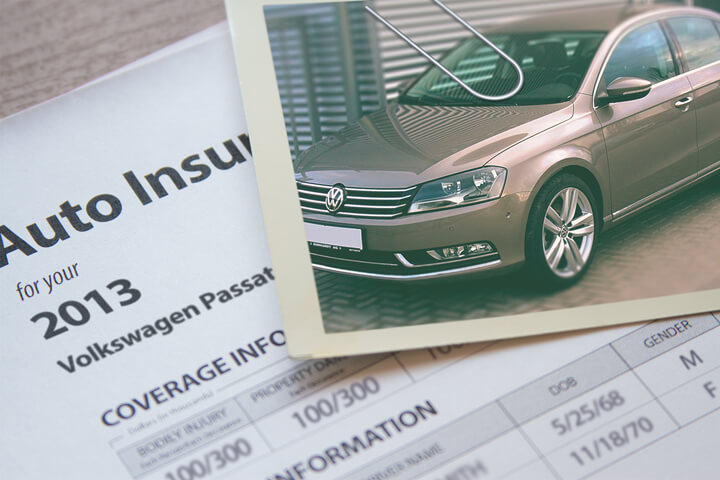

Cheapest 2013 Volkswagen Passat Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Are you a victim of an underperforming, overpriced auto insurance policy? Believe me, there are many people just like you.

Because there are so many different company options, it is very difficult to choose the lowest cost company.

It’s a good idea to price shop coverage occasionally because rates are rarely the same from one policy term to another. Just because you found the best price for Passat insurance a few years ago there may be better deals available now. Block out anything you think you know about auto insurance because we’re going to demonstrate the best methods to properly buy coverages while reducing your premium.

Pricing more affordable coverage is easy if you know what you’re doing. Basically, every driver who shops for car insurance will be able to cut their insurance bill. Although consumers can benefit from knowing how companies price online insurance.

The easiest way to get policy rate comparisons takes advantage of the fact most larger insurance companies have advanced systems to provide you with free rate quotes. All consumers are required to do is provide the companies a bit of rating information including if a SR-22 is required, level of coverage desired, whether you drive to work or school, and any included safety features. That rating information is automatically sent to multiple top-rated companies and they provide comparison quotes almost instantly.

These discounts can slash insurance rates

The price of auto insurance can be rather high, but there are discounts available to cut the cost considerably. Some trigger automatically when you purchase, but some may not be applied and must be inquired about prior to getting the savings.

- Federal Government Employee – Simply working for the federal government could cut as much as 10% off for Passat insurance with select insurance companies.

- Low Mileage – Keeping the miles down on your Volkswagen could qualify for a substantially lower rate.

- Safe Drivers – Drivers who avoid accidents can get discounts for up to 45% lower rates for Passat insurance than drivers with accidents.

- Good Student – Getting good grades can earn a discount of 20% or more. The discount lasts up until you turn 25.

- Anti-lock Brake Discount – Anti-lock brake equipped vehicles prevent accidents and earn discounts up to 10%.

- Student Driver Training – Have your child complete a driver education course in high school.

- Homeowners Discount – Owning a house may earn you a small savings because of the fact that having a home demonstrates responsibility.

- No Accidents – Drivers with accident-free driving histories can earn big discounts compared to accident-prone drivers.

- Club Memberships – Belonging to a professional or civic organization may earn a discount when shopping for insurance for Passat insurance.

- Student in College – Any of your kids living away from home attending college and do not have access to a covered vehicle can receive lower rates.

Keep in mind that some credits don’t apply to your bottom line cost. Some only reduce the price of certain insurance coverages like comprehensive or collision. So even though it sounds like having all the discounts means you get insurance for free, companies wouldn’t make money that way. Any qualifying discounts will help reduce your premiums.

Car insurance companies that possibly offer these discounts include:

- State Farm

- Esurance

- Progressive

- Liberty Mutual

- Auto-Owners Insurance

- GEICO

Double check with all companies you are considering how you can save money. Savings might not be offered in your state.

When might I need the advice of an agent?

When it comes to choosing coverage, there really is no single plan that fits everyone. Every situation is different and your policy should reflect that. Here are some questions about coverages that might help in determining whether you may require specific advice.

- Are my friends covered when driving my 2013 Volkswagen Passat?

- What is an SR-22 filing?

- Is my trailer covered?

- When should I remove comp and collision on my 2013 Volkswagen Passat?

- Is my state a no-fault state?

- What is covered by UM/UIM coverage?

