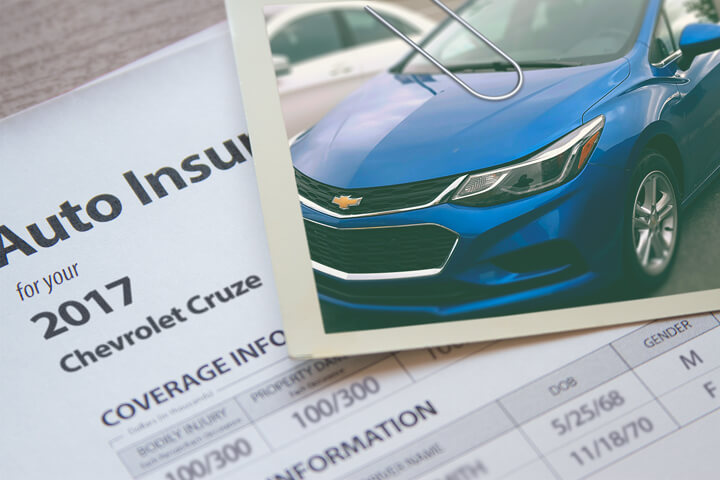

Cheapest 2017 Chevrolet Cruze Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Trying to find the cheapest insurance coverage rates for your Chevrolet Cruze? Finding cheap coverage rates on Driversinsurance coverage might be challenging for beginners to online price comparisons. Drivers have so many options available that it can turn into a big hassle to find cheaper prices.

Are you getting every discount?

The price of auto insurance can be rather high, but there could be significant discounts that you may not even know about. A few discounts will automatically apply when you complete an application, but some need to be asked about before they will apply.

- Theft Deterent – Cars and trucks equipped with anti-theft or alarm systems prevent vehicle theft and that can save you a little bit as well.

- Safety Course Discount – Completing a defensive driving class could earn you a small percentage discount depending on where you live.

- Claim Free – Good drivers with no accidents pay much less as compared to insureds who have frequent claims or accidents.

- Military Discounts – Being deployed in the military can result in better rates.

- Own a Home and Save – Just owning your own home can earn you a little savings because owning a home requires personal responsibility.

- Drivers Ed for Students – Require your teen driver to successfully complete driver’s ed class if offered at their school.

While discounts sound great, it’s important to understand that some credits don’t apply to the entire cost. Most only apply to individual premiums such as liability and collision coverage. Just because you may think it’s possible to get free car insurance, companies wouldn’t make money that way. Any qualifying discounts will bring down the amount you pay for coverage.

A few popular companies and some of their more popular discounts are detailed below.

- Esurance policyholders can earn discounts including emergency road assistance, paid-in-full, safety device, Switch & Save, and online shopper.

- The Hartford has discounts for driver training, bundle, good student, defensive driver, and anti-theft.

- AAA has savings for multi-policy, multi-car, anti-theft, good student, and AAA membership discount.

- GEICO offers discounts including anti-theft, multi-vehicle, daytime running lights, emergency military deployment, five-year accident-free, and defensive driver.

- State Farm may have discounts that include passive restraint, accident-free, safe vehicle, multiple policy, and multiple autos.

Check with all the companies which discounts you qualify for. Depending on the company, some discounts may not apply to policyholders in your state. To choose auto insurance companies with the best discounts, click here to view.

When in doubt talk to an agent

When it comes to buying adequate coverage for your personal vehicles, there really is no cookie cutter policy. Everyone’s situation is unique.

For example, these questions can aid in determining if your insurance needs would benefit from professional advice.

- Am I covered by my employer’s commercial auto policy when driving my personal car for business?

- How can I get high-risk coverage after a DUI?

- Am I covered by my spouse’s policy after a separation?

- Should I have combined single limit or split liability limits?

- Should I buy more coverage than the required minimum liability coverage?

- What can I do if my company won’t pay a claim?

If you don’t know the answers to these questions but a few of them apply, you might consider talking to an agent. If you don’t have a local agent, simply complete this short form.

Insurance policy coverages for a 2017 Chevy Cruze

Understanding the coverages of your policy aids in choosing which coverages you need and the correct deductibles and limits. Policy terminology can be ambiguous and nobody wants to actually read their policy.

Auto liability

Liability insurance can cover injuries or damage you cause to other’s property or people by causing an accident. It protects you against claims from other people, and does not provide coverage for damage sustained by your vehicle in an accident.

Coverage consists of three different limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. Your policy might show liability limits of 100/300/100 that means you have $100,000 in coverage for each person’s injuries, a per accident bodily injury limit of $300,000, and $100,000 of coverage for damaged property. Occasionally you may see one number which is a combined single limit which provides one coverage limit rather than limiting it on a per person basis.

Liability can pay for things such as pain and suffering, structural damage and repair bills for other people’s vehicles. How much liability should you purchase? That is up to you, but it’s cheap coverage so purchase higher limits if possible.

Uninsured and underinsured coverage

This coverage provides protection when other motorists are uninsured or don’t have enough coverage. Covered claims include medical payments for you and your occupants as well as damage to your Chevy Cruze.

Since a lot of drivers only carry the minimum required liability limits, it doesn’t take a major accident to exceed their coverage limits. That’s why carrying high Uninsured/Underinsured Motorist coverage should not be overlooked. Most of the time these limits do not exceed the liability coverage limits.

