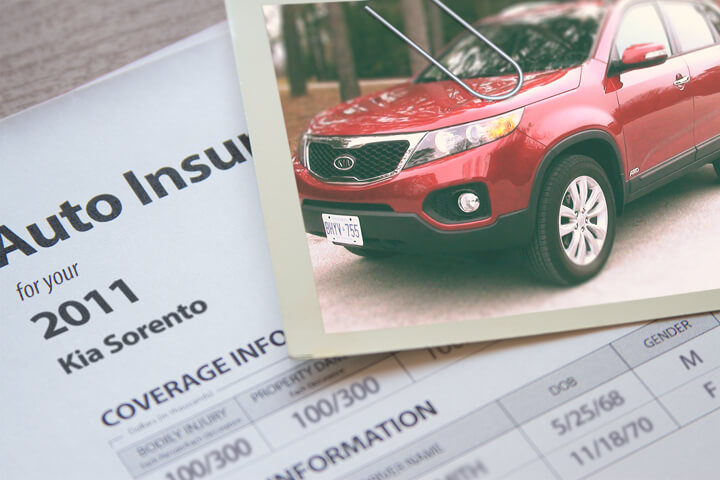

Cheapest 2011 Kia Sorento Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Searching for the cheapest insurance rates? Consumers have options when looking for low-cost Kia Sorento insurance. They can either spend hours calling around getting price quotes or leverage the internet to get rate quotes. There are both good and bad ways to shop for insurance so you’re going to learn the proper way to price shop coverage for a Kia and get the lowest price either online or from local insurance agents.

Kia Sorento rates are in the details

Smart consumers have a good feel for the rating factors that help determine the rates you pay for car insurance. Having a good understanding of what determines base rates allows you to make educated decisions that could result in better car insurance rates.

The following are a few of the “ingredients” companies use to determine premiums.

- More claims means more premium – Companies provide discounts to policyholders who do not file claims often. If you tend to file frequent claims, you can definitely plan on either policy cancellation or increased premiums. Your insurance policy is designed for larger claims.

- Bad driving skills means higher rates – Your driving record has a big impact on rates. Even a single speeding ticket can bump up the cost by twenty percent. Drivers who don’t get tickets get better rates than their less careful counterparts. Drivers who get dangerous violations such as DUI or reckless driving may be required to file a proof of financial responsibility form (SR-22) with their state DMV in order to prevent a license revocation.

- Better credit means lower rates – Your credit rating is a big factor in determining what you pay for car insurance. Drivers who have excellent credit tend to be better drivers and file fewer claims than drivers with lower credit ratings. If your credit can use some improvement, you could potentially save money when insuring your 2011 Kia Sorento by spending a little time repairing your credit.

- Where you live – Residing in less populated areas can be a good thing when it comes to car insurance. Drivers who live in large cities have much more traffic and longer commute times. Lower population means fewer accidents as well as less vandalism and auto theft.

How to Buy Auto Insurance Online

Most companies give coverage prices online. Obtaining pricing doesn’t take a lot of time as you simply enter your coverage preferences as detailed in the form. Once entered, their rating system gets your credit score and driving record and generates a price determined by many factors.

This streamlines rate comparisons, but the work required to visit multiple sites and fill out multiple forms is repetitive and time-consuming. But it is imperative to have as many quotes as possible if you want to find better auto insurance pricing.

A quicker way to lower your auto insurance bill uses one simple form that gets price quotes from multiple companies. It saves time, requires much less work on your part, and makes rate comparisons a lot less work. As soon as the form is sent, your coverage is rated and you can select your choice of the price quotes you receive. If a lower price is quoted, it’s easy to complete the application and purchase coverage. This process just takes a couple of minutes and you will find out if you’re overpaying now.

In order to fill out one form to compare multiple rates now, click here and enter your information. If you have a policy now, it’s recommended that you enter the coverage information exactly as shown on your declarations page. This ensures you will be getting a rate comparison based on identical coverages.

