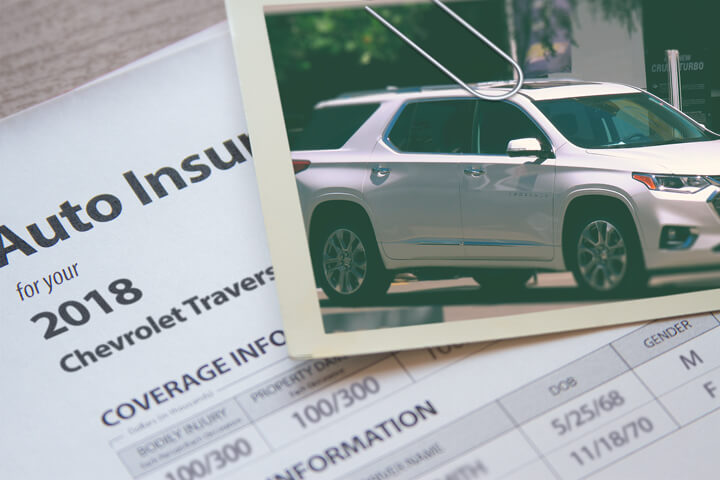

Cheapest 2018 Chevrolet Traverse Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Expensive insurance can dwindle your budget and force you to tighten up your finances. Comparison shopping is free, only takes a few minutes, and is a good way to make ends meet.

Big companies like State Farm, Allstate, GEICO and Progressive all promote huge savings with fancy advertisements and it is difficult to see through the deception and effectively compare rates to find the best deal.

It’s smart to do rate comparisons before your policy renews because prices change regularly. Even if you got the lowest price for Traverse insurance on your last policy you can probably find a better rate quote now. Block out anything you think you know about insurance because you’re going to learn the best methods to find lower rates on insurance.

Affordable insurance quotes with discounts

Insuring your fleet can be pricey, but there could be significant discounts that may help make it more affordable. Certain reductions will be credited at quote time, but a few must be specifically requested prior to getting the savings.

- Driver Education Discount – Have your child take driver’s ed class in high school.

- Multi-car Discount – Insuring multiple cars or trucks on a single policy qualifies for this discount.

- Professional Organizations – Belonging to a professional or civic organization is a simple method to lower premiums on your bill.

- Low Mileage Discounts – Maintaining low annual mileage may allow you to get better prices on cars that stay parked.

- Discount for Home Ownership – Simply owning a home can save you money due to the fact that maintaining a home demonstrates responsibility.

- Discounts for Cautious Drivers – Insureds who avoid accidents may receive a discount up to 45% for Traverse insurance as compared to drivers with claims.

- Early Payment Discounts – By paying your entire bill at once instead of paying each month you could save 5% or more.

- Telematics Data – Drivers that enable driving data collection to analyze driving habits by using a telematic data system like Drivewise from Allstate or In-Drive from State Farm might see lower rates if they show good driving skills.

- Multi-line Discount – Not all companies offer life insurance, but some may give you lower insurancerates if you buy some life insurance too.

You can save money using discounts, but some credits don’t apply to the overall cost of the policy. Some only reduce specific coverage prices like liability, collision or medical payments. So even though it sounds like adding up those discounts means a free policy, nobody gets a free ride.

Car insurance companies that may include many of the previously listed discounts are:

- Farmers Insurance

- State Farm

- Liberty Mutual

- MetLife

- Progressive

When getting a coverage quote, ask every prospective company to apply every possible discount. Savings might not be offered on policies in your area. To see a list of providers with the best discounts, click here to view.

Ways to get auto insurance quotes

There are a variety of methods you can shop for auto insurance and some are easier and takes less work. You can waste a few hours (or days) driving to agents in your area, or you can stay home and use the web to get rates in a matter of minutes.

Most of the larger companies belong to a marketplace that allows shoppers to only type in their quote data once, and each company returns a competitive quote based on the submitted data. This prevents consumers from doing quote requests to every company.

