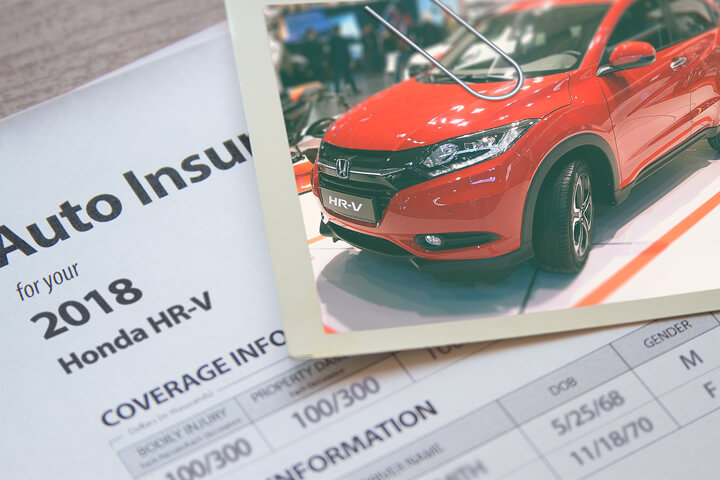

Cheapest 2018 Honda HR-V Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Cutting costs on auto insurance is hard for drivers new to comparing prices online. With dozens of companies in the marketplace, it can easily become more work than you anticipated to find the best price.

The purpose of this article is to teach you the most effective way to quote insurance and some money-saving tips. If you have car insurance now, you should be able to reduce your rates substantially using these tips. But consumers must understand how big insurance companies sell insurance online.

Do you qualify for discount insurance coverage?

Companies that sell car insurance don’t always list all disounts very clearly, so the list below contains both well-publicized as well as the least known credits available to bring down your rates.

- Driver Education Discount – It’s a good idea to have your young drivers complete a driver education course if offered at their school.

- Seat Belt Discounts – Buckling up and requiring all passengers to wear their seat belts may be able to save a few bucks on medical payment and PIP coverage.

- Military Rewards – Being on active deployment in the military could be rewarded with lower insurance coverage rates.

- 55 and Retired – Drivers over the age of 55 may receive a discount up to 10% for HR-V coverage.

- Discounts for New Vehicles – Insuring a vehicle that is new can cost up to 25% less compared to insuring an older model.

- Accident Waiver – This one isn’t a discount, but some companies like State Farm, Progressive and GEICO will allow you to have one accident before they charge you more for coverage so long as you haven’t had any claims for a certain period of time.

- Anti-theft System – Anti-theft and alarm system equipped vehicles are stolen less frequently and that can save you a little bit as well.

- Multiple Policy Discount – If you have multiple policies with one company you will save up to 20% off your total premium.

- Home Ownership Discount – Just owning your own home can save a few bucks due to the fact that maintaining a home requires a higher level of personal finance.

- Paperwork-free – Many insurance coverage companies will provide an incentive for buying a policy and signing up on the internet.

Discounts lower rates, but many deductions do not apply to the overall cost of the policy. A few only apply to the cost of specific coverages such as liability and collision coverage. If you do the math and it seems like you would end up receiving a 100% discount, that’s just not realistic.

A few popular companies and the discounts they provide are detailed below.

- Farm Bureau offers discounts including multi-policy, multi-vehicle, driver training, 55 and retired, youthful driver, good student, and safe driver.

- MetLife may offer discounts for good student, accident-free, claim-free, good driver, defensive driver, and multi-policy.

- Progressive discounts include continuous coverage, homeowner, online signing, online quote discount, and multi-policy.

- AAA offers discounts for multi-policy, multi-car, anti-theft, good student, good driver, and pay-in-full.

- American Family has savings for bundled insurance, air bags, Steer into Savings, defensive driver, accident-free, mySafetyValet, and good driver.

- GEICO includes discounts for membership and employees, five-year accident-free, anti-theft, emergency military deployment, and driver training.

- State Farm may have discounts that include passive restraint, driver’s education, multiple autos, good driver, and Drive Safe & Save.

