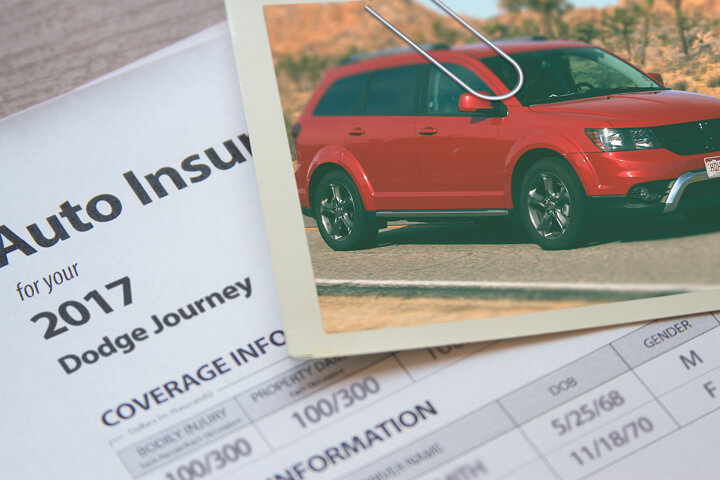

Cheapest 2017 Dodge Journey Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Comparing and finding cheaper prices for insurance can be frustrating for drivers who have little experience online price comparisons. With literally dozens of companies, it can turn into a burden to find the perfect company for you.

You need to check insurance prices every six months due to the fact that insurance rates change quite often. Even if you think you had the best rate on Journey insurance a few years ago you will most likely find a better price today. Forget all the misinformation about insurance because you’re going to learn one of the quickest ways to properly buy coverages and cut your premium.

Why you might pay inflated rates

Lots of factors are part of the equation when you get your auto insurance bill. Most are fairly basic such as your driving record, but other factors are less apparent like your continuous coverage or your financial responsibility.Smart consumers have a good feel for some of the elements that play a part in calculating the price you pay for auto insurance. If you understand what positively or negatively impacts your premiums, this enables you to make decisions that may result in lower rates.

The following are a few of the things used by companies to determine your prices.

- Raising physical damage deductibles saves money – Physical damage deductibles state the amount of money you are willing to pay in the event of a claim. Coverage for physical damage, also called comprehensive and collision insurance, is used to repair damage to your car. Some examples of covered claims could be collision with another vehicle, vandalism, and damage caused by road hazards. The more you pay before a claim is paid (deductible), the less your company will charge you for insurance on Journey insurance.

- Drive lots and pay more – The more miles you rack up on your Dodge each year the more you’ll pay to insure your vehicle. Almost all companies rate vehicles determined by how the vehicle is used. Vehicles that are left in the garage can be on a lower rate level than vehicles that have high annual mileage. It’s always a good idea to double check that your policy is showing annual mileage. An incorrectly rated Journey may be costing you higher rates.

- Pay more if you have a long commute – Living in small towns and rural areas is a good thing if you are looking for the lowest rates. Residents of big cities have traffic congestion and higher rates of accident claims. Less people translates into fewer accidents in addition to lower liability claims

- Tickets mean higher rates – Having just one moving violation can bump up the cost twenty percent or more. Good drivers tend to pay less for car insurance as compared to careless drivers. Drivers who have license-revoking violations such as DWI, reckless driving or hit and run convictions may face state-mandated requirements to maintain a SR-22 to the state department of motor vehicles in order to legally drive.

Verify you’re receiving every discount

Car insurance is expensive, but you can get discounts that you may not even know about. Some discounts will apply at quote time, but some must be asked about before they will apply.

- Homeowners Pay Less – Owning a house may earn you a small savings because maintaining a house is proof that your finances are in order.

- Onboard Data Collection – Drivers that enable driving data collection to analyze where and when they drive through the use of a telematics system such as Allstate’s Drivewise and State Farm’s In-Drive system could save a few bucks as long as they are good drivers.

- Defensive Driver Discount – Completing a course that instructs on driving safety is a good idea and can lower rates if your company offers it.

- Driver’s Education for Students – Require your teen driver to participate in a local driver’s education class if offered at their school.

- Military Discounts – Having a deployed family member may lower your rates slightly.

- Clubs and Organizations – Having an affiliation with a civic or occupational organization is a good way to get lower rates on your policy.

- Student Discounts – Being a good student may save as much as 25% on a car insurance quote. Many companies even apply the discount to college students well after school through age 25.

- Multiple Cars – Buying coverage for all your vehicles on a single policy can get a discount for every vehicle.

