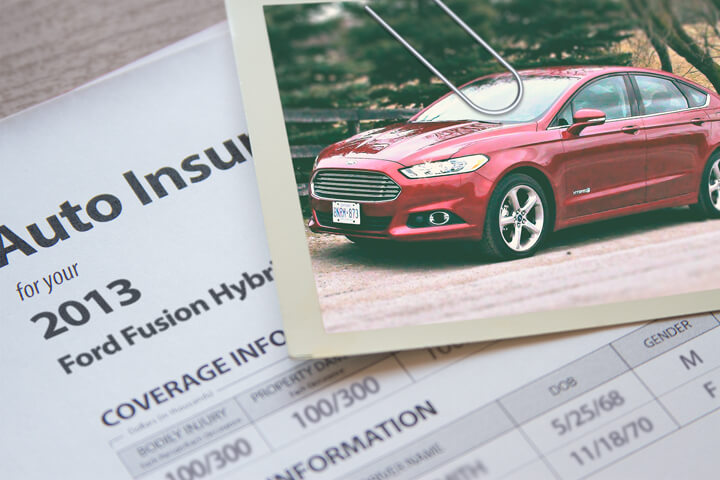

Cheapest 2013 Ford Fusion Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Are you sick and tired of paying out the nose to buy car insurance? Your situation is no different than most other car owners.

With consumers having so many choices, it can be challenging to pick the best insurer.

You need to take a look at other company’s rates quite often because prices are constantly changing. Despite the fact that you may have had the best deal on Fusion coverage last year there may be better deals available now. Ignore everything you know about car insurance because you’re about to find out the best methods to reduce your cost while improving coverage.

Buying affordable protection is easy if you know what you’re doing. Essentially every driver who buys auto insurance stands a good chance to be able to cut their insurance bill. But drivers should learn how big insurance companies price online insurance because it can help you find the best coverage.

Take discounts and save

Insurance can cost an arm and a leg, but companies offer discounts to cut the cost considerably. Larger premium reductions will be automatically applied at the time you complete a quote, but some must be specially asked for prior to getting the savings.

- Anti-theft Discount – Cars that have factory anti-theft systems prevent vehicle theft and will save you 10% or more.

- Seat Belts Save more than Lives – Buckling up and requiring all passengers to wear their seat belts could cut 10% or more off your PIP or medical payments premium.

- Early Switch Discount – Some insurance companies reward drivers for switching to them prior to your current policy expiration. It’s a savings of about 10%.

- Accident Forgiveness – Some insurance companies permit an accident before hitting you with a surcharge so long as you haven’t had any claims prior to the accident.

- Drivers Education – Make teen driver coverage more affordable by requiring them to successfully complete driver’s ed class if it’s offered in school.

It’s important to note that many deductions do not apply to the overall cost of the policy. The majority will only reduce the price of certain insurance coverages like collision or personal injury protection. So despite the fact that it appears all those discounts means the company will pay you, car insurance companies aren’t that generous. Any amount of discount will reduce your premiums.

Companies that possibly offer these benefits include:

- State Farm

- American Family

- GEICO

- 21st Century

- Progressive

Check with each insurance company which discounts you may be entitled to. Discounts might not apply in your area.

Compare Auto Insurance Today

Most companies such as Allstate and Progressive provide coverage prices on their websites. Getting quotes is fairly straightforward as you simply enter the amount of coverage you want as detailed in the form. Once you submit the form, the company’s rating system sends out for your driving record and credit report and generates a price. Quoting online makes it a lot easier to compare rates but the time it takes to visit different websites and fill out multiple forms is monotonous and tiresome. But it’s absolutely necessary to get many rate quotes in order to get lower prices.

Isn’t there an easier way to compare rates?

An easier way to lower your rates requires only one form that obtains quotes from several different companies. It’s a real time-saver, requires less work, and makes quoting online much easier to do. Immediately after submitting the form, it is quoted and you are able to buy any of the returned quotes.

