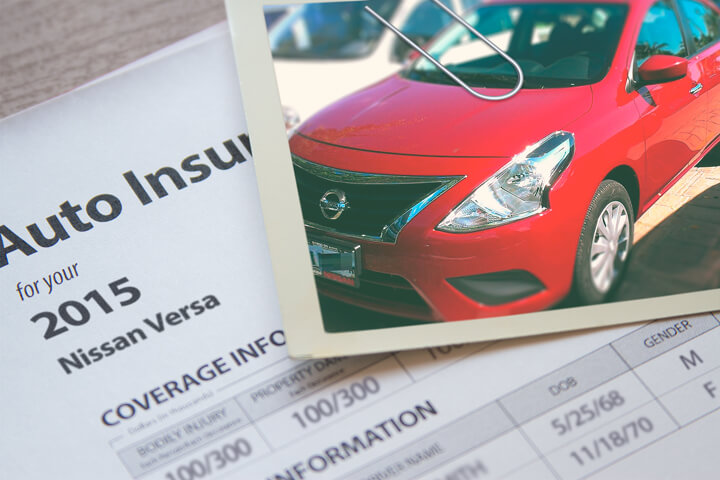

Cheapest 2015 Nissan Versa Insurance Rates in 2024

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Searching for cheaper insurance rates for your Nissan Versa? Locating cheaper insurance for a Nissan Versa can normally be a lot of work, but you can learn these tips to find lower rates. There are both good and bad ways to buy insurance so you’re going to learn the proper way to quote coverages for a Nissan and get the cheapest rates either online or from local insurance agents.

Elements that influence Nissan Versa insurance rates

It’s important that you understand the factors that go into determining auto insurance rates. When you know what positively or negatively influences your rates enables informed choices that could result in big savings.

- How your age affects price – Teenage drivers are known to be careless and easily distracted in a vehicle so they pay higher auto insurance rates. Mature drivers are more cautious drivers, statistically cause fewer accidents and get fewer tickets.

- Discounts for married couples – Having a wife or husband can get you a discount when buying auto insurance. Marriage usually means you are more mature it has been statistically shown that being married results in fewer claims.

- Optional equipment can affect rates – Choosing a vehicle with anti-theft technology or alarm system can save you a little every year. Theft prevention features like GM’s OnStar, tamper alarm systems and vehicle immobilizers can thwart your vehicle from being stolen.

- High numbers of claims are not good – If you are a frequent claim filer, you can look forward to either policy cancellation or increased premiums. Car insurance companies provide discounts to people who file claims infrequently. Your insurance policy is intended for larger claims.

Save big with these discounts

Companies do not advertise every discount very clearly, so we researched both well-publicized and the more hidden ways to save on insurance coverage. If you’re not getting every credit available, you’re paying more than you need to.

- Payment Discounts – If you pay your bill all at once instead of paying each month you could save 5% or more.

- Defensive Driving Course – Taking part in a defensive driving course could save 5% or more if you qualify.

- Anti-lock Brake System – Vehicles with anti-lock braking systems can reduce accidents and will save you 10% or more.

- Own a Home – Being a homeowner may earn you a small savings because of the fact that having a home shows financial diligence.

- Drivers Ed for Students – Require your teen driver to take driver’s ed class in school.

- Military Discounts – Being on active duty in the military may qualify for rate reductions.

- Employee of Federal Government – Simply working for the federal government could cut as much as 10% off for Versa coverage with certain companies.

- No Charge for an Accident – Certain companies will forgive one accident before your rates go up so long as you haven’t had any claims for a set time period.

It’s important to understand that many deductions do not apply to all coverage premiums. Most cut the cost of specific coverages such as medical payments or collision. So when the math indicates adding up those discounts means a free policy, you’re out of luck.

Car insurance companies that may offer some of the above discounts include:

It’s a good idea to ask all companies you are considering what discounts are available to you. Discounts may not be available in every state.