- Safety Restraint Discount – Drivers who require all occupants to use their safety belts may be able to save a few bucks off the personal injury premium cost.

- Accident Waiver – Not necessarily a discount, but some insurance companies will allow you to have one accident without getting socked with a rate hike if you are claim-free before the accident.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

A quick disclaimer, many deductions do not apply to all coverage premiums. Most only cut specific coverage prices like medical payments or collision. If you do the math and it seems like all those discounts means the company will pay you, insurance companies wouldn’t stay in business. But any discount should help lower your premiums.

The best car insurance companies and a partial list of their discounts can be found below.

- Progressive may have discounts that include continuous coverage, multi-vehicle, good student, homeowner, multi-policy, online quote discount, and online signing.

- SAFECO has discounts for anti-lock brakes, homeowner, safe driver, anti-theft, drive less, teen safety rewards, and teen safe driver.

- American Family has savings for good student, early bird, good driver, bundled insurance, air bags, and multi-vehicle.

- Farmers offers discounts for good student, defensive driver, claim-free, good driver, multi-policy, and accident-free.

- GEICO discounts include multi-vehicle, five-year accident-free, anti-lock brakes, federal employee, emergency military deployment, seat belt use, and air bags.

- The Hartford offers premium reductions for air bag, good student, vehicle fuel type, driver training, defensive driver, anti-theft, and bundle.

When getting a coverage quote, ask all companies you are considering which credits you are entitled to. Some of the discounts discussed earlier may not apply in your area. For a list of insurance companies with discount car insurance rates, click this link.

Drivers who switch save $414 a year? Really?

Well-known auto insurance companies like Allstate, GEICO and Progressive constantly bombard you with television and radio advertisements. They all advertise the message that drivers will save a bundle if you get a free car insurance quote and switch to their company. How does every company charge less that you’re paying now? It’s all in the wording.

Different companies have a preferred profile for a prospective insured that will not have excessive claims. One example of a desirable risk may be between 30 and 50, owns a home, and drives a vehicle with a low ISO rating. Anybody who fits those characteristics will probably get the lowest prices and will most likely save if they switch.

Consumers who may not quite match these stringent criteria may receive a higher rate which results in business going elsewhere. If you listen closely, the ads state “people that switch” but not “everyone who gets a quote” can get the lowest rates when switching. That is how companies can make those statements.

Each company has different criteria, so you need to get as many free car insurance quotes as possible. It is impossible to guess which company will have the best prices for your profile.

When should I discuss my situation with an agent?

When choosing adequate coverage, there isn’t really a “perfect” insurance plan. Everyone’s needs are different.

For instance, these questions might point out whether your personal situation would benefit from professional advice.

- Do I need higher collision deductibles?

- Should I rate my 2017 Dodge Journey as pleasure use or commute?

- Is my nanny covered when driving my vehicle?

- How do I insure my teen driver?

- Is my vehicle covered by my employer’s policy when using it for work?

- Should I file a claim if it’s only slightly more than my deductible?

- Should I buy additional glass protection?

If you can’t answer these questions but one or more may apply to you, you might consider talking to a licensed insurance agent. To find lower rates from a local agent, take a second and complete this form.

Car insurance 101

Having a good grasp of your insurance policy helps when choosing appropriate coverage at the best deductibles and correct limits. The coverage terms in a policy can be confusing and nobody wants to actually read their policy.

Comprehensive coverages

This coverage covers damage that is not covered by collision coverage. A deductible will apply and then insurance will cover the rest of the damage.

Comprehensive insurance covers claims such as hail damage, rock chips in glass, a broken windshield, vandalism and hitting a bird. The most you can receive from a comprehensive claim is the cash value of the vehicle, so if it’s not worth much more than your deductible consider removing comprehensive coverage.

Uninsured and underinsured coverage

Your UM/UIM coverage gives you protection when other motorists are uninsured or don’t have enough coverage. This coverage pays for medical payments for you and your occupants as well as damage to your Dodge Journey.

Due to the fact that many drivers carry very low liability coverage limits, it doesn’t take a major accident to exceed their coverage limits. That’s why carrying high Uninsured/Underinsured Motorist coverage is a good idea. Frequently the UM/UIM limits are identical to your policy’s liability coverage.

Auto liability

This will cover damages or injuries you inflict on a person or their property that is your fault. It protects you from claims by other people. It does not cover your injuries or vehicle damage.

