Cheapest Car Insurance for 16-Year-Olds in 2025

Enter your Car Insurance Coverage FAQs zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jul 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

There are three things guaranteed in life: death, taxes, and expensive car insurance for teenage drivers.

Adding a newly licensed 16-year-old (or even younger with a learner’s permit) to your car insurance policy comes with mixed emotions for most parents. One one hand, your child has the independence to now drive themselves to school, practice, or to the movies, but on the other hand, the anxiety of having them behind the wheel is stressful.

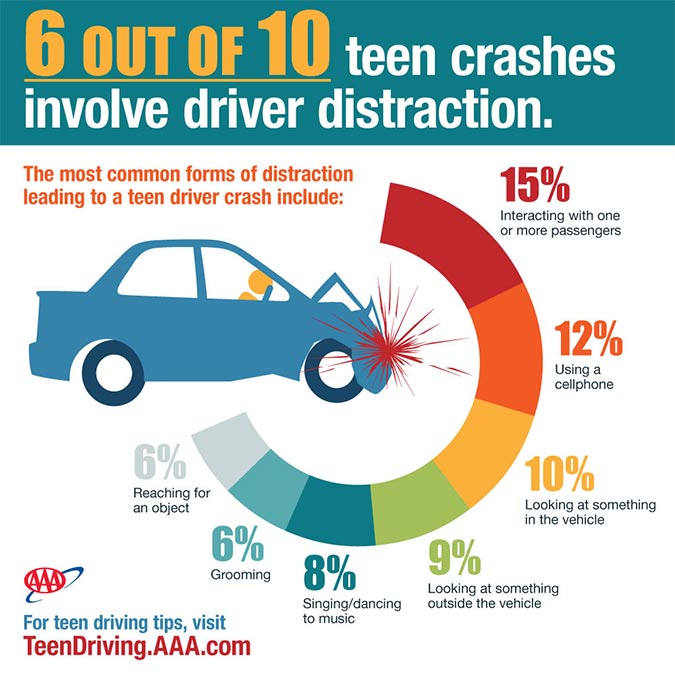

Teen drivers are much more likely to be involved in a car accident due to both inexperience and distractions. The radio, cell phone, friends, and no fear factor all contribute to increased accidents and more expensive auto insurance bills.

The diagram below shows why distracted teenagers give their parents gray hair.

Image courtesy of AAA

What factors determine the cost of teen car insurance?

The big question on most parent’s mind when the time comes to add junior to the policy is ‘How much is it going to cost?‘.

There are a lot of factors that contribute to the added cost of having a teen driver rated on your policy including the type of vehicle they drive, how it’s insured, where they live, and their driving record. After we cover those topics, we’ll show you some ways to save money when insuring a teen driver.

Does the vehicle they drive factor in?

There will be a big price difference if your teen is driving a newer, more expensive vehicle than if they inherit a 20-year-old sedan from the grandparents. As parents, we try to balance affordability with safety, as not everyone can afford a newer vehicle, but we also want to protect our children as much as possible if they do have an accident.

Newer vehicles are more expensive to insure not only because they have a higher actual cash value, but also because more than likely they will require full coverage including comprehensive and collision insurance.

The table below shows estimated car insurance rates for a variety of vehicles that a typical teenager may drive.

| Year, Make, and Model | Full Coverage | Liability Only |

|---|---|---|

| 2006 Chevrolet Silverado | $4,526 | $3,206 |

| 2011 Dodge Ram | $5,072 | $3,116 |

| 2013 Ford Escape | $4,016 | $2,294 |

| 2011 Ford Focus | $4,610 | $2,758 |

| 2005 Ford F-150 | $3,914 | $2,858 |

| 2011 GMC Acadia | $4,380 | $2,758 |

| 2008 GMC Sierra | $4,388 | $2,798 |

| 2011 Honda Accord | $4,452 | $2,758 |

| 2010 Honda Civic | $5,064 | $3,138 |

| 2004 Honda CR-V | $3,254 | $2,410 |

| 2011 Honda Pilot | $4,424 | $2,758 |

| 2011 Hyundai Sonata | $4,912 | $3,116 |

| 2013 Nissan Altima | $4,966 | $2,700 |

| 2010 Toyota Camry | $4,578 | $2,778 |

| 2006 Toyota Corolla | $4,146 | $2,838 |

| 2011 Toyota Prius | $4,170 | $2,344 |

| 2003 Toyota RAV4 | $3,752 | $2,838 |

As vehicles age, insurance prices drop due to the reduced payout insurance companies will have to make if the vehicle is totaled. This is known as the actual cash value. If the vehicle is not insured for physical damage coverage, then liability, medical or PIP, and uninsured/underinsured motorists are the coverages you will be buying.

