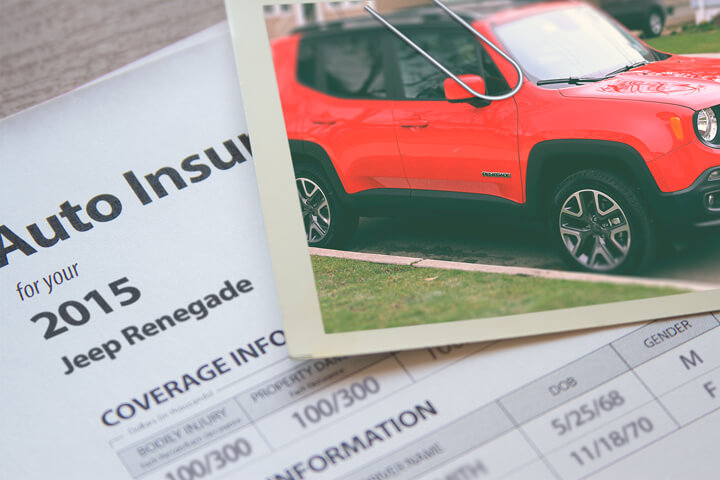

Jeep Renegade Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Buying auto insurance by getting online quotes is easy, in addition you will probably save money. The key is to get rates from as many companies as possible in order to accurately compare all your choices.

People who are new to comparing rates may think finding cut-rate Jeep Renegade insurance is nearly impossible. To find the best auto insurance prices, there are several ways to get quotes from auto insurance companies in your area. The fastest way to find the cheapest Jeep Renegade insurance quotes is to get quotes online. This is very easy and can be done by getting a quick quote here.

Criteria which help determine

Insurance rates for your Jeep Renegade can fluctuate considerably based upon several criteria. A few of these criteria are:

- Your driving record

- Credit rating impacts rates

- Where you live

- High miles vs. low miles

- Men typically pay more than women

- The deductible you choose

- NTSB crash rating for your vehicle

- Your profession

- The amount of protection requested

- Owning a home can lower rates

One last important factor that helps determine the rate you pay on your Jeep Renegade is the year of manufacture. Older models have a much lower replacement value so the payout to repair will push premiums down. But more recent Renegade vehicles may have options including traction control, tire pressure monitors, a collision avoidance system, and a telematics system which may help offset higher rates.

Liability

injuries or damage you cause to claims such as funeral expenses, loss of income, and emergency aid. .

Collision insurance

another vehicle or an object, but not an animal. . , . .

Comprehensive insurance

caused by mother nature, theft, vandalism and other events. . a auto insurance company will pay at claim time , .

UM/UIM (Uninsured/Underinsured Motorist) coverage

This coverage . , . .

Medical costs insurance

bills ambulance fees, surgery, and doctor visits. . .

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2024

- Cheapest Jeep Insurance Rates in 2024

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Corolla Insurance

- Chevrolet Equinox Insurance

- Subaru Outback Insurance

- Toyota Camry Insurance

- Toyota Rav4 Insurance

- Honda Accord Insurance

- Kia Optima Insurance

- Nissan Rogue Insurance

- Honda CR-V Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area