Dodge Avenger Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

If you are reading this article, you are probably wondering if Dodge Avengers are expensive to insure. Finding the right Dodge Avenger insurance rates can be hard, but we are here to help you through the process.

Our guide goes over different insurance rates for the Dodge Avenger. We also explain why you end up with the rates you do by showing you what insurers are looking for in vehicles.

Want to get a Dodge Avenger car insurance quote right away to find out how much insurance is on a Dodge Avenger? Enter your ZIP code in our free tool above.

Estimated auto insurance rates for a Dodge Avenger are $1,194 annually for full coverage. Comprehensive insurance costs an estimated $180 each year, collision costs $300, and liability coverage costs $534. Liability-only insurance costs as little as $588 a year, with high-risk driver insurance costing $2,584 or more. Teen drivers pay the most at $4,812 a year or more.

Average premium for full coverage: $1,194

Premium estimates broken down by type of coverage:

Full coverage includes $500 deductibles, minimum liability limits, and includes medical and UM/UIM coverage. Rates include averaging for all states and Avenger models.

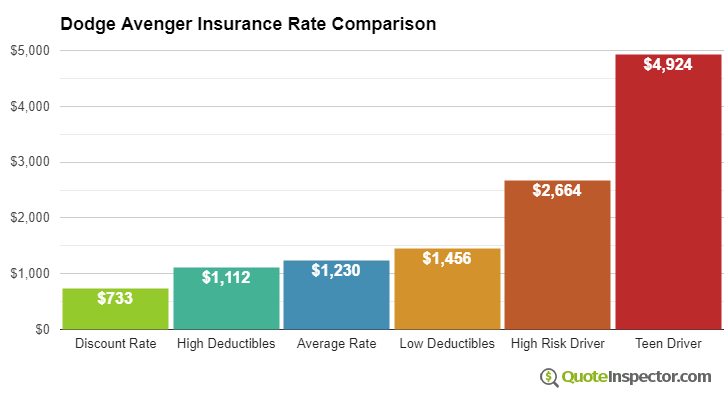

Insurance Price Range by Risk and Coverage

For a driver in their 40's, insurance rates for a Dodge Avenger go from as cheap as $588 for just liability insurance to a high rate of $2,584 for high-risk insurance.

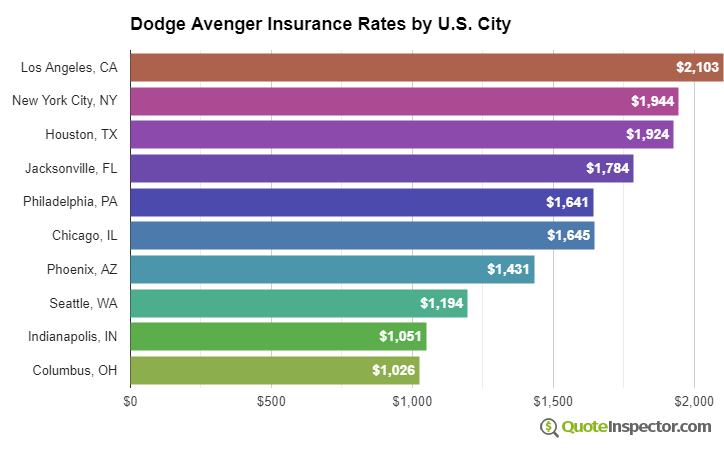

Insurance Price Range by Location

Your location has a large influence on insurance rates. More rural locations are statistically proven to have fewer accident claims than larger metro areas.

The graphic below illustrates how location helps determine insurance prices.

These rate differences show why all drivers should compare rates for a targeted area and their own personal driving habits, rather than using price averages.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

More Rate Details

The chart below shows estimated Dodge Avenger insurance rates for other coverage scenarios.

- The lowest rate with discounts is $714

- Drivers who choose higher $1,000 deductibles will pay approximately $110 a year

- The estimated rate for a 40-year-old good driver who has $500 deductibles is $1,194

- Choosing low deductibles for comprehensive and collision insurance costs an additional $208 each year

- High-risk insureds with multiple violations and an at-fault accident could pay up to $2,584 or more

- An auto insurance policy with full coverage for a teenage driver can cost as much as $4,812 a year

Insurance prices for a Dodge Avenger also have a wide range based on the model of your Avenger, your driver profile, and liability limits and deductibles.