For teens and even college-aged kids, it’s hard to justify buying a nice vehicle knowing they will be sitting (and getting door dinged) in parking lots for most of the foreseeable future. That’s why a liability-only policy makes a lot of sense and can save mom and dad a lot of money.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What are the policy coverages and limits?

Liability insurance coverage will be expensive regardless of the vehicle they drive, but adding comprehensive and especially collision coverage will really inflate the rates. Teenage drivers, especially newly-licensed ones, have the highest rate of accidents of any age group.

Collision insurance pays to repair your vehicle if it overturns or impacts with another object or vehicle, and the chances of having this type of claim are very high with a teen driver. They don’t always check their rear-view mirror or have the same depth perception as an experienced driver, and this contributes to many parking lot fender benders.

If your budget is the biggest concern, vehicles in the 10 to 15-year-old range are a sweet spot for teen drivers. Most vehicles will still have safety features like anti-lock brakes and air bags, but the actual cash value has depreciated to the point where full coverage is not needed.

The table below shows estimated rates for different full coverage and liability-only scenarios, for a 16-year-old driver. For this example, the rated vehicle is a 2010 Honda Accord.

| Policy Coverage | Annual Premium |

|---|---|

| Full Coverage with $100 Deductibles | $5,024 |

| Full Coverage with $250 Deductibles | $4,684 |

| Full Coverage with $500 Deductibles | $4,316 |

| Full Coverage with $1,000 Deductibles | $3,972 |

| Liability Only with 30/60 Limits | $2,724 |

| Liability Only with 100/300 Limits | $3,367 |

It’s easy to see why either having high deductibles or eliminating full coverage altogether is an attractive option. A high deductible can save over $1,000 a year, while dropping comprehensive and collision insurance can save as much as $2,300 a year.

What is your teenager’s driving record?

Insurance for a teenager is expensive enough even with a perfect driving record. But since teens are inexperienced drivers, speeding tickets, running stop signs, failure to yield, and other minor traffic citations are common. And if they cause an accident, chances are they’ll get a double whammy with both a citation and an at-fault accident blemish on their driving record.

If your child does happen to get a citation or two, prepare for more sticker shock. Depending on your insurance company, the first ticket may not impact rates as much as you might think. But add a second citation or an accident, and you can expect to see a large double-digit rate increase. Clean driving records equal lower insurance premiums, as the average cost will go up with any accidents or moving violations.

The table below shows how accidents and violations can impact the price of insurance for young drivers.

| Driving Violations/Accidents | Full Coverage | Liability Only |

|---|---|---|

| No Violations or Accidents | $4,316 | $2,778 |

| One Violation No Accidents | $5,224 | $3,386 |

| Two Violations No Accidents | $5,554 | $3,534 |

| Three Violations No Accidents | $5,848 | $3,628 |

| One Violation One Accident | $5,842 | $3,740 |

| Two Violations One Accident | $6,116 | $3,842 |

| Three Violations One Accident | $6,390 | $3,978 |

Chances are good that even before you get to the point where you teen has three violations and an at-fault accident, you’ve already received notification from your insurance company that he or she needs to be removed from the policy and placed into a high-risk or ‘non-standard’ policy.

It’s also worth noting that male drivers typically pay more than female drivers, particularly among male and female teen drivers.

Many of the major car insurers will not even insure an older driver with that flawed of a driving record, much less a 16-year-old.

What about your ZIP code?

Where you live is a large factor that determines the cost of coverage. Some states like North Carolina, Virginia, Indiana, Illinois, and Ohio have relatively cheap car insurance. Other states like Michigan, New York, Louisiana, Nevada, and Connecticut tend to have higher rates. And even within any particular state, rates can vary considerably if you live in a rural area as compared to a highly populated metro area.

Mother nature also has a big say in auto insurance prices, as areas that are prone to hail or flooding will have higher rates than areas that are not subjected to the forces of nature.