Is there truth in advertising?

Consumers get pounded daily by advertisements that promise big savings from the likes of Progressive, Allstate and GEICO. All the companies say the same thing that you can save if you move your coverage to them.

How can each company make the same claim? It’s all in the numbers.

Insurance companies can use profiling for the type of driver that earns them a profit. For example, a driver they prefer might be profiled as between the ages of 30 and 50, is a homeowner, and has excellent credit. A customer getting a price quote who fits that profile gets the lowest rates and therefore will save quite a bit of money when switching.

Consumers who don’t meet this ideal profile must pay higher premiums and this can result in business not being written. The ads say “customers that switch” but not “drivers who get quotes” save that much. That is how insurance companies can advertise the savings. This illustrates why you absolutely need to get as many comparisons as possible. It’s impossible to know which insurance companies will give you the biggest savings on Nissan Versa insurance.

But I don’t know anything about car insurance

When choosing coverage, there really is no single plan that fits everyone. Everyone’s situation is a little different.

Here are some questions about coverages that may help you determine if you might need professional guidance.

- What is an SR-22 filing?

- How do I insure my teen driver?

- Is my state a no-fault state?

- Will I be non-renewed for getting a DUI or other conviction?

- What can I do if my company won’t pay a claim?

- Are my tools covered if they get stolen from my vehicle?

- What if I don’t agree with a claim settlement offer?

- Am I covered when driving a rental car?

- When do I need to add a new car to my policy?

If you’re not sure about those questions, you may need to chat with an insurance agent. To find lower rates from a local agent, complete this form. It’s fast, doesn’t cost anything and can provide invaluable advice.

Car insurance coverage information

Understanding the coverages of your policy can help you determine the right coverages at the best deductibles and correct limits. The terms used in a policy can be difficult to understand and coverage can change by endorsement.

Liability

This protects you from injuries or damage you cause to a person or their property in an accident. This coverage protects you against claims from other people. It does not cover damage sustained by your vehicle in an accident.

It consists of three limits, per person bodily injury, per accident bodily injury, and a property damage limit. Your policy might show liability limits of 25/50/25 which stand for $25,000 bodily injury coverage, $50,000 for the entire accident, and a total limit of $25,000 for damage to vehicles and property.

Liability can pay for claims such as repair bills for other people’s vehicles, legal defense fees, funeral expenses and pain and suffering. How much liability should you purchase? That is up to you, but you should buy as much as you can afford.

Coverage for collisions

This pays to fix your vehicle from damage resulting from colliding with a stationary object or other vehicle. You will need to pay your deductible then the remaining damage will be paid by your insurance company.

Collision coverage protects against claims such as hitting a mailbox, damaging your car on a curb and driving through your garage door. Collision coverage makes up a good portion of your premium, so you might think about dropping it from vehicles that are older. Drivers also have the option to bump up the deductible to get cheaper collision coverage.

Coverage for medical payments

Med pay and PIP coverage provide coverage for bills for things like pain medications, EMT expenses, rehabilitation expenses, prosthetic devices and nursing services. They can be used to fill the gap from your health insurance policy or if you do not have health coverage. Medical payments and PIP cover you and your occupants in addition to if you are hit as a while walking down the street. PIP is only offered in select states and may carry a deductible

Comprehensive coverages

This covers damage caused by mother nature, theft, vandalism and other events. You need to pay your deductible first and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive coverage pays for things such as hitting a bird, fire damage, hitting a deer, vandalism and a broken windshield. The highest amount you can receive from a comprehensive claim is the market value of your vehicle, so if your deductible is as high as the vehicle’s value it’s not worth carrying full coverage.

Uninsured and underinsured coverage

This coverage gives you protection when other motorists either have no liability insurance or not enough. It can pay for hospital bills for your injuries and also any damage incurred to your Nissan Versa.

