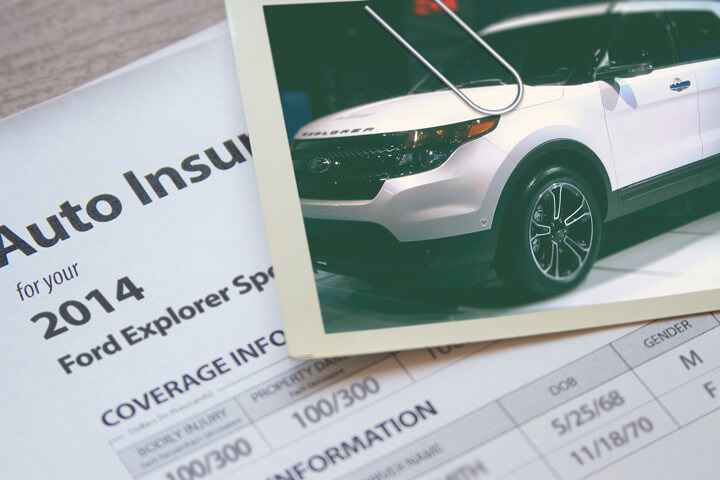

Cheapest 2014 Ford Explorer Insurance Rates in 2024

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Are you a victim of an overpriced insurance policy? Trust us, many consumers are feeling buyer’s remorse and feel like there’s no way out. There are many insurance companies to choose from, and even though it’s nice to have a choice, so many choices can make it hard to adequately compare rates.

Free Car Insurance Quotes

All the larger car insurance companies provide price estimates on the web. Getting quotes doesn’t take much effort as you just type in your required coverages as requested by the quote form. After you complete the form, the system makes automated requests for your credit score and driving record and quotes a price. Being able to quote online makes comparing rates easy, but the work required to visit a lot of sites and type in the same information is repetitive and time-consuming. But it’s very important to perform this step if you are searching for the best price on car insurance.

The quickest way to lower your rates makes use of a single form that gets prices from several companies at one time. It’s a real time-saver, reduces the work, and makes price shopping online much more efficient. After your information is entered, your coverage is rated and you can choose any of the quotes returned.

If a lower price is quoted, you can click and sign and purchase coverage. It takes just a few minutes to complete and could lower your rates considerably.

To quickly compare pricing, simply click here to open in new window and submit your coverage information. If you have a policy now, it’s recommended that you enter the coverages just like they are on your policy. This way, you will get comparison quotes for similar insurance coverage.

Pay less by taking advantage of these six discounts

The cost of insuring your cars can be expensive, but there could be available discounts to cut the cost considerably. Larger premium reductions will be automatically applied at quote time, but some may not be applied and must be inquired about before being credited. If you don’t get every credit you qualify for, you’re just leaving money on the table.

- Defensive Driver – Taking a driver safety course could possibly earn you a 5% discount depending on where you live.

- Safe Driver Discount – Safe drivers may save up to 50% more on Explorer insurance than drivers with accidents.

- Early Switch Discount – A few companies offer discounts for switching policies prior to your current policy expiring. It’s a savings of about 10%.

- Pay Now and Pay Less – By paying your policy upfront instead of monthly or quarterly installments you could save 5% or more.

- New Car Discount – Buying coverage on a new vehicle can cost up to 25% less compared to insuring an older model.

- Theft Prevention System – Anti-theft and alarm systems help deter theft and qualify for as much as a 10% discount.

As a disclaimer on discounts, most credits do not apply to the entire cost. Most cut the price of certain insurance coverages like comprehensive or collision. Just because it seems like it’s possible to get free car insurance, it just doesn’t work that way. Any amount of discount will cut the cost of coverage.

To see a list of insurers with discount car insurance rates, follow this link.

Your coverage should be tailored to you

When it comes to buying coverage for your vehicles, there isn’t really a cookie cutter policy. Everyone’s situation is a little different and your policy should reflect that. These are some specific questions may help you determine if your insurance needs could use an agent’s help.

- Do I need added coverage for expensive stereo equipment?

- Do I need to file an SR-22 for a DUI in my state?

- Is my custom paint covered by insurance?

- Can I get a multi-policy discount for packaging my home and auto coverage?

- Is my trailer covered?

- Should I sign the liability waiver when renting a car?

- Do I have coverage if my license is suspended?

If you don’t know the answers to these questions, then you may want to think about talking to an agent. If you don’t have a local agent, fill out this quick form or click here for a list of auto insurance companies in your area. It’s fast, free and you can get the answers you need.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto insurance 101

Knowing the specifics of insurance can help you determine the best coverages at the best deductibles and correct limits. The terms used in a policy can be ambiguous and reading a policy is terribly boring. Listed below are typical coverages offered by insurance companies.

Uninsured Motorist or Underinsured Motorist insurance

Uninsured or Underinsured Motorist coverage protects you and your vehicle’s occupants when other motorists either have no liability insurance or not enough. Covered claims include medical payments for you and your occupants and also any damage incurred to your Ford Explorer.

Since many drivers only carry the minimum required liability limits, their liability coverage can quickly be exhausted. So UM/UIM coverage should not be overlooked. Usually the UM/UIM limits do not exceed the liability coverage limits.

