 | $1,802 |

| 2012 Audi R8 | $368 | $642 | $478 | $1,646 |

| 2011 Audi R8 | $342 | $588 | $474 | $1,562 |

| 2010 Audi R8 | $322 | $534 | $474 | $1,488 |

| 2009 Audi R8 | $312 | $478 | $468 | $1,416 |

Rates are averaged for all Audi R8 models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Shop for Affordable Audi R8 Insurance

Saving money on auto insurance requires being safe and accident-free, maintaining a good credit score, eliminating unnecessary coverage, and consideration of higher deductibles. Take the time to comparison shop at every policy renewal by obtaining price quotes from direct companies like GEICO, Progressive, and Esurance, and also from several local insurance agents.

Below you'll find a brief review of the data touched on in the above illustrations.

- Consumers who may need more liability protection will pay around $520 every year to increase from a minimum limit to a 250/500 level

- You may be able to save up to $190 per year just by quoting online in advance

- Increasing deductibles could save as much as $625 each year

- Youthful drivers are the costliest to insure, with premiums as much as $484 per month if the policy includes full coverage

Savings don’t have to be complicated. Getting quotes will help you find the right Audi R8 insurance cost and sort through companies, such as State Farm vs Allstate, Geico, and Progressive. Enter your ZIP code in our free tool below to get started.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Size and Class of the Audi A8 and Liability Insurance Rates

The Audi A8’s size and class has a direct effect on your liability insurance rates. Since liability insurance covers other drivers’ medical bills and property damage bills, a vehicle that crashes easily or is larger will have higher liability insurance rates.

This brings us to an important question about the Audi R8. Is the Audi R8 considered a supercar? The Audi A8 is considered a supercar, as it is a sports car. The engine strength of a supercar could present problems, as it could mean the Audi A8 is more prone to crashing.

Can you drive an R8 every day even though it is a higher risk? Absolutely. Just make sure you understand that a higher crash risk means higher liability rates. Read on to learn what else determines the price of car insurance.

Audi A8 Liability Insurance Cost

Because the Audi A8 may be prone to higher liability insurance rates, we want to breakdown a quote from Geico to show you what you may be paying. Our sample quote is based on a 40-year-old male driver who has a clean driving record and travels 13,000 miles a year.

The first set of rates is for bodily injury liability coverage for a 2020 Audi A8 Quattro. These rates are for six months of coverage.

- Low ($15,000/$30,000): $12.01

- Medium ($100,000/$200,000): $24.64

- High ($500,000/$500,000): $39.66

The Audi A8 Quattro must have low bodily injury losses, as it only costs $39 for high bodily injury coverage. That is a very low price, as high coverage is usually over $100.

The final set of rates is for property damage liability coverage for a 2020 Audi A8 Quattro.

- Low ($5,000): $389.33

- Medium ($20,000): $406.19

- High ($100,000): $418.51

The cost to increase your property damage coverage from low to high is only $29. How much is a monthly payment on an Audi R8 for property damage? Your amount will likely be a little less than $5 extra a month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Audi A8 Safety Features and Ratings

CarandDriver listed the following safety features for the 2020 Audi R8 Quattro:

- Electronic Stability Control (ESC)

- ABS And Driveline Traction Control

- Side Impact Beams

- Dual Stage Driver And Passenger Seat-Mounted Side Airbags

- Audi parking system plus Front And Rear Parking Sensors

- Tire Pressure Monitoring System

- Tire Specific Low Tire Pressure Warning

- Dual Stage Driver And Passenger Front Airbags

- Sideguard Curtain 1st Row Airbags

- Airbag Occupancy Sensor

- Driver And Passenger Knee Airbag

- Outboard Front Lap And Shoulder Safety Belts

- Pretensioners

- Back-Up Camera

Why should you care about this list of safety features? These features are not only meant to keep you safe and prevent crashes, but they can also earn you a discount on auto insurance.

