Mazda Tribute Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 3, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

U.S. average insurance rates for a Mazda Tribute are $780 a year including full coverage. Comprehensive insurance costs around $116, collision costs $152, and liability insurance costs $376. Liability-only coverage costs as little as $426 a year, with high-risk coverage costing $1,672 or more. Teens pay the highest rates at $3,186 a year or more.

Average premium for full coverage: $780

Price estimates for individual coverage:

Full coverage includes $500 physical damage insurance deductibles, bodily injury liability limits of 30/60, and includes uninsured motorist and medical coverage. Estimates are averaged for all 50 U.S. states and for different Tribute trim levels.

Price Range from Low to High

For the average driver, Mazda Tribute insurance prices go from the low end price of $426 for the bare minimum liability coverage to a much higher rate of $1,672 for a driver who has had serious violations or accidents.

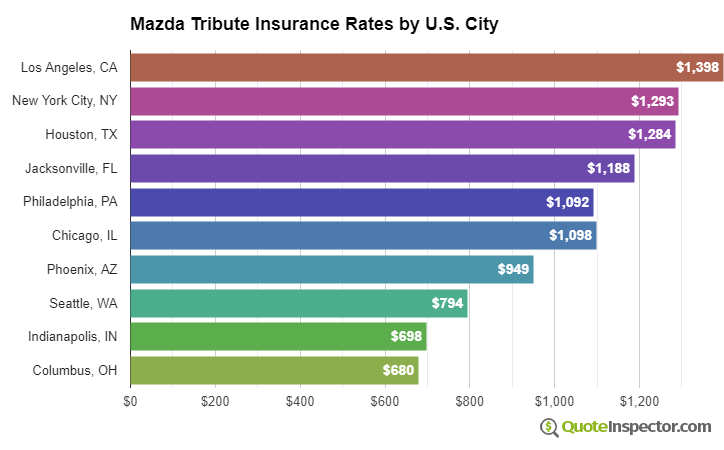

Geographic Price Range

Your location has a significant impact on the price of insurance. Areas with sparse population have lower incidents of comprehensive and collision claims than cities with more traffic congestion.

The price range example below illustrates how location impacts auto insurance rates.

The ranges above highlight why anyone shopping for car insurance should compare rates for a specific zip code, rather than relying on averaged prices.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Additional Rate Information

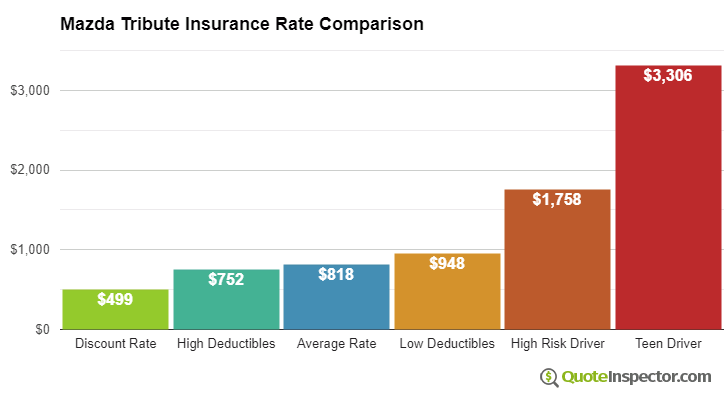

The chart below breaks down estimated Mazda Tribute insurance rates for additional coverage choices and driver risks.

- The cheapest rate after discounts is $479

- Drivers who choose higher $1,000 deductibles will pay about $62 every year

- The estimated price for the average middle-age driver using $500 deductibles is $780

- Selecting more expensive low deductibles for comprehensive and collision insurance will cost an additional $116 a year

- High risk drivers with serious driving violations could pay at least $1,672 or more

- The price that insures a teen driver with full coverage can be $3,186 a year

Auto insurance prices for a Mazda Tribute are also quite variable based on the model year and trim level, your driving record and age, and deductibles and policy limits.

If you have some driving violations or you caused an accident, you are likely paying at least $900 to $1,300 in extra premium each year, depending on your age. High-risk driver insurance can cost anywhere from 41% to 128% more than the average policy. View High Risk Driver Rates

An older driver with a good driving record and higher comprehensive and collision deductibles could pay as little as $800 per year on average for full coverage. Prices are much higher for teenage drivers, since even teens with perfect driving records will have to pay as much as $3,100 a year. View Rates by Age