Liability insurance

Liability insurance protects you from damages or injuries you inflict on other people or property that is your fault. It protects you from legal claims by others. It does not cover damage sustained by your vehicle in an accident.

Coverage consists of three different limits, per person bodily injury, per accident bodily injury, and a property damage limit. You commonly see limits of 100/300/100 that means you have $100,000 bodily injury coverage, $300,000 for the entire accident, and property damage coverage for $100,000. Alternatively, you may have one limit called combined single limit (CSL) which limits claims to one amount without having the split limit caps.

Liability coverage pays for things such as loss of income, court costs, repair costs for stationary objects and legal defense fees. The amount of liability coverage you purchase is up to you, but consider buying as much as you can afford.

Insurance for medical payments

Medical payments and Personal Injury Protection insurance kick in for expenses for things like prosthetic devices, hospital visits, X-ray expenses, pain medications and funeral costs. They are often used in conjunction with a health insurance program or if you do not have health coverage. Medical payments and PIP cover not only the driver but also the vehicle occupants and also covers any family member struck as a pedestrian. PIP coverage is not an option in every state and gives slightly broader coverage than med pay

Comprehensive coverage (or Other than Collision)

This coverage will pay to fix damage caused by mother nature, theft, vandalism and other events. A deductible will apply and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive insurance covers claims such as hitting a bird, a broken windshield, damage from flooding and damage from a tornado or hurricane. The most a insurance company will pay at claim time is the cash value of the vehicle, so if the vehicle is not worth much it’s not worth carrying full coverage.

Collision protection

This pays to fix your vehicle from damage from colliding with a stationary object or other vehicle. You first must pay a deductible then your collision coverage will kick in.

Collision coverage protects against claims like crashing into a building, hitting a mailbox and damaging your car on a curb. Paying for collision coverage can be pricey, so consider removing coverage from older vehicles. Drivers also have the option to choose a higher deductible to save money on collision insurance.

A penny earned…

Budget-conscious 2014 Ford Explorer insurance can be bought from both online companies and also from your neighborhood agents, and you should compare price quotes from both in order to have the best chance of saving money. Some companies may not provide you the ability to get quotes online and many times these regional insurance providers only sell through independent insurance agents.

While you’re price shopping online, do not reduce coverage to reduce premium. There have been many cases where consumers will sacrifice collision coverage and found out when filing a claim that saving that couple of dollars actually costed them tens of thousands. The proper strategy is to purchase a proper amount of coverage at an affordable rate.

Use our FREE quote tool to compare rates now!

Helpful learning opportunities

- No-Fault Auto Insurance Statistics (Insurance Information Institute)

- Determining Auto Insurance Rates (GEICO)

- Liability Insurance Coverage (Nationwide)

- Teen Driving Statistics (iihs.org)

- Safety Belts FAQ (iihs.org)

- Five Mistakes to Avoid (Insurance Information Institute)

Frequently Asked Questions

How can I obtain free auto insurance rates?

To obtain free auto insurance rates, you can use online resources provided by various car insurance companies. Simply enter your ZIP code and fill out the required information in the quote form. The system will then generate price estimates based on your provided details, credit score, and driving record. It is recommended to compare quotes from multiple companies to ensure you find the best price for your car insurance.

How can I find the cheapest insurance rates for a 2014 Ford Explorer in 2023?

To find the cheapest insurance rates for a 2014 Ford Explorer in 2023, you can utilize online quote tools that allow you to compare prices from different insurance providers. By entering your ZIP code and coverage information, you can receive quotes from multiple companies. It’s important to compare these rates and choose the one that offers the most affordable coverage for your specific needs.

What discounts are available to help lower auto insurance rates?

There are several discounts available that can help lower your auto insurance rates. Some common discounts include safe driver discounts, good student discounts, multi-policy discounts (for bundling multiple insurance policies with the same provider), and anti-theft device discounts. It’s important to inquire about these discounts with your insurance provider to ensure you’re taking advantage of all the potential savings.

How can I tailor my auto insurance coverage to suit my needs?

When it comes to auto insurance coverage, there is no one-size-fits-all policy. It’s important to customize your coverage based on your specific needs. Factors such as your driving habits, the value of your vehicle, and your financial situation should all be taken into consideration. To determine the right coverage for you, consider consulting with an insurance agent who can provide personalized advice based on your circumstances.

What are the typical coverages offered by insurance companies?

Insurance companies typically offer a range of coverages, including:

- Liability insurance: This protects you from damages or injuries you cause to others and their property.

- Uninsured/Underinsured Motorist insurance: This coverage protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance.

- Medical payments and Personal Injury Protection (PIP) insurance: These cover medical expenses for you and your passengers in the event of an accident.

- Comprehensive coverage: This covers damage to your vehicle caused by events such as theft, vandalism, or natural disasters.

- Collision protection: This coverage pays for damage to your vehicle resulting from a collision with another vehicle or object.

It’s important to review these coverages and choose the ones that best suit your needs and budget.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2024

- Cheapest Jeep Insurance Rates in 2024

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Hyundai Sonata Insurance

- Honda CR-V Insurance

- Toyota Camry Insurance

- Toyota Rav4 Insurance

- Chevrolet Cruze Insurance

- Dodge Ram Insurance

- Chevrolet Impala Insurance

- Ford Edge Insurance

- Toyota Prius Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area