Audi S3 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

How much is insurance on an Audi S3? A luxury car brand, Audi S3s can be expensive to insure with average rates of over $1,400 a year. If you need help reducing rates or just want to learn more about Audi S3 insurance costs, you’ve come to the right place.

Read our Audi S3 review to learn about average rates, crash test ratings, and more. Ready to start shopping for Audi S3 insurance rates today? Enter your ZIP code in our free online tool above.

Estimated insurance prices for an Audi S3 are $1,218 every 12 months for full coverage insurance. Comprehensive costs approximately $278, collision insurance costs $526, and liability costs around $304. A liability-only policy costs as low as $346 a year, and high-risk insurance costs around $2,638. 16-year-old drivers pay the most at up to $4,406 a year.

Average premium for full coverage: $1,218

Premium estimates by type of coverage:

Estimates include $500 comprehensive and collision deductibles, 30/60 liability limits, and includes UM/UIM and medical coverage. Rates include averaging for all 50 states and for different S3 trim levels.

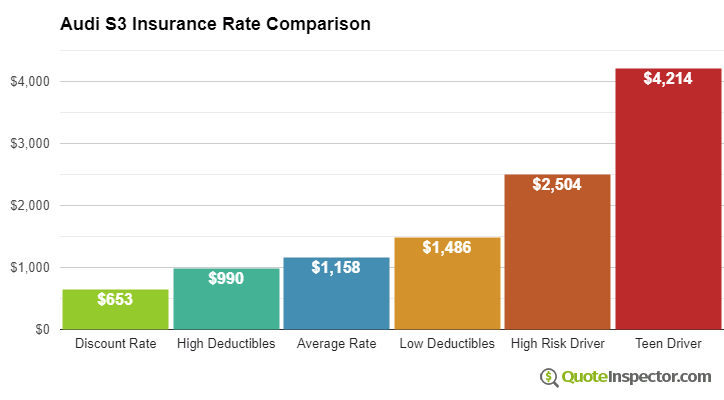

Insurance Price Range by Risk and Coverage

For a driver in their 40's, insurance rates for an Audi S3 range from the cheapest price of $346 for a discount liability-only rate to a much higher rate of $2,638 for a driver required to buy high-risk insurance.

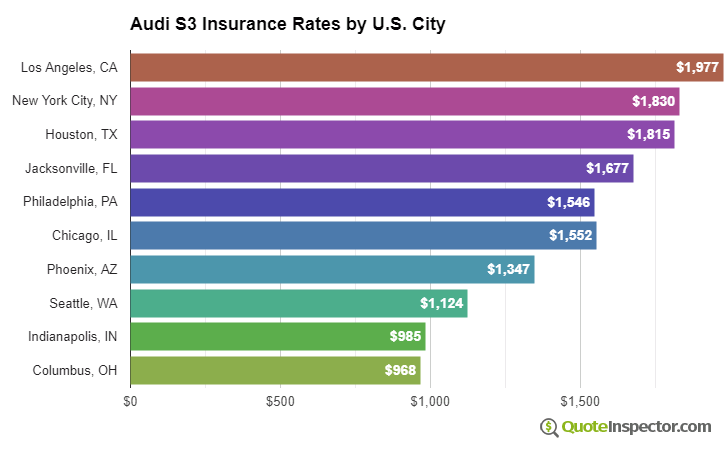

Insurance Price Range by Location

Where you live can have significant affects on the price of auto insurance. Rural locations are statistically proven to have more infrequent physical damage claims than congested cities. The price range example below illustrates how location helps determine auto insurance prices.

These rate differences illustrate why anyone shopping for car insurance should compare prices using their specific location and their own driving history, instead of using rate averages.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Rates by State, City, and Model

The chart below illustrates average Audi S3 insurance rates for additional coverage and risk scenarios.

- The best full coverage rate is $684

- Using higher $1,000 deductibles will save $182 each year

- The average price for a 40-year-old good driver who chooses $500 deductibles is $1,218

- Buying more expensive low deductibles for physical damage coverage increases the price to $1,576

- Drivers with multiple tickets or accidents could pay around $2,638

- An auto insurance policy to insure a teen driver with full coverage can cost $4,406 or more

Auto insurance prices for an Audi S3 also have a wide range based on physical damage deductibles and liability limits, your risk profile, and the model of your S3.