Either way, more safety features is a win/win situation, especially because the Audi R8 is a sports car and already has marks against it. In fact, cars, in general, are more dangerous.

The Insurance Information Institute for Highway Safety’s (IIHS) fatality data for three different vehicle types showed cars have the highest fatality numbers.

The data revealed that driver fatalities per million vehicles showed 48 car fatalities compared to only 34 pickup fatalities and 23 SUV fatalities. The occupant fatalities per million vehicles also showed that cars lead fatalities: 69 car fatalities, 42 pickup fatalities, and 32 SUV fatalities.

These averages were gleaned from the total fatalities, which was 13,138 for cars, 5,035 for SUVs, and 4,369 for pickups. The list below is a breakdown of the 13,138 car fatalities by crash type.

- Frontal Impact: 7,433 fatalities

- Side Impact: 3,568 fatalities

- Rear Impact: 834 fatalities

- Other (mostly rollovers): 1,303 fatalities

The Audi R8’s safety features can help, as you may avoid rear impacts with the backup camera or the multiple different airbags will prevent a neck injury. So keep in mind that safety features aren’t just beneficial for discounts — they will also keep you protected.

Audi A8 Manufacturer Suggested Retail Price

How does the manufacturer’s suggested retail price (MSRP) relate to what you pay for insurance? Remember that insurers are the ones footing the bill after a crash, so a high MSRP means your insurer will have to pay more.

The two main car insurance coverages that a high MSRP will affect are collision and comprehensive coverages, as these two coverages pay for repairs to your vehicle after an accident.

To give you an estimate of how much the MSRP is for an Audi R8, we pulled prices from Kelley Blue Book (KBB) for a 2020 Audi R8 coupe.

- MSRP: $172,850

- Invoice price: $162,657

The invoice price is simply what sellers price the car at. Because the invoice price isn’t a set price, insurers tend to use the MSRP instead.

Unfortunately, the MSRP is very high for the Audi R8 Coupe. This means higher collision and comprehensive rates. Insurers also know what the best and worst vehicles for overall collision losses are, so a sports car like the Audi R8 Coupe will automatically have higher rates.

Rates will likely remain high no matter what style of Audi R8 you have or how old the Audi R8 is. So whether you are buying insurance for an Audi R8 used or an Audi R8 decennium, you can expect higher insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is an Audi R8 expensive to maintain? This is another question that you should be asking yourself in relation to insurance costs. Not only can expensive maintenance throw a wrench in your car budget, but expensive repair costs mean expensive car insurance rates because insurers are footing the bill after accidents.

Because the Audi A8 is so expensive to buy, the repair parts will also be expensive. While shopping around for repair shop estimates can bring costs down, keep in mind that your insurer may require you to use a specific shop after an accident.

We hope our guide to Audi A8 rates was helpful. Check out other rate articles on our site to learn about everything from what is the cheapest supercar to maintain to BMW I8 insurance cost.

Want to start finding rates for your car today? Enter your ZIP code in our free online tool.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,802 |

| 20 | $3,588 |

| 30 | $1,628 |

| 40 | $1,562 |

| 50 | $1,426 |

| 60 | $1,398 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,972 |

| $250 | $1,782 |

| $500 | $1,562 |

| $1,000 | $1,350 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,562 |

| 50/100 | $1,717 |

| 100/300 | $1,835 |

| 250/500 | $2,143 |

| 100 CSL | $1,764 |

| 300 CSL | $2,025 |

| 500 CSL | $2,215 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $8,290 |

| 20 | $5,724 |

| 30 | $3,458 |

| 40 | $3,384 |

| 50 | $3,228 |

| 60 | $3,198 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $84 |

| Multi-vehicle | $83 |

| Homeowner | $24 |

| 5-yr Accident Free | $115 |

| 5-yr Claim Free | $102 |

| Paid in Full/EFT | $72 |

| Advance Quote | $78 |

| Online Quote | $112 |

| Total Discounts | $670 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area