It consists of three limits, bodily injury per person, bodily injury per accident and property damage. As an example, you may have values of 100/300/100 which stand for a $100,000 limit per person for injuries, a total of $300,000 of bodily injury coverage per accident, and $100,000 of coverage for damaged property. Occasionally you may see one number which is a combined single limit that pays claims from the same limit with no separate limits for injury or property damage.

Liability coverage protects against things like medical services, funeral expenses, emergency aid and attorney fees. How much liability should you purchase? That is up to you, but buy as much as you can afford.

Coverage for collisions

Collision coverage covers damage to your Journey from colliding with another vehicle or an object, but not an animal. You first must pay a deductible and then insurance will cover the remainder.

Collision insurance covers things like hitting a mailbox, driving through your garage door, sustaining damage from a pot hole, hitting a parking meter and crashing into a ditch. This coverage can be expensive, so you might think about dropping it from vehicles that are 8 years or older. Another option is to bump up the deductible in order to get cheaper collision rates.

Coverage for medical payments

Personal Injury Protection (PIP) and medical payments coverage pay for expenses such as doctor visits, rehabilitation expenses, surgery and X-ray expenses. They are utilized in addition to your health insurance policy or if you do not have health coverage. Coverage applies to you and your occupants as well as being hit by a car walking across the street. Personal Injury Protection is not universally available and may carry a deductible

Make an honest buck

As you shop your coverage around, it’s a bad idea to skimp on critical coverages to save a buck or two. There have been many situations where consumers will sacrifice comprehensive coverage or liability limits only to discover later they didn’t purchase enough coverage. Your aim should be to find the BEST coverage at the lowest possible cost.

Lower-priced 2017 Dodge Journey insurance can be sourced online as well as from insurance agents, and you need to comparison shop both to have the best chance of lowering rates. There are still a few companies who may not provide the ability to get quotes online and these small, regional companies provide coverage only through local independent agencies.

Insureds who switch companies do it for many reasons like denial of a claim, not issuing a premium refund, unfair underwriting practices or being labeled a high risk driver. Regardless of your reason for switching companies, finding a new insurance coverage company can be pretty painless.

Use our FREE quote tool to compare rates now!

Additional learning opportunities

- Five Tips to Save on Auto Insurance (Insurance Information Institute)

- Rental Car Insurance Tips (Insurance Information Institute)

- How Much Auto Coverage do I Need? (Insurance Information Institute)

- Auto Insurance Learning Center (State Farm)

Frequently Asked Questions

What factors contribute to the cost of insurance for a 2017 Dodge Journey?

Several factors influence the cost of insurance for a 2017 Dodge Journey. These include the driver’s age, driving record, location, and insurance history. Additionally, the vehicle’s make and model, safety features, mileage, and usage patterns can affect insurance rates.

Are there any specific insurance discounts available for a 2017 Dodge Journey?

Yes, there are various insurance discounts that may apply to a 2017 Dodge Journey. These can include discounts for safety features such as anti-lock brakes and airbags, as well as discounts for anti-theft devices, bundled policies, good driving records, and certain affiliations such as being a member of certain organizations or professional groups.

Can installing security devices lower insurance costs for a 2017 Dodge Journey?

Yes, installing security devices in your 2017 Dodge Journey can potentially reduce insurance costs. Anti-theft devices like alarm systems, GPS trackers, and immobilizers can make your vehicle less prone to theft or break-ins. Insurance providers often offer discounts for these security measures, as they minimize the risk of theft-related claims.

Is it possible to lower insurance costs for a 2017 Dodge Journey?

Yes, there are several strategies to potentially lower insurance costs for your 2017 Dodge Journey. Maintaining a clean driving record, opting for higher deductibles, bundling policies, and taking advantage of available discounts can all help reduce insurance premiums.

Does the location where I live impact the cost of insurance for a 2017 Dodge Journey?

Yes, your location can impact the cost of insurance for your 2017 Dodge Journey. Areas with higher population densities, higher crime rates, or higher instances of accidents may have higher insurance premiums compared to areas with lower risks.

Can maintaining a good credit score affect insurance costs for a 2017 Dodge Journey?

Yes, maintaining a good credit score can potentially affect insurance costs for a 2017 Dodge Journey. In some states and for certain insurance providers, a higher credit score may be correlated with lower insurance premiums.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- GMC Sierra Insurance

- Honda Accord Insurance

- Chevrolet Silverado Insurance

- Dodge Ram Insurance

- Honda Civic Insurance

- Ford F-150 Insurance

- Toyota Corolla Insurance

- Honda CR-V Insurance

- Chevrolet Cruze Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area