Comprehensive coverages

This covers damage caused by mother nature, theft, vandalism and other events. A deductible will apply then your comprehensive coverage will pay.

Comprehensive coverage pays for things such as falling objects, vandalism and damage from a tornado or hurricane. The most your insurance company will pay is the cash value of the vehicle, so if it’s not worth much more than your deductible it’s not worth carrying full coverage.

Collision coverage protection

Collision coverage pays for damage to your Cruze caused by collision with another car or object. A deductible applies and then insurance will cover the remainder.

Collision insurance covers claims like backing into a parked car, driving through your garage door, colliding with another moving vehicle and sideswiping another vehicle. Collision is rather expensive coverage, so analyze the benefit of dropping coverage from lower value vehicles. Another option is to bump up the deductible in order to get cheaper collision rates.

Coverage for medical payments

Med pay and PIP coverage reimburse you for expenses for hospital visits, pain medications and doctor visits. They are often used in conjunction with a health insurance policy or if you lack health insurance entirely. It covers you and your occupants in addition to getting struck while a pedestrian. PIP coverage is not available in all states but can be used in place of medical payments coverage

Summing up your auto insurance search

As you shop your coverage around, never reduce needed coverages to save money. In many instances, someone dropped physical damage coverage only to regret that the few dollars in savings costed them thousands. Your goal should be to find the BEST coverage for the lowest price, but do not sacrifice coverage to save money.

Drivers switch companies for any number of reasons including policy non-renewal, unfair underwriting practices, not issuing a premium refund and even questionable increases in premium. Regardless of your reason, switching auto insurance companies is less work than it seems.

The cheapest 2017 Chevy Cruze insurance is definitely available on the web and from local insurance agents, and you should compare rates from both to get a complete price analysis. There are still a few companies who may not offer rates over the internet and these regional insurance providers only sell through local independent agencies.

To learn more, link through to the articles below:

- Understanding Rental Car Insurance (Insurance Information Institute)

- Comprehensive Coverage (Liberty Mutual)

- Credit Impacts Car Insurance Rates (State Farm)

- Insuring a Leased Car (Insurance Information Institute)

Frequently Asked Questions

How can I find the cheapest insurance coverage rates for my 2017 Chevrolet Cruze?

To find the cheapest insurance coverage rates for your 2017 Chevrolet Cruze, you can enter your ZIP code below to view companies that offer cheap auto insurance rates. By comparing quotes from multiple insurance providers, you can find the most affordable option that meets your coverage needs.

What factors can affect the insurance rates for a 2017 Chevrolet Cruze?

Several factors can influence the insurance rates for a 2017 Chevrolet Cruze, including:

- Your driving record: Having a clean driving record with no accidents or violations can help lower your insurance premiums.

- Location: Insurance rates can vary based on where you live due to factors such as crime rates, population density, and local regulations.

- Age and gender: Younger and inexperienced drivers, as well as male drivers, often pay higher insurance rates.

- Coverage options and deductibles: The level of coverage you choose and the deductible amount can impact your insurance premiums.

Can I add other drivers to my insurance policy for the Chevrolet Cruze?

Yes, you can typically add other drivers to your insurance policy for the Chevrolet Cruze. This can include family members or household members who regularly use the vehicle. However, it’s important to disclose all drivers to your insurance provider to ensure proper coverage and avoid potential claim denials.

Can I get insurance coverage for my 2017 Chevrolet Cruze if I have a poor driving record or have been classified as high-risk?

Yes, it is possible to get insurance coverage for your 2017 Chevrolet Cruze even if you have a poor driving record or have been classified as high-risk. However, insurance rates may be higher in these situations. You may need to seek specialized insurance providers that cater to high-risk drivers or explore options such as non-standard auto insurance policies. Working with an insurance agent can help you find appropriate coverage options based on your circumstances.

Should I speak to an insurance agent when determining my insurance needs for my personal Chevrolet Cruze?

Yes, it can be beneficial to speak to an insurance agent when determining your insurance needs for your personal Chevrolet Cruze. Insurance needs can vary based on individual circumstances, and an agent can provide professional advice tailored to your specific situation. They can help answer questions such as whether you’re covered by your employer’s commercial auto policy when driving your personal car for business, how to obtain high-risk coverage after a DUI, or if you’re covered by your spouse’s policy after a separation. If you don’t have a local agent, you can complete a short form to receive assistance.

How can I ensure I find the best coverage for the lowest price when shopping for auto insurance?

While finding affordable insurance is important, it’s equally crucial to ensure you have the necessary coverage. Here are some tips to help you find the best coverage for the lowest price:

- Compare quotes from multiple insurance companies to get a comprehensive view of available options.

- Evaluate the coverage limits and deductibles offered by each company.

- Consider the reputation and customer reviews of the insurance companies you’re considering.

- Be cautious about reducing coverage too much to save money, as inadequate coverage may leave you financially vulnerable in the event of an accident.

- Switch insurance companies if you find a better deal or if you experience issues with your current provider.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Volkswagen Jetta Insurance

- Chevrolet Silverado Insurance

- Nissan Altima Insurance

- Honda Accord Insurance

- Nissan Rogue Insurance

- Honda CR-V Insurance

- Toyota Tacoma Insurance

- Toyota Highlander Insurance

- Dodge Ram Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area