If the quotes result in lower rates, you can click and sign and buy the new coverage. The whole process only takes a few minutes and you will find out if you’re overpaying now.

To compare your current rates, we recommend that you enter the coverages exactly as they are listed on your policy. Using the same limits helps guarantee you’re receiving rate comparison quotes based on the exact same insurance coverage.

Which policy gives me the best coverage?

When it comes to buying the right insurance coverage, there really is not a one size fits all plan. Your needs are not the same as everyone else’s so your insurance should reflect that Here are some questions about coverages that might point out if your situation would benefit from an agent’s advice.

- Should I have combined single limit or split liability limits?

- How can I force my company to pay a claim?

- When should I remove comp and collision on my 2013 Ford Fusion?

- Should I have a commercial auto policy?

- Does coverage extend to Mexico or Canada?

- Am I better off with higher deductibles on my 2013 Ford Fusion?

- Does my insurance cover damage caused when ticketed for reckless driving?

- If my pet gets injured in an accident are they covered?

- Is my state a no-fault state?

If you don’t know the answers to these questions but you think they might apply to your situation, you might consider talking to a licensed agent.

Auto insurance coverage information

Having a good grasp of a insurance policy helps when choosing the best coverages and proper limits and deductibles. The coverage terms in a policy can be difficult to understand and nobody wants to actually read their policy. These are typical coverage types found on most insurance policies.

Coverage for uninsured or underinsured drivers

Uninsured or Underinsured Motorist coverage protects you and your vehicle from other motorists when they are uninsured or don’t have enough coverage. This coverage pays for hospital bills for your injuries and damage to your Ford Fusion.

Since many drivers have only the minimum liability required by law, their limits can quickly be used up. This is the reason having UM/UIM coverage is important protection for you and your family. Usually your uninsured/underinsured motorist coverages are similar to your liability insurance amounts.

Coverage for liability

Liability coverage protects you from damage that occurs to other people or property in an accident. This coverage protects you against other people’s claims, and does not provide coverage for damage sustained by your vehicle in an accident.

It consists of three limits, per person bodily injury, per accident bodily injury, and a property damage limit. You commonly see policy limits of 50/100/50 that means you have a $50,000 limit per person for injuries, $100,000 for the entire accident, and a limit of $50,000 paid for damaged property. Occasionally you may see one limit called combined single limit (CSL) which provides one coverage limit and claims can be made without the split limit restrictions.

Liability coverage protects against things like attorney fees, loss of income, pain and suffering, legal defense fees and repair bills for other people’s vehicles. How much liability should you purchase? That is up to you, but consider buying higher limits if possible.

Coverage for medical expenses

Medical payments and Personal Injury Protection insurance kick in for short-term medical expenses like chiropractic care, rehabilitation expenses, hospital visits, X-ray expenses and pain medications. They are utilized in addition to your health insurance policy or if you lack health insurance entirely. They cover both the driver and occupants as well as any family member struck as a pedestrian. PIP coverage is not available in all states but it provides additional coverages not offered by medical payments coverage

Collision coverage protection

This will pay to fix damage to your Fusion caused by collision with another vehicle or an object, but not an animal. A deductible applies then your collision coverage will kick in.

Collision coverage protects against claims like scraping a guard rail, sideswiping another vehicle, driving through your garage door and hitting a mailbox. Paying for collision coverage can be pricey, so consider dropping it from lower value vehicles. Drivers also have the option to increase the deductible to bring the cost down.

Comprehensive insurance

Comprehensive insurance pays for damage from a wide range of events other than collision. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive coverage pays for claims such as falling objects, damage from flooding, rock chips in glass, damage from getting keyed and a tree branch falling on your vehicle. The most a insurance company will pay at claim time is the ACV or actual cash value, so if the vehicle is not worth much consider dropping full coverage.