To fill out one form to compare multiple rates now click to open in new window.

One minor caveat to pricing coverage this way is you are unable to specify which companies to get quotes from. If you prefer to choose individual companies for rate comparison, we have a listing of companies who write auto insurance in your area. Click to view list.

It’s your choice how you get your quotes, but try to keep the same deductibles and coverage limits with every price quote. If your comparisons have unequal deductibles or liability limits it will be nearly impossible to make an equal comparison.

Tailor your insurance coverage to you

When choosing coverage for your personal vehicles, there isn’t really a perfect coverage plan. Every insured’s situation is different so this has to be addressed. For example, these questions may help you determine whether your personal situation may require specific advice.

- Does my policy cover me when driving someone else’s vehicle?

- Is a fancy paint job covered?

- Do I need roadside assistance coverage?

- What is UM/UIM insurance?

- Do I need PIP (personal injury protection) coverage in my state?

- Does insurance cover tools stolen from my truck?

- When should I remove comp and collision on my 2018 Chevy Traverse?

If it’s difficult to answer those questions then you might want to talk to a licensed insurance agent. If you want to speak to an agent in your area, take a second and complete this form or you can go here for a list of companies in your area. It’s fast, doesn’t cost anything and can help protect your family.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Car insurance coverage options for a Chevy Traverse

Having a good grasp of a car insurance policy can help you determine appropriate coverage at the best deductibles and correct limits. Car insurance terms can be confusing and even agents have difficulty translating policy wording. Shown next are typical coverages found on most car insurance policies.

Protection from uninsured/underinsured drivers – This coverage protects you and your vehicle from other drivers when they either are underinsured or have no liability coverage at all. Covered losses include injuries sustained by your vehicle’s occupants and also any damage incurred to your Chevy Traverse.

Because many people have only the minimum liability required by law, their limits can quickly be used up. So UM/UIM coverage should not be overlooked.

Comprehensive (Other than Collision) – This coverage covers damage caused by mother nature, theft, vandalism and other events. A deductible will apply then the remaining damage will be covered by your comprehensive coverage.

Comprehensive coverage pays for things like a broken windshield, damage from a tornado or hurricane and hail damage. The maximum amount your car insurance company will pay is the ACV or actual cash value, so if the vehicle’s value is low consider dropping full coverage.

Collision coverages – Collision insurance covers damage to your Traverse from colliding with another car or object. You will need to pay your deductible then your collision coverage will kick in.

Collision can pay for claims like hitting a mailbox, scraping a guard rail, hitting a parking meter, driving through your garage door and crashing into a ditch. This coverage can be expensive, so you might think about dropping it from lower value vehicles. It’s also possible to raise the deductible in order to get cheaper collision rates.

Medical expense insurance – Med pay and PIP coverage reimburse you for bills for things like doctor visits, ambulance fees, EMT expenses, prosthetic devices and hospital visits. They can be used to fill the gap from your health insurance policy or if you do not have health coverage. Medical payments and PIP cover not only the driver but also the vehicle occupants and will also cover being hit by a car walking across the street. PIP is not an option in every state but it provides additional coverages not offered by medical payments coverage

Liability coverage – Liability coverage can cover damages or injuries you inflict on other people or property that is your fault. It protects YOU from legal claims by others. Liability doesn’t cover damage to your own property or vehicle.

Coverage consists of three different limits, per person bodily injury, per accident bodily injury, and a property damage limit. Your policy might show limits of 50/100/50 which means a limit of $50,000 per injured person, a limit of $100,000 in injury protection per accident, and property damage coverage for $50,000.

Liability can pay for claims such as legal defense fees, bail bonds, loss of income, medical services and structural damage. The amount of liability coverage you purchase is up to you, but you should buy as large an amount as possible.

Don’t throw your cash in the trash

Discount 2018 Chevy Traverse insurance can be bought online as well as from insurance agents, and you should compare price quotes from both to get a complete price analysis. Some insurance companies may not have the ability to get quotes online and these regional insurance providers prefer to sell through independent insurance agencies.

