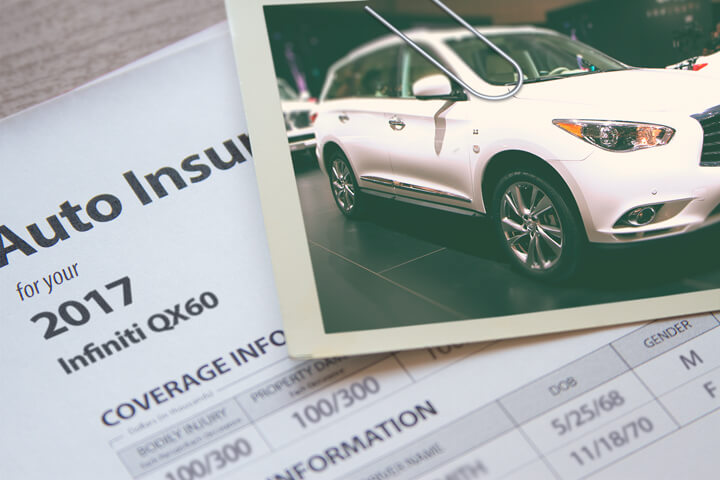

Cheapest 2017 Infiniti QX60 Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Trying to find cheaper insurance coverage rates for your Infiniti QX60? Car owners who are new to the process of shopping for insurance online are likely to discover locating the cheapest insurance coverage is tougher than they thought.

How to buy auto insurance online

Most larger insurance companies allow consumers to get pricing from their websites. Getting prices online can be done by anyone as you just type in your personal and coverage information on the page. Upon sending the form, the system gets your driving and credit reports and provides a quote based on these and other factors.

Online quotes makes it a lot easier to compare rates but the process of having to visit different websites and type in the same information can get tiresome after awhile. But it’s also necessary to perform this step if you are searching for the lowest auto insurance rates.

An easier way to find better auto insurance pricing utilizes a single form to get prices from several companies at one time. It’s a real time-saver, reduces the work, and makes price shopping online a little more enjoyable. As soon as the form is sent, it is rated and you can choose any or none of the resulting price quotes. If the quotes result in lower rates, it’s easy to complete the application and purchase coverage. The entire process takes 15 minutes at the most and could lower your rates considerably.

To save time and compare rates using this form now, simply click here to open in new window and input your coverage information. If you have coverage now, it’s recommended you duplicate the limits and deductibles just like they are on your policy. This makes sure you will have rate comparison quotes for the exact same coverage.

Insurance coverage can be complex

When choosing the best insurance coverage coverage, there really is not a single plan that fits everyone. Coverage needs to be tailored to your specific needs.

Here are some questions about coverages that may help you determine if your insurance needs may require specific advice.

- How high should my medical payments coverage be?

- When should I remove comp and collision on my 2017 Infiniti QX60?

- Should I buy more coverage than the required minimum liability coverage?

- What should my uninsured motorist coverage limits be in my state?

- Do I have coverage for damage caused while driving under the influence?

- Does my medical payments coverage pay my health insurance deductible?

- Does my insurance cover a custom paint job?

- Am I covered when driving someone else’s vehicle?

- If I drive on a suspended license am I covered?

- Does car insurance cover theft of personal property?

If you’re not sure about those questions, then you may want to think about talking to a licensed insurance agent. To find an agent in your area, take a second and complete this form.

Insurance coverage options for a 2017 Infiniti QX60

Learning about specific coverages of a insurance policy can help you determine the right coverages and the correct deductibles and limits. The coverage terms in a policy can be confusing and nobody wants to actually read their policy.

Coverage for medical expenses

Medical payments and Personal Injury Protection insurance provide coverage for expenses for things like nursing services, chiropractic care, funeral costs and pain medications. They can be used to cover expenses not covered by your health insurance policy or if you lack health insurance entirely. Coverage applies to both the driver and occupants and will also cover being hit by a car walking across the street. PIP coverage is not an option in every state and may carry a deductible

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comprehensive insurance

This pays for damage from a wide range of events other than collision. You first have to pay a deductible then your comprehensive coverage will pay.

Comprehensive can pay for things such as rock chips in glass, vandalism, hail damage, damage from getting keyed and a tree branch falling on your vehicle. The highest amount you can receive from a comprehensive claim is the actual cash value, so if your deductible is as high as the vehicle’s value it’s not worth carrying full coverage.

Coverage for uninsured or underinsured drivers

This coverage protects you and your vehicle when other motorists either have no liability insurance or not enough. Covered claims include injuries sustained by your vehicle’s occupants as well as damage to your Infiniti QX60.

Due to the fact that many drivers have only the minimum liability required by law, their limits can quickly be used up. So UM/UIM coverage is very important.

Collision protection

This pays for damage to your QX60 resulting from a collision with an object or car. A deductible applies and the rest of the damage will be paid by collision coverage.

Collision coverage pays for claims like hitting a parking meter, colliding with another moving vehicle and rolling your car. Collision is rather expensive coverage, so consider removing coverage from vehicles that are older. Another option is to choose a higher deductible to bring the cost down.

Liability coverages

Liability insurance will cover injuries or damage you cause to a person or their property. This insurance protects YOU against other people’s claims, and does not provide coverage for your injuries or vehicle damage.

Coverage consists of three different limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. As an example, you may have liability limits of 50/100/50 that translate to a $50,000 limit per person for injuries, a per accident bodily injury limit of $100,000, and property damage coverage for $50,000.

Liability can pay for things like court costs, bail bonds, emergency aid, repair bills for other people’s vehicles and loss of income. How much liability coverage do you need? That is your choice, but consider buying as large an amount as possible.

Use our FREE quote tool to compare rates now!

Frequently Asked Questions

How much liability coverage do I need?

The amount of liability coverage you need is a personal choice. However, it is recommended to consider buying as much liability coverage as possible. Higher coverage limits provide greater financial protection in case of accidents or damages. State requirements and your own financial situation can also influence the amount of liability coverage you should consider.

How can I find a licensed insurance agent in my area?

You can find a licensed insurance agent in your area by completing a form available on the insurance company’s website. This form will help you connect with an agent who can provide specific advice and guidance based on your insurance needs.

Does car insurance cover theft of personal property?

Car insurance generally does not cover theft of personal property. However, if you have homeowners or renters insurance, your personal property may be covered under those policies. It’s recommended to review your policies or consult with your insurance agent to understand the coverage for theft.

Am I covered when driving someone else’s vehicle?

Coverage for driving someone else’s vehicle may depend on the terms of your insurance policy. Some policies may provide limited coverage while driving another person’s vehicle, but it is best to check your policy or contact your insurance agent to understand the specifics.

Does car insurance cover a custom paint job?

Standard car insurance policies usually cover the factory paint job of your vehicle. If you have a custom paint job, it may not be covered unless you have added specific coverage for modifications. Check your policy or consult with your insurance agent to confirm the coverage.

Do I need coverage for damage caused while driving under the influence?

Insurance coverage for damage caused while driving under the influence may vary depending on the insurance policy. It is recommended to review your policy or consult with a licensed insurance agent to understand the coverage in such situations.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Honda Odyssey Insurance

- Dodge Ram Insurance

- Honda Civic Insurance

- Nissan Rogue Insurance

- Chevrolet Silverado Insurance

- Honda CR-V Insurance

- Ford Focus Insurance

- Ford F-150 Insurance

- Hyundai Santa Fe Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area