Take advantage of discounts

Companies that sell car insurance don’t necessarily list every discount very clearly, so here is a list some of the more common and the more hidden ways to save on car insurance. If you’re not getting every credit available, you are paying more than you should be.

- Multiple Policy Discount – If you insure your home and vehicles with one insurance company you will save 10% to 20% off each policy.

- College Student – Any of your kids living away from home attending college and don’t have a car may be able to be covered for less.

- Good Student Discount – Getting good grades can earn a discount of 20% or more. The good student discount can last up to age 25.

- Pay Upfront and Save – If you pay your entire premium ahead of time instead of monthly or quarterly installments you can actually save on your bill.

- Driver Safety – Successfully completing a course in driver safety could save 5% or more if you qualify.

- Military Rewards – Having a deployed family member could be rewarded with lower premiums.

Drivers should understand that most of the big mark downs will not be given to the entire policy premium. Most cut specific coverage prices like physical damage coverage or medical payments. So even though they make it sound like adding up those discounts means a free policy, you’re out of luck.

Car insurance companies that possibly offer these benefits include:

Double check with all companies you are considering which discounts you may be entitled to. Savings may not apply everywhere.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to know if you need help

When choosing adequate coverage for your vehicles, there really is not a one size fits all plan. Your needs are not the same as everyone else’s.

These are some specific questions may help highlight if your insurance needs will benefit from professional help.

- Is rental equipment covered for theft or damage?

- When should I drop full coverage on my 2011 Kia Sorento?

- Am I covered by my employer’s commercial auto policy when driving my personal car for business?

- Does my personal policy cover me when driving out-of-state?

- Does my car insurance cover rental cars?

- Do I need PIP (personal injury protection) coverage in my state?

- How high should deductibles be on a 2011 Kia Sorento?

- Am I better off with higher deductibles on my 2011 Kia Sorento?

- Am I covered when driving in Canada or Mexico?

If you’re not sure about those questions but one or more may apply to you, you might consider talking to an insurance agent. If you want to speak to an agent in your area, simply complete this short form. It’s fast, doesn’t cost anything and you can get the answers you need.

Insurance coverages and their meanings

Knowing the specifics of a insurance policy aids in choosing the best coverages and proper limits and deductibles. Insurance terms can be impossible to understand and reading a policy is terribly boring.

Collision protection

This coverage pays for damage to your Sorento resulting from colliding with another car or object. You first must pay a deductible then your collision coverage will kick in.

Collision coverage pays for things such as sideswiping another vehicle, crashing into a building, driving through your garage door and scraping a guard rail. This coverage can be expensive, so consider dropping it from older vehicles. Another option is to choose a higher deductible to bring the cost down.

Liability coverages

This coverage protects you from injuries or damage you cause to other’s property or people that is your fault. This coverage protects you against claims from other people. It does not cover damage sustained by your vehicle in an accident.

Coverage consists of three different limits, per person bodily injury, per accident bodily injury, and a property damage limit. You commonly see values of 100/300/100 that means you have $100,000 bodily injury coverage, $300,000 for the entire accident, and $100,000 of coverage for damaged property.

Liability coverage protects against claims such as repair bills for other people’s vehicles, pain and suffering, repair costs for stationary objects, bail bonds and emergency aid. How much liability should you purchase? That is up to you, but consider buying as much as you can afford.

Coverage for uninsured or underinsured drivers

Uninsured or Underinsured Motorist coverage protects you and your vehicle from other drivers when they are uninsured or don’t have enough coverage. This coverage pays for injuries sustained by your vehicle’s occupants and damage to your Kia Sorento.

Since many drivers have only the minimum liability required by law, it only takes a small accident to exceed their coverage. For this reason, having high UM/UIM coverages is very important.