Opting for high physical damage deductibles could cut prices by as much as $540 every year, while increasing your policy's liability limits will push prices upward. Switching from a 50/100 liability limit to a 250/500 limit will cost up to $273 extra every year. View Rates by Deductible or Liability Limit

An older driver with a good driving record and higher deductibles may pay as little as $1,100 a year, or $92 per month, for full coverage. Prices are highest for drivers in their teens, since even excellent drivers will have to pay in the ballpark of $4,400 a year. View Rates by Age

If you have a few violations or you were responsible for an accident, you are probably paying anywhere from $1,500 to $2,000 in extra premium annually, depending on your age. High-risk driver insurance can be as much as 45% to 137% more than the average rate. View High Risk Driver Rates

Where you choose to live has a huge impact on Audi S3 insurance prices. A driver around age 40 might see prices as low as $800 a year in states like North Carolina, Wisconsin, and Vermont, or at least $1,640 on average in Florida, New York, and Michigan.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,102 | -$116 | -9.5% |

| Alaska | $934 | -$284 | -23.3% |

| Arizona | $1,012 | -$206 | -16.9% |

| Arkansas | $1,218 | -$0 | 0.0% |

| California | $1,388 | $170 | 14.0% |

| Colorado | $1,162 | -$56 | -4.6% |

| Connecticut | $1,252 | $34 | 2.8% |

| Delaware | $1,378 | $160 | 13.1% |

| Florida | $1,522 | $304 | 25.0% |

| Georgia | $1,124 | -$94 | -7.7% |

| Hawaii | $876 | -$342 | -28.1% |

| Idaho | $824 | -$394 | -32.3% |

| Illinois | $908 | -$310 | -25.5% |

| Indiana | $918 | -$300 | -24.6% |

| Iowa | $824 | -$394 | -32.3% |

| Kansas | $1,156 | -$62 | -5.1% |

| Kentucky | $1,660 | $442 | 36.3% |

| Louisiana | $1,804 | $586 | 48.1% |

| Maine | $750 | -$468 | -38.4% |

| Maryland | $1,004 | -$214 | -17.6% |

| Massachusetts | $970 | -$248 | -20.4% |

| Michigan | $2,116 | $898 | 73.7% |

| Minnesota | $1,018 | -$200 | -16.4% |

| Mississippi | $1,460 | $242 | 19.9% |

| Missouri | $1,080 | -$138 | -11.3% |

| Montana | $1,308 | $90 | 7.4% |

| Nebraska | $960 | -$258 | -21.2% |

| Nevada | $1,462 | $244 | 20.0% |

| New Hampshire | $878 | -$340 | -27.9% |

| New Jersey | $1,360 | $142 | 11.7% |

| New Mexico | $1,076 | -$142 | -11.7% |

| New York | $1,282 | $64 | 5.3% |

| North Carolina | $700 | -$518 | -42.5% |

| North Dakota | $998 | -$220 | -18.1% |

| Ohio | $842 | -$376 | -30.9% |

| Oklahoma | $1,250 | $32 | 2.6% |

| Oregon | $1,116 | -$102 | -8.4% |

| Pennsylvania | $1,162 | -$56 | -4.6% |

| Rhode Island | $1,622 | $404 | 33.2% |

| South Carolina | $1,102 | -$116 | -9.5% |

| South Dakota | $1,026 | -$192 | -15.8% |

| Tennessee | $1,066 | -$152 | -12.5% |

| Texas | $1,468 | $250 | 20.5% |

| Utah | $902 | -$316 | -25.9% |

| Vermont | $832 | -$386 | -31.7% |

| Virginia | $730 | -$488 | -40.1% |

| Washington | $938 | -$280 | -23.0% |

| West Virginia | $1,118 | -$100 | -8.2% |

| Wisconsin | $842 | -$376 | -30.9% |

| Wyoming | $1,082 | -$136 | -11.2% |

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2022 Audi S3 | $344 | $726 | $274 | $1,454 |

| 2021 Audi S3 | $332 | $696 | $284 | $1,422 |

| 2020 Audi S3 | $314 | $672 | $292 | $1,388 |

| 2019 Audi S3 | $302 | $624 | $298 | $1,334 |

| 2018 Audi S3 | $290 | $588 | $300 | $1,288 |

| 2017 Audi S3 | $278 | $526 | $304 | $1,218 |

| 2016 Audi S3 | $260 | $484 | $304 | $1,158 |

| 2015 Audi S3 | $250 | $454 | $306 | $1,120 |

Rates are averaged for all Audi S3 models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Shop for Low Cost Audi S3 Insurance

