Key Takeaways

Standard automobile insurance policies usually do not cover racing and racing-related activities

Track policies may provide limited liability and medical coverage, but usually do not cover damage to your vehicle

Race car insurance provides financial protection for damage that

Key Takeaways

One-day car insurance and short term car insurance are often confused

A majority of insurance companies will not allow a contract for a vehicle for a single day

There are special short-term options for drivers for as little as $15 per day

Drivers looking for one-da

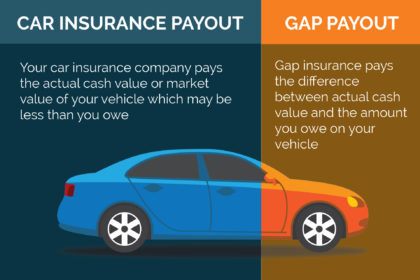

Gap insurance, otherwise known as Guaranteed Auto Protection insurance, is protection from major insurance companies for when the actual cash value of your car auto loan balance is less than what you owe.