Since many drivers only purchase the least amount of liability that is required, their liability coverage can quickly be exhausted. This is the reason having UM/UIM coverage is important protection for you and your family.

Take this to the bank

Throughout this article, we presented some good ideas how you can shop for 2015 Nissan Versa insurance online. The key thing to remember is the more quotes you get, the more likely it is that you will get a better rate. You may be surprised to find that the lowest rates come from an unexpected company.

Insureds switch companies for any number of reasons including delays in paying claims, extreme rates for teen drivers, policy non-renewal or even high prices. Whatever your reason, choosing a new insurance company is pretty easy and you might even save some money in the process.

When trying to cut insurance costs, make sure you don’t skimp on critical coverages to save a buck or two. In many instances, consumers will sacrifice collision coverage only to find out that it was a big mistake. Your strategy should be to buy the best coverage you can find at an affordable rate.

To read more, link through to the following helpful articles:

- Top Signs Your Brakes are Giving Out (State Farm)

- Information for Teen Drivers (GEICO)

- Keeping Children Safe in Crashes Video (iihs.org)

- What if I Can’t Find Coverage? (Insurance Information Institute)

Frequently Asked Questions

What factors determine the insurance rates for a 2015 Nissan Versa?

Various factors can influence the insurance rates for a 2015 Nissan Versa. These factors may include the driver’s age, driving history, location, credit score, annual mileage, and the level of coverage chosen.

Is the 2015 Nissan Versa considered an affordable car to insure?

Generally, the 2015 Nissan Versa is considered an affordable car to insure. However, insurance rates can vary depending on multiple factors, including the ones mentioned earlier. It is always recommended to compare insurance quotes from different providers to find the most suitable and affordable coverage for your specific circumstances.

Are there any specific safety features of the 2015 Nissan Versa that can help lower insurance rates?

The 2015 Nissan Versa typically comes with standard safety features, such as anti-lock brakes, stability control, multiple airbags, and a tire pressure monitoring system. These safety features may potentially help lower insurance rates since they can reduce the risk of accidents or injuries.

Can I save on insurance for my 2015 Nissan Versa by increasing my deductible?

Increasing the deductible on your insurance policy may lead to lower premiums. However, it is important to assess your financial situation and determine if you can afford to pay a higher deductible in the event of a claim. It is advisable to consult with your insurance provider to understand how different deductible levels may affect your rates.

Are there any discounts available for insuring a 2015 Nissan Versa?

Insurance providers often offer various discounts that may apply to insuring a 2015 Nissan Versa. Some common discounts include multi-policy discounts (if you have multiple policies with the same provider), safe driver discounts, good student discounts (for student drivers with good grades), and discounts for certain safety features or anti-theft devices installed in the vehicle. It is recommended to inquire with your insurance provider about the available discounts.

Can my insurance rates for a 2015 Nissan Versa change over time?

Yes, insurance rates for any vehicle, including the 2015 Nissan Versa, can change over time. Insurance premiums can be influenced by factors such as changes in your driving record, location, insurance provider’s pricing policies, and overall market conditions. It is advisable to review your insurance coverage periodically and compare quotes from different providers to ensure you are getting the best rates available.

Where can I find the cheapest insurance rates for a 2015 Nissan Versa?

To find the cheapest insurance rates for a 2015 Nissan Versa, it is recommended to shop around and compare quotes from different insurance providers. You can contact insurance companies directly, use online comparison websites, or work with an independent insurance agent who can help you gather multiple quotes. Keep in mind that the cheapest insurance rates may vary depending on your personal circumstances, location, and coverage needs.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2024

- Cheapest Jeep Insurance Rates in 2024

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Highlander Insurance

- Dodge Ram Insurance

- Toyota Rav4 Insurance

- Ford Focus Insurance

- Honda Accord Insurance

- Ford Fusion Insurance

- Honda Civic Insurance

- Nissan Rogue Insurance

- Chevrolet Cruze Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area