Finding better rates on car insurance requires having a decent driving record, having a good credit score, paying for small claims out-of-pocket, and possibly higher deductibles. Invest time comparing rates at every policy renewal by getting rate quotes from direct insurance companies, and also from local insurance agencies.

The following items are a review of the data covered in the charts and tables above.

- Policyholders who purchase additional liability coverage will pay around $330 annually to increase from 30/60 bodily injury limits to a 250/500 level

- It is possible to save around $150 per year just by shopping early and online

- Increasing policy deductibles could save as much as $550 each year

- 16 to 18-year-old drivers have the highest car insurance prices, with premiums being up to $367 per month if comprehensive and collision insurance is included

You can save almost $200 by getting quotes. What is the cheapest Audi to insure? If you want to get started on finding rates for your vehicle to find out how much is Audi S3 insurance to much is insurance for an Audi A4, enter your ZIP code in our free tool below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Audi S3 Size and Class and Liability Insurance

What does liability insurance cover? This coverage will cover other driver’s costs (medical and property damages) if you caused the accident. This is why the size and class of your vehicle influence your liability rates.

If your vehicle is large, heavy, or prone to crashing, it means that your vehicle is at a higher risk of damaging other vehicles/people. This will result in your liability rates being higher.

The Audi S3 is a compact luxury sedan, so it isn’t a very large car. This means that if you are in an accident, it is unlikely that the car you hit will be crushed unless it is smaller. However, luxury usually means that the car has a more powerful engine and acceleration. Insurers sometimes raise rates for these cars because luxury cars are more likely to be crashed.

While your liability rates will depend upon what company you choose, such as Greenlight Insurance or State Farm insurance, rates should be within a similar price range. To find out if what else determines the price of car insurance, keep reading.

Audi S3 Liability Insurance Rates

Liability insurance is composed of bodily injury and property damage, so we are going to go over sample Geico quotes for both of these liability parts. The sample rates are for a 40-year-old male driver who owns a 2020 Audi S3 Quattro Prestige, has a clean driving record, and travels an average of 13,000 miles a year.

How much does it cost to insure an Audi S3? Below are the average liability rates for a six-month policy for bodily injury insurance.

- Low ($15,000/$30,000): $26.70

- Medium ($100,000/$200,000): $54.73

- High ($500,000/$500,000): $88.11

It costs around $62 if you want to upgrade your bodily injury insurance from low to high coverage, or about $10 extra a month. This isn’t a bad price upgrade, especially because your insurance will cover up to $500,000 in medical bills if you hit someone.

The jump in coverage for property damage is similar, as you can upgrade from $5,000 to $100,000 of coverage for an extra $37 ($6 a month).

- Low ($5,000): $407.47

- Medium ($20,000): $429.04

- High ($100,000): $444.81

We always recommend getting the highest possible coverage you can afford, as you will be better protected from legal actions and paying bills out of pocket if you cause an accident. Keep in mind, however, that liability rates will be different for a 40-year-old than Audi S3 insurance for a 21-year-old, as age and driving record will affect your rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Audi S3 Safety Features and Ratings

Most people take note of safety features when they buy a car, as safety features help prevent crashes and keep the driver and passengers safe in a crash. The safety benefits of features are why insurers often offer a discount if your car has certain safety features, such as stability control or backup cameras.