The state you live in makes a big difference in Mazda Tribute insurance rates. A 40-year-old driver could pay as low as $600 a year in states like Missouri, New Hampshire, and Vermont, or have to pay at least $1,110 on average in Michigan, New York, and Louisiana.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $704 | -$76 | -9.7% |

| Alaska | $596 | -$184 | -23.6% |

| Arizona | $646 | -$134 | -17.2% |

| Arkansas | $780 | -$0 | 0.0% |

| California | $888 | $108 | 13.8% |

| Colorado | $744 | -$36 | -4.6% |

| Connecticut | $798 | $18 | 2.3% |

| Delaware | $880 | $100 | 12.8% |

| Florida | $972 | $192 | 24.6% |

| Georgia | $720 | -$60 | -7.7% |

| Hawaii | $560 | -$220 | -28.2% |

| Idaho | $528 | -$252 | -32.3% |

| Illinois | $580 | -$200 | -25.6% |

| Indiana | $586 | -$194 | -24.9% |

| Iowa | $524 | -$256 | -32.8% |

| Kansas | $740 | -$40 | -5.1% |

| Kentucky | $1,062 | $282 | 36.2% |

| Louisiana | $1,152 | $372 | 47.7% |

| Maine | $482 | -$298 | -38.2% |

| Maryland | $644 | -$136 | -17.4% |

| Massachusetts | $620 | -$160 | -20.5% |

| Michigan | $1,352 | $572 | 73.3% |

| Minnesota | $652 | -$128 | -16.4% |

| Mississippi | $932 | $152 | 19.5% |

| Missouri | $692 | -$88 | -11.3% |

| Montana | $836 | $56 | 7.2% |

| Nebraska | $612 | -$168 | -21.5% |

| Nevada | $932 | $152 | 19.5% |

| New Hampshire | $564 | -$216 | -27.7% |

| New Jersey | $870 | $90 | 11.5% |

| New Mexico | $690 | -$90 | -11.5% |

| New York | $820 | $40 | 5.1% |

| North Carolina | $448 | -$332 | -42.6% |

| North Dakota | $638 | -$142 | -18.2% |

| Ohio | $538 | -$242 | -31.0% |

| Oklahoma | $798 | $18 | 2.3% |

| Oregon | $714 | -$66 | -8.5% |

| Pennsylvania | $742 | -$38 | -4.9% |

| Rhode Island | $1,040 | $260 | 33.3% |

| South Carolina | $706 | -$74 | -9.5% |

| South Dakota | $658 | -$122 | -15.6% |

| Tennessee | $682 | -$98 | -12.6% |

| Texas | $938 | $158 | 20.3% |

| Utah | $576 | -$204 | -26.2% |

| Vermont | $530 | -$250 | -32.1% |

| Virginia | $468 | -$312 | -40.0% |

| Washington | $600 | -$180 | -23.1% |

| West Virginia | $714 | -$66 | -8.5% |

| Wisconsin | $538 | -$242 | -31.0% |

| Wyoming | $692 | -$88 | -11.3% |

Choosing higher comprehensive and collision insurance deductibles could save up to $180 each year, while increasing your policy's liability limits will increase prices. Changing from a 50/100 bodily injury protection limit to a 250/500 limit will increase prices by as much as $339 extra every year. View Rates by Deductible or Liability Limit

Since prices can be so different, the best way to figure out your exact price is to compare prices from as many companies as possible. Every company calculates prices differently, and quoted prices may be quite different.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Mazda Tribute I Sport 2WD | $750 | $63 |

| Mazda Tribute I Sport 4WD | $766 | $64 |

| Mazda Tribute I Touring 2WD | $766 | $64 |

| Mazda Tribute I Grand Touring 2WD | $780 | $65 |

| Mazda Tribute I Touring 4WD | $780 | $65 |

| Mazda Tribute I Grand Touring 4WD | $794 | $66 |

| Mazda Tribute S Grand Touring 2WD | $794 | $66 |

| Mazda Tribute S Grand Touring 4WD | $808 | $67 |

Rates assume 2005 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2009 Mazda Tribute | $134 | $182 | $398 | $850 |

| 2006 Mazda Tribute | $120 | $160 | $380 | $796 |

| 2005 Mazda Tribute | $116 | $152 | $376 | $780 |

Rates are averaged for all Mazda Tribute models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Find More Affordable Mazda Tribute Insurance

Getting lower rates on Mazda Tribute insurance not only requires being a low-risk driver, but also maintaining a good credit score, being claim-free, and maximizing policy discounts. Compare rates every other policy renewal by obtaining price quotes from direct car insurance companies, and also from local insurance agencies.

The items below are a summary of the ideas that were touched on above.

- Teen drivers are expensive to insure, possibly costing $266 a month if the policy includes full coverage

- High-risk drivers who have multiple accidents or major violations may have to pay on average $890 more every year to insure their Tribute

- Increasing physical damage deductibles can save approximately $175 each year

- You may be able to save up to $90 per year simply by shopping early and online

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $3,186 |

| 20 | $1,786 |

| 30 | $790 |

| 40 | $780 |

| 50 | $716 |

| 60 | $704 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $896 |

| $250 | $844 |

| $500 | $780 |

| $1,000 | $718 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $780 |

| 50/100 | $883 |

| 100/300 | $977 |

| 250/500 | $1,222 |

| 100 CSL | $921 |

| 300 CSL | $1,128 |

| 500 CSL | $1,278 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $4,472 |

| 20 | $2,838 |

| 30 | $1,682 |

| 40 | $1,672 |

| 50 | $1,600 |

| 60 | $1,582 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $39 |

| Multi-vehicle | $42 |

| Homeowner | $14 |

| 5-yr Accident Free | $46 |

| 5-yr Claim Free | $48 |

| Paid in Full/EFT | $27 |

| Advance Quote | $33 |

| Online Quote | $52 |

| Total Discounts | $301 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area