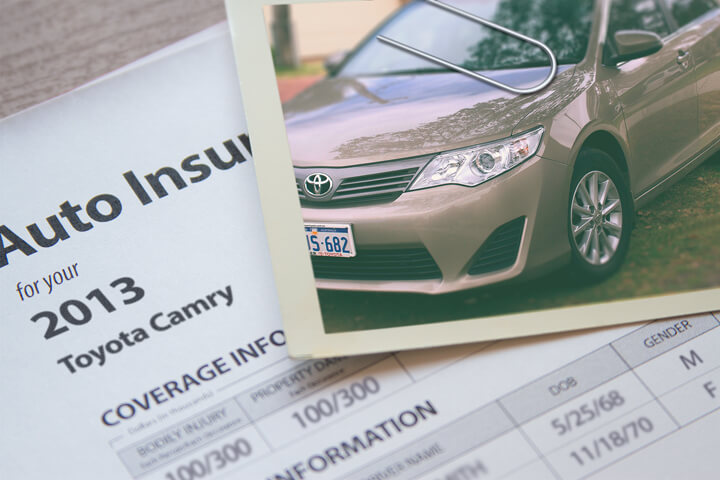

Cheapest 2013 Toyota Camry Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Trying to find the cheapest insurance coverage rates for your Toyota Camry? Tired of being strong-armed each month for car insurance? Your situation is no different than the majority of other car owners. There are many insurance companies to buy insurance from, and even though it’s nice to have a selection, lots of choices makes it harder to compare rates and find the lowest cost insurance coverage.

It’s a good habit to compare prices every six months because insurance rates fluctuate regularly. Even if you think you had the best deal for Camry insurance a year ago you may be paying too much now. Ignore everything you know about insurance coverage because I’m going to let you in on the secrets to the only way to buy cheaper insurance coverage.

How to Compare Auto Insurance Costs

Lowering your 2013 Toyota Camry auto insurance rates is surprisingly easy. You just need to take the time to compare rate quotes provided by online insurance companies. This is very easy and can be done using a couple different methods.

- The single most time-saving way to get quotes is a comparison rater form (click to open form in new window). This method prevents you from having to do separate quotes for each company. One simple form compares rates from multiple low-cost companies.

- A slightly less efficient method to get comparison quotes requires a trip to the website for each individual company and request a quote. For example, we’ll assume you want to compare rates from GEICO, 21st Century and Progressive. To get each rate you have to visit each site to input your insurance information, which is why the first method is quicker.

However you get your quotes, double check that you are using exactly the same coverages for every company. If you are comparing different values for each quote then you won’t be able to find the best deal for your Toyota Camry.

Discounts can save BIG

Insuring your fleet can be pricey, buy you may qualify for discounts that you may not know about. Larger premium reductions will be automatically applied at quote time, but some may not be applied and must be inquired about before you will receive the discount. If you’re not getting every credit you qualify for, you are paying more than you should be.

- Pay Upfront and Save – If paying your policy premium upfront instead of paying each month you could save up to 5%.

- Multiple Vehicles – Buying insurance for multiple vehicles on the same car insurance policy could earn a price break for each car.

- Auto/Home Discount – If you insure your home and vehicles with the same company you may save approximately 10% to 15%.

- Student Driver Training – Make teen driver coverage more affordable by requiring them to enroll in driver’s education if it’s offered in school.

- Sign Online – Certain companies may give you up to $50 for buying your policy online.

- Life Insurance – Some companies give a discount if you purchase life insurance from them.

- Safe Driver Discount – Safe drivers can pay as much as 50% less for Camry insurance than less cautious drivers.

Drivers should understand that many deductions do not apply to the entire policy premium. Most only reduce individual premiums such as physical damage coverage or medical payments. So even though they make it sound like you can get free auto insurance, it just doesn’t work that way. But all discounts will reduce the cost of coverage.

Will just any policy work for me?

When it comes to choosing the right insurance coverage, there really is not a one size fits all plan. Everyone’s situation is unique and a cookie cutter policy won’t apply. Here are some questions about coverages that could help you determine if your situation will benefit from professional help.

- Do I need rental car coverage?

- Can I rate high risk drivers on liability-only vehicles?

- What vehicles should carry emergency assistance coverage?

- How can I force my company to pay a claim?

- Can I make deliveries for my home business?

- Is my teenager covered with friends in the car?

- Does having multiple vehicles earn me a discount?

- Am I covered when driving in Canada or Mexico?

- If my 2013 Toyota Camry is totaled, can I afford another vehicle?

If you can’t answer these questions but a few of them apply, then you may want to think about talking to an insurance agent. If you want to speak to an agent in your area, fill out this quick form. It’s fast, free and you can get the answers you need.