More mature drivers with no violations or accidents and high physical damage deductibles may only pay around $1,100 per year on average, or $92 per month, for full coverage. Prices are highest for drivers in their teens, where even without any violations or accidents they should be prepared to pay at least $4,800 a year. View Rates by Age

If you have a few violations or you caused a few accidents, you could be paying $1,400 to $2,000 additional annually, depending on your age. Insurance for high-risk drivers can cost around 42% to 130% more than average. View High Risk Driver Rates

Choosing high deductibles could save up to $320 a year, whereas increasing liability limits will increase premiums. Going from a 50/100 bodily injury limit to a 250/500 limit will cost up to $480 more each year. View Rates by Deductible or Liability Limit

Where you choose to live makes a big difference in Dodge Avenger insurance rates. A 40-year-old driver could pay as low as $790 a year in states like Iowa, Maine, and Idaho, or as much as $1,700 on average in New York, Louisiana, and Michigan.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,078 | -$116 | -9.7% |

| Alaska | $916 | -$278 | -23.3% |

| Arizona | $990 | -$204 | -17.1% |

| Arkansas | $1,194 | -$0 | 0.0% |

| California | $1,360 | $166 | 13.9% |

| Colorado | $1,136 | -$58 | -4.9% |

| Connecticut | $1,226 | $32 | 2.7% |

| Delaware | $1,348 | $154 | 12.9% |

| Florida | $1,492 | $298 | 25.0% |

| Georgia | $1,102 | -$92 | -7.7% |

| Hawaii | $854 | -$340 | -28.5% |

| Idaho | $808 | -$386 | -32.3% |

| Illinois | $888 | -$306 | -25.6% |

| Indiana | $900 | -$294 | -24.6% |

| Iowa | $804 | -$390 | -32.7% |

| Kansas | $1,132 | -$62 | -5.2% |

| Kentucky | $1,626 | $432 | 36.2% |

| Louisiana | $1,768 | $574 | 48.1% |

| Maine | $736 | -$458 | -38.4% |

| Maryland | $984 | -$210 | -17.6% |

| Massachusetts | $954 | -$240 | -20.1% |

| Michigan | $2,068 | $874 | 73.2% |

| Minnesota | $998 | -$196 | -16.4% |

| Mississippi | $1,428 | $234 | 19.6% |

| Missouri | $1,056 | -$138 | -11.6% |

| Montana | $1,280 | $86 | 7.2% |

| Nebraska | $942 | -$252 | -21.1% |

| Nevada | $1,430 | $236 | 19.8% |

| New Hampshire | $862 | -$332 | -27.8% |

| New Jersey | $1,334 | $140 | 11.7% |

| New Mexico | $1,056 | -$138 | -11.6% |

| New York | $1,256 | $62 | 5.2% |

| North Carolina | $688 | -$506 | -42.4% |

| North Dakota | $976 | -$218 | -18.3% |

| Ohio | $822 | -$372 | -31.2% |

| Oklahoma | $1,224 | $30 | 2.5% |

| Oregon | $1,092 | -$102 | -8.5% |

| Pennsylvania | $1,136 | -$58 | -4.9% |

| Rhode Island | $1,590 | $396 | 33.2% |

| South Carolina | $1,082 | -$112 | -9.4% |

| South Dakota | $1,008 | -$186 | -15.6% |

| Tennessee | $1,042 | -$152 | -12.7% |

| Texas | $1,436 | $242 | 20.3% |

| Utah | $882 | -$312 | -26.1% |

| Vermont | $816 | -$378 | -31.7% |

| Virginia | $714 | -$480 | -40.2% |

| Washington | $920 | -$274 | -22.9% |

| West Virginia | $1,092 | -$102 | -8.5% |

| Wisconsin | $826 | -$368 | -30.8% |

| Wyoming | $1,062 | -$132 | -11.1% |

With such a large range in prices, the only way to know which insurance company is cheapest is to do a rate comparison and see how they stack up. Every company uses a different rate calculation, and prices will be substantially different between companies.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Dodge Avenger Express | $1,194 | $100 |

| Dodge Avenger R/T | $1,194 | $100 |

| Dodge Avenger SXT | $1,194 | $100 |

Rates assume 2013 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2014 Dodge Avenger | $194 | $322 | $534 | $1,230 |

| 2013 Dodge Avenger | $180 | $300 | $534 | $1,194 |

| 2012 Dodge Avenger | $174 | $272 | $540 | $1,166 |

| 2011 Dodge Avenger | $162 | $248 | $534 | $1,124 |

| 2010 Dodge Avenger | $152 | $226 | $534 | $1,092 |

Rates are averaged for all Dodge Avenger models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Buy More Affordable Dodge Avenger Insurance

Finding better rates on auto insurance not only requires not taking risks behind the wheel, but also having good credit, not filing small claims, and maximizing policy discounts. Invest time comparing rates every couple of years by getting quotes from direct carriers, and also from local exclusive and independent agents.

The following is a summary of the material that was covered in the charts and tables above.

- Consumers who want higher liability limits will pay about $590 each year to go from 30/60 bodily injury limits to higher 250/500 limits

- Teens are expensive to insure, as much as $401 per month if they have full coverage

- Drivers who have multiple accidents or major violations may pay on average $1,390 more annually for Avenger insurance

- Increasing policy deductibles could save up to $325 each year

You can save a few hundred dollars on car insurance by shopping for quotes and increasing your deductible limits. Want to know what else determines the price of car insurance? Keep reading to find out.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does the size and class of the Dodge Avenger affect liability rates?