We just covered a lot of tips how to reduce 2018 Chevy Traverse insurance premium rates online. The key thing to remember is the more you quote insurance coverage, the better your chances of lowering your prices. Consumers could even find that the most savings is with some of the lesser-known companies. Some small companies often have lower prices on specific markets as compared to the big name companies such as Allstate or State Farm.

While you’re price shopping online, never sacrifice coverage to reduce premiums. In many instances, consumers will sacrifice uninsured motorist or liability limits and learned later that they should have had better coverage. The proper strategy is to buy the best coverage you can find at an affordable rate, but do not skimp to save money.

Use our FREE quote tool to compare insurance rates now!

Helpful resources

- Comprehensive Coverage (Liberty Mutual)

- Insuring a Leased Car (Insurance Information Institute)

- Distracted Driving Extends Beyond Texting (State Farm)

- Understanding Rental Car Insurance (Insurance Information Institute)

- What if I Can’t Find Coverage? (Insurance Information Institute)

- Top Signs Your Brakes are Giving Out (State Farm)

Frequently Asked Questions

What should I do if I need personalized assistance with my insurance options for a Chevrolet Traverse?

If you need personalized assistance with your insurance options for a Chevrolet Traverse, it’s recommended to speak with a licensed insurance agent. They can help assess your specific needs, explain available coverage options, and provide tailored advice to help you make informed decisions. Contacting an insurance agent in your area or filling out a form online can connect you with an agent who can assist you.

How can I find the most affordable insurance rates for my 2018 Chevrolet Traverse if I have multiple vehicles to insure?

If you have multiple vehicles to insure, you may be eligible for a multi-car discount from insurance companies. Insuring multiple vehicles on a single policy can lead to lower premiums. Contact your insurance provider or obtain quotes from different companies to inquire about the availability of multi-car discounts and compare rates to find the most affordable option.

Can I remove comprehensive and collision coverage from my 2018 Chevy Traverse to save on insurance premiums?

Removing comprehensive and collision coverage from your 2018 Chevy Traverse may lower your insurance premiums, but it’s important to consider the value of your vehicle and your personal risk tolerance. Comprehensive and collision coverage protect your vehicle against damage from various events, including accidents and non-collision incidents. If your Traverse still holds significant value or if you want the added peace of mind, it may be wise to maintain these coverages.

Does my auto insurance policy cover my Chevrolet Traverse if I lend it to someone else and they have an accident?

In most cases, auto insurance coverage follows the vehicle rather than the driver. This means that if you lend your Chevrolet Traverse to someone else and they have an accident, your insurance policy should provide coverage. However, it’s always a good idea to check with your insurance provider to confirm the details of your coverage in such situations.

Is it necessary to purchase additional coverage options, such as roadside assistance or rental car reimbursement, for my Chevrolet Traverse?

Additional coverage options like roadside assistance and rental car reimbursement are not mandatory, but they can provide extra protection and convenience. Roadside assistance can help in case of breakdowns, while rental car reimbursement covers the cost of a rental vehicle if your Traverse is being repaired due to a covered claim. Consider your specific needs and budget when deciding whether to include these options in your insurance policy.

Can I get insurance coverage for a 2018 Chevrolet Traverse if I have a less-than-perfect driving record?

Yes, insurance coverage for a 2018 Chevrolet Traverse is still available even if you have a less-than-perfect driving record. However, having violations or accidents on your record may result in higher insurance premiums. It’s recommended to shop around and compare quotes from different insurance companies to find the most affordable rates despite your driving history.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Corolla Insurance

- Hyundai Santa Fe Insurance

- Honda Civic Insurance

- Nissan Rogue Insurance

- Ford F-150 Insurance

- Dodge Ram Insurance

- Chevrolet Cruze Insurance

- GMC Sierra Insurance

- Jeep Wrangler Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area