Insurance coverages 101

Having a good grasp of a insurance policy helps when choosing which coverages you need and the correct deductibles and limits. The terms used in a policy can be difficult to understand and coverage can change by endorsement. Below you’ll find typical coverage types found on the average insurance policy.

Auto collision coverage

Collision coverage pays for damage to your Camry from colliding with another car or object. You will need to pay your deductible and the rest of the damage will be paid by collision coverage.

Collision insurance covers things such as rolling your car, crashing into a ditch, backing into a parked car, hitting a mailbox and damaging your car on a curb. This coverage can be expensive, so you might think about dropping it from lower value vehicles. You can also bump up the deductible to get cheaper collision coverage.

Comprehensive coverages

Comprehensive insurance pays for damage that is not covered by collision coverage. You first must pay your deductible and then insurance will cover the rest of the damage.

Comprehensive coverage protects against claims like hitting a bird, rock chips in glass and falling objects. The maximum amount a insurance company will pay at claim time is the cash value of the vehicle, so if the vehicle’s value is low consider dropping full coverage.

Coverage for medical payments

Med pay and PIP coverage kick in for short-term medical expenses for pain medications, prosthetic devices, rehabilitation expenses and doctor visits. They are used to cover expenses not covered by your health insurance plan or if you are not covered by health insurance. Coverage applies to you and your occupants as well as if you are hit as a while walking down the street. PIP coverage is not available in all states but it provides additional coverages not offered by medical payments coverage

Uninsured and underinsured coverage

This protects you and your vehicle’s occupants when other motorists either have no liability insurance or not enough. Covered claims include injuries sustained by your vehicle’s occupants and also any damage incurred to your Toyota Camry.

Since a lot of drivers only carry the minimum required liability limits, their liability coverage can quickly be exhausted. For this reason, having high UM/UIM coverages is very important. Frequently the UM/UIM limits do not exceed the liability coverage limits.

Liability coverage

Liability coverage protects you from damage or injury you incur to other people or property in an accident. This coverage protects you from legal claims by others, and doesn’t cover damage to your own property or vehicle.

It consists of three limits, bodily injury per person, bodily injury per accident and property damage. Your policy might show policy limits of 100/300/100 that translate to $100,000 in coverage for each person’s injuries, $300,000 for the entire accident, and a limit of $100,000 paid for damaged property. Occasionally you may see one limit called combined single limit (CSL) that pays claims from the same limit without having the split limit caps.

Liability coverage pays for claims like court costs, structural damage, medical expenses and medical services. How much liability should you purchase? That is a decision to put some thought into, but you should buy as high a limit as you can afford.

Frequently Asked Questions

How can I compare auto insurance costs?

Comparing auto insurance costs is easy and can be done using online insurance companies. You can use a couple of different methods to obtain rate quotes.

What should I consider when comparing auto insurance quotes?

Make sure you are using exactly the same coverages for every company when comparing quotes. If the values for each quote differ, you won’t be able to find the best deal for your Toyota Camry.

Are there any discounts available to lower my auto insurance rates?

Yes, there are discounts available that can significantly reduce your premiums. Some discounts are automatically applied at the time of the quote, while others may require you to inquire about them. Keep in mind that most discounts only apply to specific components of your policy, not the entire premium.

Will any insurance policy work for me?

No, there is no one-size-fits-all insurance coverage plan. The right insurance coverage depends on your unique situation. If you’re unsure about which coverages you need or if you have specific questions, it’s recommended to speak with an insurance agent.

What are the typical coverage types found in an insurance policy?

- Auto collision coverage: Pays for damage to your Camry from colliding with another car or object.

- Comprehensive coverage: Pays for damage not covered by collision coverage, such as hitting a bird or rock chips in glass.

- Medical payments (Med Pay) and Personal Injury Protection (PIP) coverage: Cover short-term medical expenses not covered by health insurance, including pain medications, prosthetic devices, and rehabilitation expenses.

- Uninsured and underinsured coverage: Protects you and your vehicle’s occupants when other motorists have no liability insurance or insufficient coverage.

- Liability coverage: Protects you from damage or injury you cause to other people or property in an accident. It does not cover damage to your own property or vehicle.

How much liability coverage should I purchase?

The amount of liability coverage you should purchase depends on your personal circumstances and budget. However, it is generally recommended to buy as high a limit as you can afford to ensure adequate protection.

How can I find companies with the cheapest auto insurance rates in my area?

Enter your ZIP code on this page to use the free quote tool. It will provide you with a list of companies that offer cheap auto insurance rates in your area.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Nissan Rogue Insurance

- Honda CR-V Insurance

- Kia Optima Insurance

- Honda Accord Insurance

- Ford Escape Insurance

- Jeep Grand Cherokee Insurance

- Dodge Ram Insurance

- Chevrolet Silverado Insurance

- Toyota Rav4 Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area