What does liability insurance cover? Liability insurance covers the costs of other drivers if you caused the accident. This insurance is often required by law, and it is composed of two parts: bodily injury insurance and property liability insurance. Bodily injury pays for injured drivers’ medical bills, and property damage pays for their vehicle repairs.

Because liability insurance pays for other drivers’ accident costs, you will have higher liability rates if your car can easily injure other drivers and damage vehicles. Riskier vehicles could either be a large, heavy vehicle or a vehicle prone to crashing.

Some people ask if a Dodge Avenger is a sedan or if Dodge Avengers are considered sports cars. But since the Dodge Avenger is a midsize, four-door car, it likely won’t be able to crush vehicles the same size as it and won’t be grouped in with sports cars.

However, we do want to make sure that the Dodge Avenger has low liability losses (claims paid) even though it isn’t likely to total other vehicles. We took a look at the Insurance Institute for Highway Safety’s (IIHS) 2012 to 2014 data on insurance losses by make and model to find out liability losses for the Dodge Avenger.

- Bodily Injury Liability Losses: 77 percent (substantially worse than average)

- Property Damage Liability Losses: 41 percent (substantially worse than average)

Unfortunately, the Dodge Avenger has very poor losses. These high numbers mean multiple liability claims were filed on the Dodge Avenger from 2012 to 2104. Since this could result in higher rates, the next section will cover average liability rates, so you are prepared for what you’ll be paying.

What does liability insurance cost for the Dodge Avenger?

Our rates in this section were collected from a sample Geico quote for a 40-year-old male driver with a clean driving record. He owns his 2014 Dodge Avenger SE, travels 13,000 miles a year, and lives in Pennsylvania (rates will vary depending on your area). The first set of rates is for bodily injury liability coverage levels.

- Low ($15,000/$30,000): $42.58

- Medium ($100,000/$200,000): $87.28

- High ($500,000/$500,000): $140.50

The price increases may seem high as you upgrade your coverage level, but these rates are for a six-month period. So the $98 price tag to upgrade from low to high coverage only amounts to $16 a month. The price increases for property damage liability are even lower.

- Low ($5,000): $458.66

- Medium ($20,000): $493.55

- High ($100,000): $519.04

It only costs $5 a month to upgrade to medium coverage and only $10 a month to upgrade to high coverage. While you may be tempted to save a few bucks a month and buy low coverage for your Dodge Avenger, we do not recommend this.

Since Dodge Avengers have poor liability losses, multiple claims are filed against them. Paying extra for medium or high coverage will ensure you aren’t stuck paying for other drivers’ accident costs out of pocket. If you can’t pay the costs, you risk being sued by the other driver. Having high amounts of coverage ensures costs will be covered.

What are the safety features and ratings of the Dodge Avenger?

The 2014 Dodge Avenger (the last model year made) has some great safety features. Below is a complete list of standard safety features from AutoBlog.

- Crash prevention features: anti-lock brakes and stability features.

- Crash protection features: front-impact airbags, side-impact airbags, overhead airbags, seatbelt pretensioners, and anti-whiplash headrests.

- Anti-theft features: vehicle intrusion alarm and ignition disable device.

The standard safety features on the 2014 Dodge Avenger are designed to protect you, which makes means your insurer will have to pay less on your claim. Likewise, if your car helps you avoid a crash altogether, your insurer won’t even have to deal with a claim.

So the more safety features you have in your car, the more likely it is that insurers will give you a good discount on your average car insurance rates. A good safety rating on your car will also help you earn a discount.

The IIHS’s crash test on the 2014 Dodge Avenger showed great results, as the Dodge Avenger won the IIHS’s 2014 Top Safety Pick award. Below, you can see the ratings from the IIHS’s various crash tests on the Dodge Avenger.

- Small overlap front (driver-side): Acceptable

- Moderate overlap front: Good

- Side: Good

- Roof strength: Good

- Head restraints and seats: Good

Good is the highest rating possible, which means four out of the five crash tests were excellent. However, since acceptable is the second-highest rating, the Dodge Avenger did well overall. The IIHS video below shows how the small overlap front (driver-side) crash test works.

These crash tests test both how the car holds up and how the test dummies hold up. Good results mean your car will protect you in a crash. Insurers may also look at fatality rates by vehicle type to determine risk.

Cars do have the highest fatality rates, as the IIHS’s 2018 study found that car driver fatalities per million vehicles equaled 49 fatalities. This is high, as the driver pickup fatalities only equaled 34, and the driver SUV fatalities equaled 23. All occupant fatalities per million vehicles showed similar differences: 69 car fatalities, 42 pickup fatalities, and 32 SUV deaths.