Saving money is sweet as honey

Cheap 2013 Ford Fusion insurance can be bought from both online companies and also from your neighborhood agents, and you need to comparison shop both to have the best rate selection. Some insurance companies may not provide online price quotes and most of the time these smaller companies sell through independent agents.

When buying insurance coverage, never skimp on critical coverages to save a buck or two. There have been many situations where drivers have reduced collision coverage and learned later that it was a big error on their part. The aim is to buy enough coverage for the lowest price while not skimping on critical coverages.

Even more information can be read in these articles:

- Child Safety FAQ (iihs.org)

- Liability Insurance Coverage (Nationwide)

- Steps to Take After an Auto Accident (Insurance Information Institute)

- Frontal Crash Tests (iihs.org)

- What is Full Coverage? (Allstate)

Frequently Asked Questions

What factors can affect the insurance rates for a 2013 Ford Fusion?

Several factors can influence the insurance rates for a 2013 Ford Fusion. These factors include the driver’s age, driving record, location, annual mileage, coverage options selected, and the insurance company’s individual pricing policies. Additionally, the Fusion’s model, trim level, engine size, and value can also impact insurance rates.

Is the 2013 Ford Fusion considered an expensive vehicle to insure?

The 2013 Ford Fusion is a midsize sedan, and insurance rates for such vehicles are typically moderate. However, insurance rates can vary based on multiple factors, including the driver’s profile and the insurance company’s pricing policies. It’s recommended to obtain quotes from different insurers to get an accurate understanding of the insurance costs for a 2013 Ford Fusion.

Are there any specific discounts available to help reduce the insurance rates for a 2013 Ford Fusion?

Insurance companies often offer various discounts that can help lower insurance rates. Some common discounts that may apply to a 2013 Ford Fusion include safe driver discounts, multi-policy discounts (insuring multiple vehicles or having other policies with the same company), discounts for safety features such as anti-lock brakes and airbags, and discounts for completing driver education or defensive driving courses. It’s advisable to inquire with your insurance provider about the available discounts.

How can I find the cheapest insurance rates for a 2013 Ford Fusion?

To find the most affordable insurance rates for a 2013 Ford Fusion, it is recommended to obtain quotes from multiple insurance companies. Contact insurers directly or use online comparison tools to gather quotes and compare coverage options. Providing accurate information when requesting quotes is important to ensure the rates are as precise as possible.

Are there any specific insurance companies known for offering competitive rates on 2013 Ford Fusion insurance?

Insurance rates can vary significantly between companies, so it is advisable to obtain quotes from multiple insurers to find the best rates for a 2013 Ford Fusion. Some insurers that are often recognized for offering competitive rates on midsize sedan insurance include Geico, Progressive, State Farm, and Allstate. However, it’s important to compare quotes from different insurers to find the best deal for your specific circumstances.

Can I adjust my coverage options to lower the insurance rates for my 2013 Ford Fusion?

Adjusting your coverage options can potentially help lower insurance rates. However, it is important to carefully consider the impact on your financial protection. Lowering coverage limits or removing optional coverages may result in less protection in the event of an accident or other covered incidents. It is advisable to evaluate your coverage needs and consult with your insurance provider to find the right balance between cost and coverage.

Are there any aftermarket modifications that can help reduce insurance rates for a 2013 Ford Fusion?

While some modifications, such as installing safety features or anti-theft devices, may reduce the risk of theft or accidents and potentially lead to lower insurance premiums, it is advisable to consult with your insurance provider. Some modifications may not directly affect insurance rates, and others may even increase rates if they alter the performance or value of the vehicle. It’s crucial to discuss any modifications with your insurer to understand their impact on your insurance premiums.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Kia Forte Insurance

- Chevrolet Silverado Insurance

- Toyota Rav4 Insurance

- Subaru Forester Insurance

- Dodge Grand Caravan Insurance

- Toyota Corolla Insurance

- Nissan Altima Insurance

- Toyota Camry Insurance

- Nissan Rogue Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area