According to VehicleHistory, the 2017 Audi S3 has the following standard safety features:

- Electronic Stability Control (ESC)

- ABS And Driveline Traction Control

- Side Impact Beams

- Dual Stage Driver And Passenger Seat-Mounted Side Airbags

- Front And Rear Parking Sensors

- Low Tire Pressure Warning

- Dual Stage Driver And Passenger Front Airbags

- Sideguard Curtain

- 1st and 2nd Row Airbags

- Airbag Occupancy Sensor

- Driver And Passenger Knee Airbag

- Rear Child Safety Locks

- Outboard Front Lap And Shoulder Safety Belts

- Height Adjusters and Pretensioners

- Back-Up Camera

The Audi S3 has some great safety features, so you should be able to get a discount. Another way to check if your vehicle is likely to have lower rates is to look at crash test ratings. The National Highway Traffic Safety Administration (NHTSA) gave the 2020 Audi S3 an overall safety rating of five out five.

The parts of the crash safety test that scored less than five were:

- Rollover Resistance Test: Four

- Front Driver Side Test: Four

A four is still good, so the Audi S3 has a great safety rating overall. This is important because cars do have higher fatality rates, so they will automatically cost more to insure than pickups and SUVs.

This conclusion is based on the Insurance Information Institute for Highway Safety’s (IIHS) 2018 fatality data for the three different vehicle types (cars, pickups, and SUVs), which showed cars have the highest number of fatalities.

The IIHS found that driver fatalities per million vehicles were 48 car fatalities, 34 pickup fatalities, and 23 SUV fatalities. The occupant fatalities per million vehicles were 69 car fatalities, 42 pickup fatalities, and 32 SUV fatalities.

The IIHS’s averages are based on the total fatalities, which were 13,138 for cars, 5,035 for SUVs, and 4,369 for pickups. Below, the list shows the breakdown of the 13,138 car fatalities by crash type.

- Frontal Impact: 7,433 fatalities

- Side Impact: 3,568 fatalities

- Rear Impact: 834 fatalities

- Other (mostly rollovers): 1,303 fatalities

Because the Audi S3 has a good safety rating, drivers will be better protected and less likely to end up as one of the numbers on these lists. So whether you are worried about Audi A3 insurance cost or Audi A4 insurance costs, one way to make sure you have lower rates is to check safety ratings and safety features.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Audi S3 Manufacturer Suggested Retail Price

Because the manufacturer suggested retail price (MSRP) is the price a car is valued to be worth, insurers use the MSRP to determine collision and comprehensive insurance rates. Since collision and comprehensive insurance pay for your vehicle repairs after an accident, the MSRP gives insurers an idea of how much it will cost to repair or replace your vehicle.

According to Kelley Blue Book (KBB), the average MSRP for the 2019 Audi S3 Premium Plus are:

- MSRP: $45,495

- Invoice Price: $42,827

- Fair Purchase Price: $39,043

- Fair Market Range: $36,762 to $41,323

The Audi S3 does cost more than a typical vehicle, so it will cost a little more to insure than a cheaper vehicle. We did include other prices to show you what you should be paying for an Audi S3, as the MSRP is never the price you should pay.

To prepare for costs, it is also important to know what insurance group is an Audi S3 in, as researching this will tell you if an Audi S3 will be expensive to insure.

We hope our guide to Audi S3 insurance helped you gain a better understanding of pricing. If you want to start comparing vehicle rates from Audi S3 insurance rates to Audi RS3 insurance rates to find out which cars are cheapest to insure, make sure to enter your ZIP code in our free tool below.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $4,406 |

| 20 | $2,804 |

| 30 | $1,280 |

| 40 | $1,218 |

| 50 | $1,110 |

| 60 | $1,092 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,576 |

| $250 | $1,410 |

| $500 | $1,218 |

| $1,000 | $1,036 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,218 |

| 50/100 | $1,279 |

| 100/300 | $1,355 |

| 250/500 | $1,552 |

| 100 CSL | $1,309 |

| 300 CSL | $1,476 |

| 500 CSL | $1,598 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $6,330 |

| 20 | $4,472 |

| 30 | $2,706 |

| 40 | $2,638 |

| 50 | $2,514 |

| 60 | $2,494 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $66 |

| Multi-vehicle | $64 |

| Homeowner | $17 |

| 5-yr Accident Free | $95 |

| 5-yr Claim Free | $80 |

| Paid in Full/EFT | $60 |

| Advance Quote | $63 |

| Online Quote | $89 |

| Total Discounts | $534 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area