Comprehensive insurance

This pays to fix your vehicle from damage that is not covered by collision coverage. You first must pay your deductible and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive coverage protects against things like hail damage, hitting a deer, fire damage, hitting a bird and damage from a tornado or hurricane. The highest amount you can receive from a comprehensive claim is the market value of your vehicle, so if it’s not worth much more than your deductible it’s not worth carrying full coverage.

Coverage for medical expenses

Medical payments and Personal Injury Protection insurance provide coverage for immediate expenses for things like funeral costs, dental work, rehabilitation expenses and nursing services. The coverages can be used to cover expenses not covered by your health insurance plan or if you lack health insurance entirely. Medical payments and PIP cover you and your occupants in addition to any family member struck as a pedestrian. PIP is not universally available but can be used in place of medical payments coverage

In any little way, save everyday

Lower-priced 2011 Kia Sorento insurance is possible online and also from your neighborhood agents, and you need to comparison shop both so you have a total pricing picture. Some insurance providers may not provide the ability to get a quote online and most of the time these regional insurance providers sell through independent agents.

People switch companies for a variety of reasons including an unsatisfactory settlement offer, questionable increases in premium, high rates after DUI convictions or policy non-renewal. It doesn’t matter why you want to switch finding a new company can be easy and end up saving you some money.

As you go through the steps to switch your coverage, do not buy poor coverage just to save money. There have been many cases where an insured dropped liability coverage limits only to regret at claim time that it was a big error on their part. Your strategy should be to purchase plenty of coverage for the lowest price, not the least amount of coverage.

Use our FREE quote tool to compare rates now!

More tips and info about car insurance can be found by following these links:

- Cellphones, Texting and Driving (iihs.org)

- Crash Avoidance Technologies FAQ (iihs.org)

- Insuring a Leased Car (Insurance Information Institute)

- Neck Injury FAQ (iihs.org)

- Driving in Bad Weather (Insurance Information Institute)

Frequently Asked Questions

What factors affect the cost of insurance for a 2011 Kia Sorento?

Several factors can influence the cost of insurance for a 2011 Kia Sorento. The main ones include your location, driving history, age, gender, credit score, coverage options, deductibles, and the level of insurance you choose.

How can I find the cheapest insurance for a 2011 Kia Sorento?

To find the most affordable insurance for your 2011 Kia Sorento, it’s recommended to shop around and compare quotes from multiple insurance providers. Additionally, you can consider the following strategies: maintaining a good driving record, bundling your auto insurance with other policies, opting for a higher deductible, and inquiring about any available discounts.

Are there specific insurance companies that offer cheaper rates for a 2011 Kia Sorento?

Insurance rates can vary among different companies, so it’s essential to research and obtain quotes from multiple providers. Some well-known insurance companies that may offer competitive rates include Progressive, GEICO, State Farm, Allstate, and Farmers. However, the rates can vary based on your individual circumstances, so it’s crucial to compare quotes.

Are there any safety features on the 2011 Kia Sorento that can lower insurance costs?

Yes, certain safety features on the 2011 Kia Sorento may help lower insurance costs. These features can include anti-lock brakes, stability control, airbags, alarm systems, and anti-theft devices. Insurance companies often offer discounts for vehicles equipped with these safety features, as they can reduce the risk of accidents and theft.

Can my driving history affect the cost of insurance for a 2011 Kia Sorento?

Yes, your driving history plays a significant role in determining your insurance rates. If you have a clean driving record with no accidents or traffic violations, you are likely to receive lower insurance premiums. However, if you have a history of accidents, tickets, or DUI convictions, your insurance rates may be higher due to the increased risk you pose as a driver.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Honda CR-V Insurance

- Subaru Outback Insurance

- Chevrolet Silverado Insurance

- Toyota Tacoma Insurance

- Toyota Corolla Insurance

- Nissan Rogue Insurance

- Ford F-150 Insurance

- Honda Accord Insurance

- Toyota Rav4 Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area