When getting free car insurance quotes, it’s a good idea to every insurance company which discounts you qualify for. Some discounts may not apply to policyholders in your area. To see a list of providers who offer insurance coverage discounts, click here.

How to get insurance coverage quotes

There are several ways you can shop for insurance coverage and some are less time-consuming than others. You can spend countless hours talking to insurance agencies in your area, or you could save time and use the web to quickly compare rates.

All the larger companies take part in a program that allows shoppers to send in one quote, and every company provides a quote. This system prevents you from having to do repetitive form submissions for each company.

To participate in this free quote system, click to open in new window.

The only drawback to using this type of system is you don’t know exactly which providers to get pricing from. If you prefer to choose from a list of companies to compare prices, we have a page of the cheapest insurance coverage companies in your area. Click here for list of insurance companies.

The approach you take is up to you, just be sure you’re using apples-to-apples coverage data for every company. If each company quotes differing limits you will not be able to determine the best price for your Honda HR-V. Quoting even small variations in limits could throw off the whole comparison. It’s important to know that comparing a large number of companies helps increase your odds of locating more affordable rates. Not every company allows you to get prices over the internet, so it’s recommended that you also compare price estimates from those companies as well.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What insurance coverages do I need?

When buying the best auto insurance coverage, there isn’t really a one size fits all plan. Everyone’s situation is unique.

For instance, these questions may help highlight whether you might need professional guidance.

- Do I need special endorsements for business use of my vehicle?

- Is a fancy paint job covered?

- Do I need PIP (personal injury protection) coverage in my state?

- Is my 2018 Honda HR-V covered for smoke damage?

- Is business property covered if stolen from my car?

- Will my rates increase for filing one claim?

- Is pleasure use cheaper than using my 2018 Honda HR-V to commute?

- At what point should I drop full coverage?

If you don’t know the answers to these questions but you know they apply to you, you may need to chat with a licensed insurance agent. If you don’t have a local agent, take a second and complete this form.

Detailed coverages of your car insurance policy

Learning about specific coverages of your car insurance policy aids in choosing the right coverages at the best deductibles and correct limits. Car insurance terms can be impossible to understand and coverage can change by endorsement.

Medical expense insurance

Med pay and PIP coverage reimburse you for immediate expenses for pain medications, nursing services, doctor visits and rehabilitation expenses. They are used to fill the gap from your health insurance program or if you do not have health coverage. Medical payments and PIP cover not only the driver but also the vehicle occupants and will also cover getting struck while a pedestrian. Personal injury protection coverage is not universally available and may carry a deductible

Comprehensive (Other than Collision)

This covers damage that is not covered by collision coverage. A deductible will apply then your comprehensive coverage will pay.

Comprehensive coverage pays for things such as hitting a bird, hail damage, damage from flooding and rock chips in glass. The maximum payout you’ll receive from a claim is the cash value of the vehicle, so if the vehicle’s value is low it’s probably time to drop comprehensive insurance.

Coverage for liability

Liability insurance can cover damage that occurs to a person or their property in an accident. This coverage protects you against claims from other people, and doesn’t cover your own vehicle damage or injuries.

Liability coverage has three limits: bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. As an example, you may have policy limits of 100/300/100 which stand for $100,000 bodily injury coverage, a total of $300,000 of bodily injury coverage per accident, and a limit of $100,000 paid for damaged property. Some companies may use one limit called combined single limit (CSL) which limits claims to one amount with no separate limits for injury or property damage.

Liability coverage pays for claims such as repair bills for other people’s vehicles, loss of income, bail bonds and emergency aid. How much coverage you buy is up to you, but you should buy higher limits if possible.

Collision protection

This coverage covers damage to your HR-V resulting from a collision with a stationary object or other vehicle. A deductible applies then your collision coverage will kick in.

Collision coverage pays for claims like sustaining damage from a pot hole, backing into a parked car, colliding with another moving vehicle, colliding with a tree and rolling your car. Collision is rather expensive coverage, so you might think about dropping it from older vehicles. Another option is to increase the deductible to save money on collision insurance.