The total car crash fatalities can be broken up into the following crash types.

- Frontal Impact: 7,433 fatalities

- Side Impact: 3,568 fatalities

- Rear Impact: 834 fatalities

- Other (mostly rollovers): 1,303 fatalities

These crash types total 13,138 fatalities, which is higher than SUV total fatalities (5,035) and pickup total fatalities (4,369).

Since cars have higher fatality rates, it is important that you pick a car that has great safety ratings and safety features. This will help balance out the higher rates for cars. Luckily, the Dodge Avenger meets these criteria, so you should receive a decent discount on your average car insurance rates.

What is the MSRP of the Dodge Avenger?

Insurers often use the manufacturer suggested retail price of a car to determine car insurance rates for collision and comprehensive insurance. Why? The MSRP price is a fixed price that doesn’t change, unlike the seller’s invoice price and the fair market value of a car. So the MSRP gives insurers a good idea of how much a car will cost to repair or replace.

As for why MSRP affects collision and comprehensive insurance, it’s because these two coverages cover repair costs of your vehicle after an accident, regardless of who caused the accident. Collision coverage covers costs after collisions with other vehicles and objects, while comprehensive coverage covers animal collisions, natural disasters, weather, theft, and vandalism.

In fact, these two coverages are so important that most lenders require drivers to carry them when they sign a lease. This is called force-placed insurance, and it is more expensive to have collision and comprehensive insurance through your lender. So to save money, buy these coverages through a regular insurer, not your lender.

So what is the MSRP of the Dodge Avenger? Because it is an older car, Kelley Blue Book (KBB) doesn’t have the MSRP for the 2014 Dodge Avenger. However, KBB does have the following average prices.

- Typical Listing Price: $8,002

- Fair Purchase Price: $7,210

- Fair Market Range: $6,171 to $8,248

The typical listing price is usually lower than the MSRP, so we can expect that the MSRP is about $10,000. This isn’t bad, as a lower MSRP means lower rates. Low collision and comprehensive losses will also help lower the price of insurance. According to the IIHS, the Dodge Avenger had the following insurance losses from 2012 to 2014.

- Collision Losses: 19 percent (average)

- Comprehensive Losses: 5 percent (average)

Both the losses are average, which is good. While above-average losses mean lower rates, average losses aren’t a bad thing. It means you’ll have a normal rate on your car insurance.

How much will it cost to repair my Dodge Avenger?

Along with using the cost of your vehicle, insurers will use repair estimates to calculate insurance rates. Cars that are often more expensive to repair include older vehicles, unpopular models, or custom made cars.

To see how much it costs to maintain and repair the Dodge Avenger, we took a look at RepairPal’s reliability rating of the Dodge Avenger. The reliability rating of the Dodge Avenger is 4 out of 5 (above average), and the average annual repair cost is $541, which includes maintenance like oil changes. This repair cost is slightly above the average for compact cars ($526), but it is still low.

As for damage repairs, we visited InstantEstimator and used its free tool to calculate the repair costs for level two damage to a 2014 Dodge Avenger. The following estimates are based on paint labor, body labor, painting supplies, hazardous waste disposal, and sand/paint/buff.

- Front bumper: $413

- Rear bumper: $423

- Hood: $387

- Roof: $423

- Door: $391

- Fender: $351

- Quarter panel: $363

These prices are fairly normal. Like most cars, repairing the rear bumper and front bumper are some of the more expensive repairs to make. Still, the repair costs are average, so the Dodge Avenger shouldn’t be expensive to insure.

We hope our guide to the Dodge Avenger’s average car insurance rates has helped. You should now be ready to start shopping for car insurance to find out which car insurance company is the cheapest. If you want to start comparing rates for the Dodge Avenger, use our free rate tool by entering your ZIP code.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $4,812 |

| 20 | $2,758 |

| 30 | $1,216 |

| 40 | $1,194 |

| 50 | $1,096 |

| 60 | $1,074 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,402 |

| $250 | $1,306 |

| $500 | $1,194 |

| $1,000 | $1,084 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,194 |

| 50/100 | $1,301 |

| 100/300 | $1,434 |

| 250/500 | $1,781 |

| 100 CSL | $1,354 |

| 300 CSL | $1,648 |

| 500 CSL | $1,862 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $6,798 |

| 20 | $4,400 |

| 30 | $2,610 |

| 40 | $2,584 |

| 50 | $2,474 |

| 60 | $2,450 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $61 |

| Multi-vehicle | $66 |

| Homeowner | $21 |

| 5-yr Accident Free | $76 |

| 5-yr Claim Free | $76 |

| Paid in Full/EFT | $45 |

| Advance Quote | $54 |

| Online Quote | $81 |

| Total Discounts | $480 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area