- What is the rate difference between pleasure use and commuting?

If you can’t answer these questions but one or more may apply to you, then you may want to think about talking to an agent. If you want to speak to an agent in your area, fill out this quick form.

Car insurance coverage specifics

Knowing the specifics of a car insurance policy can help you determine the right coverages and the correct deductibles and limits. The terms used in a policy can be difficult to understand and coverage can change by endorsement. These are typical coverages found on most car insurance policies.

Collision coverages – Collision insurance pays to fix your vehicle from damage resulting from colliding with a stationary object or other vehicle. You have to pay a deductible then your collision coverage will kick in.

Collision insurance covers claims such as colliding with a tree, scraping a guard rail, crashing into a building, hitting a mailbox and sustaining damage from a pot hole. Collision coverage makes up a good portion of your premium, so you might think about dropping it from lower value vehicles. You can also raise the deductible to get cheaper collision coverage.

Protection from uninsured/underinsured drivers – Your UM/UIM coverage provides protection from other drivers when they either are underinsured or have no liability coverage at all. It can pay for injuries sustained by your vehicle’s occupants as well as your vehicle’s damage.

Due to the fact that many drivers carry very low liability coverage limits, their liability coverage can quickly be exhausted. For this reason, having high UM/UIM coverages is very important. Most of the time these limits are identical to your policy’s liability coverage.

Comprehensive (Other than Collision) – This covers damage OTHER than collision with another vehicle or object. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive coverage pays for claims such as vandalism, theft and rock chips in glass. The maximum amount you can receive from a comprehensive claim is the cash value of the vehicle, so if the vehicle is not worth much consider dropping full coverage.

Medical expense insurance – Med pay and PIP coverage pay for expenses such as surgery, pain medications, prosthetic devices, chiropractic care and funeral costs. The coverages can be used to cover expenses not covered by your health insurance policy or if there is no health insurance coverage. It covers you and your occupants and will also cover if you are hit as a while walking down the street. Personal Injury Protection is not an option in every state but can be used in place of medical payments coverage

Liability auto insurance – This can cover damage that occurs to other’s property or people in an accident. It protects YOU against claims from other people. It does not cover your injuries or vehicle damage.

It consists of three limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. Your policy might show liability limits of 25/50/25 that means you have $25,000 bodily injury coverage, a per accident bodily injury limit of $50,000, and a total limit of $25,000 for damage to vehicles and property. Some companies may use a combined limit which provides one coverage limit with no separate limits for injury or property damage.

Liability coverage protects against things like bail bonds, attorney fees, pain and suffering, medical expenses and emergency aid. How much liability coverage do you need? That is your choice, but you should buy as much as you can afford.

Frequently Asked Questions

Is it possible to remove certain coverages from my Passat insurance policy to lower costs?

Depending on your circumstances, you may choose to remove certain coverages, such as collision or comprehensive, from your Passat insurance policy to reduce premiums. However, carefully consider the potential risks and the value of your vehicle before making this decision.

What should I do if I have questions about my Passat insurance policy?

If you have specific questions about your Passat insurance policy, it’s best to reach out to your insurance agent or company directly. They can provide you with personalized guidance and clarification regarding your coverage.

How can I save on Passat insurance if I rarely drive my vehicle?

If you have low mileage on your Passat, you may qualify for a substantially lower rate. Be sure to inform your insurance provider about your low mileage to potentially receive this discount.

Can I add additional coverage options to my Passat insurance policy?

Yes, you can add additional coverage options to enhance your Passat insurance policy. Some common optional coverages include roadside assistance, rental car reimbursement, gap insurance, and extended coverage for custom parts and equipment. Discuss these options with your insurance provider.

Are there any discounts available for young drivers insuring a Passat?

Yes, young drivers may qualify for discounts on Passat insurance. For example, having good grades as a student can earn a discount of 20% or more. However, it’s advisable to check with insurance companies directly to see what discounts they offer for young drivers.

Is it possible to lower my Passat insurance premiums?

Yes, there are several strategies to help lower your insurance premiums. These include maintaining a clean driving record, taking advantage of available discounts, increasing your deductibles, bundling your insurance policies, and improving the safety and security features of your Passat.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Nissan Altima Insurance

- Dodge Ram Insurance

- Ford F-150 Insurance

- Ford Focus Insurance

- Hyundai Tucson Insurance

- Nissan Rogue Insurance

- Toyota Rav4 Insurance

- Honda CR-V Insurance

- Toyota Sienna Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area