Protection from uninsured/underinsured drivers

Your UM/UIM coverage protects you and your vehicle from other drivers when they either are underinsured or have no liability coverage at all. It can pay for injuries sustained by your vehicle’s occupants as well as your vehicle’s damage.

Because many people only carry the minimum required liability limits, it only takes a small accident to exceed their coverage. So UM/UIM coverage is a good idea. Usually these coverages are set the same as your liability limits.

Saving money makes a lot of cents

Lower-priced insurance can be bought from both online companies and from local agencies, so you should compare both so you have a total pricing picture. Some insurance providers don’t offer online quoting and usually these small insurance companies prefer to sell through independent agents.

Consumers who switch companies do it for any number of reasons including policy cancellation, lack of trust in their agent, high prices and denial of a claim. Regardless of your reason, choosing a new insurance company can be less work than you think.

While you’re price shopping online, it’s a bad idea to reduce coverage to reduce premium. There are many occasions where an insured cut liability coverage limits to discover at claim time that a couple dollars of savings turned into a financial nightmare. The aim is to find the BEST coverage at the best price, but do not skimp to save money.

Use our FREE quote tool to compare insurance rates now!

Additional information is available at these links:

- If I File a Claim will My Insurance Go Up? (Insurance Information Institute)

- Uninsured Motorists: Threats on the Road (Insurance Information Institute)

- What Determines the Price of My Auto Insurance Policy? (Insurance Information Institute)

- Uninsured Motorist Statistics (Insurance Information Institute)

- Choosing a Car for Your Teen (State Farm)

Frequently Asked Questions

Are there any specific insurance companies known for offering cheaper rates for a 2018 Honda HR-V?

The cost of insurance can vary among insurance companies. It’s best to compare quotes from multiple insurers to find the most affordable rates for your 2018 Honda HR-V. Some well-known insurance companies include Geico, Progressive, State Farm, Allstate, and Liberty Mutual. However, it’s always a good idea to research and compare rates from various insurers to find the one that suits your needs and budget.

What factors can influence the insurance rates for a 2018 Honda HR-V?

Here are the seven factors can affect the insurance rates for a 2018 Honda HR-V, including:

- Location

- Driving record

- Age and gender

- Coverage options

- Vehicle usage

- Credit history

- Insurance history

Are there any specific safety features that can help reduce insurance rates for a 2018 Honda HR-V?

Yes, having certain safety features on your 2018 Honda HR-V can potentially lower your insurance rates.Here’s the seven features that may help reduce premiums include:

- Anti-lock braking system (ABS)

- Electronic stability control (ESC)

- Multiple airbags, including front and side airbags

- Rearview cameras or parking sensors

- Anti-theft devices, such as alarm systems or vehicle tracking systems

- Daytime running lights (DRL)

- Lane departure warning systems or collision avoidance systems

Can I change my insurance coverage mid-policy to reduce costs for my 2018 Honda HR-V?

Yes, in most cases, you can adjust your insurance coverage mid-policy to potentially reduce costs for your 2018 Honda HR-V. You can contact your insurance provider and discuss options such as changing your coverage limits, increasing deductibles, or removing certain optional cover

Will the age of my 2018 Honda HR-V affect my insurance rates in 2023?

Yes, the age of your vehicle can impact your insurance rates. Generally, newer vehicles may have higher insurance premiums due to their higher value and potential repair costs. However, as your Honda HR-V ages, its value may decrease, which could result in lower insurance rates.

Are there any specific insurance requirements for a 2018 Honda HR-V?

Yes, like any other vehicle, your 2018 Honda HR-V must meet the minimum insurance requirements mandated by your state or country. These requirements typically include liability insurance, which covers injuries or damages to others in an accident you cause. It’s important to check the specific insurance requirements in your area and ensure you have the necessary coverage.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Ford Focus Insurance

- Toyota Camry Insurance

- Dodge Ram Insurance

- Nissan Rogue Insurance

- Chevrolet Malibu Insurance

- Chevrolet Cruze Insurance

- Honda CR-V Insurance

- Volkswagen Jetta Insurance

- Ford Escape Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area