The table below shows estimated car insurance prices for a 16-year-old driver for both full coverage and liability-only in all 50 U.S. states. Again, we are using a 2010 Honda Accord as the example rated vehicle with $500 deductibles for the full coverage rates.

| State | Full Coverage | Liability Only |

|---|---|---|

| Alabama | $4,152 | $2,672 |

| Alaska | $3,544 | $2,280 |

| Arizona | $4,332 | $2,788 |

| Arkansas | $4,378 | $2,818 |

| California | $4,850 | $3,122 |

| Colorado | $4,484 | $2,886 |

| Connecticut | $5,656 | $3,640 |

| Delaware | $5,258 | $3,384 |

| Florida | $5,824 | $3,748 |

| Georgia | $4,280 | $2,754 |

| Hawaii | $4,656 | $2,996 |

| Idaho | $3,006 | $1,934 |

| Illinois | $3,204 | $2,062 |

| Indiana | $3,082 | $1,984 |

| Iowa | $3,244 | $2,088 |

| Kansas | $3,966 | $2,552 |

| Kentucky | $5,596 | $3,602 |

| Louisiana | $6,996 | $4,502 |

| Maine | $2,956 | $1,902 |

| Maryland | $4,440 | $2,856 |

| Massachusetts | $3,804 | $2,448 |

| Michigan | $7,938 | $5,108 |

| Minnesota | $3,792 | $2,440 |

| Mississippi | $4,226 | $2,720 |

| Missouri | $3,688 | $2,374 |

| Montana | $3,910 | $2,516 |

| Nebraska | $3,556 | $2,288 |

| Nevada | $5,578 | $3,590 |

| New Hampshire | $3,518 | $2,264 |

| New Jersey | $4,302 | $2,770 |

| New Mexico | $4,002 | $2,576 |

| New York | $5,618 | $3,616 |

| North Carolina | $3,070 | $1,976 |

| North Dakota | $4,202 | $2,704 |

| Ohio | $3,040 | $1,956 |

| Oklahoma | $5,250 | $3,378 |

| Oregon | $4,038 | $2,598 |

| Pennsylvania | $4,864 | $3,130 |

| Rhode Island | $5,238 | $3,372 |

| South Carolina | $4,026 | $2,590 |

| South Dakota | $3,384 | $2,178 |

| Tennessee | $3,878 | $2,496 |

| Texas | $4,152 | $2,672 |

| Utah | $3,830 | $2,466 |

| Vermont | $3,076 | $1,980 |

| Virginia | $3,104 | $1,998 |

| Washington | $3,804 | $2,448 |

| West Virginia | $4,394 | $2,828 |

| Wisconsin | $4,402 | $2,834 |

| Wyoming | $4,774 | $3,072 |

The cost to insure a 16-year-old ranges from a low in the state of Maine at $2,956 a year to a high of $7,938 in Michigan, a difference of $4,982. That’s a heck of a difference considering the driver risk and vehicle coverages are identical. Michigan is a no-fault state and has notoriously high car insurance rates.

Case Studies: Cheapest Car Insurance for 16-Year-Olds

Case Study 1: ShieldGuard Insurance

John, a 16-year-old resident of Illinois, was excited to start driving. However, his parents were concerned about the high cost of car insurance for teenage drivers. After thorough research, they discovered ShieldGuard Insurance, a company known for offering competitive rates for young drivers. ShieldGuard provided John with affordable coverage.

Case Study 2: SafeDrive Solutions

Sarah, a newly licensed driver from California, was determined to find affordable car insurance without compromising on quality. Through her search, she found SafeDrive Solutions, an insurance provider specializing in cost-effective coverage for young drivers. SafeDrive Solutions offered Sarah a competitive rate, allowing her to have peace of mind.

Case Study 3: Trustworthy Insurance Agency

Mark, a 16-year-old driver residing in Texas, was looking for reliable and affordable car insurance options. His parents wanted to ensure that Mark had sufficient coverage without straining their budget. They came across Trustworthy Insurance Agency, known for their commitment to customer satisfaction and reasonable rates for teenage drivers.

for a 16-year-old driver?

No matter how you spin it, car insurance for young drivers is going to be expensive. Their lack of driving experience and inattentiveness behind the wheel is responsible for earning them the distinction of the highest car insurance rates.

There are ways to help lower rates, however, and here are the top ways to control costs, including discounts to drivers.

- Enroll your teen in a driver’s safety course approved by your car insurance company

- Consider dropping full coverage on the vehicle your teen drives and keep liability coverage only

- If eliminating full coverage is not an option, raise the physical damage deductibles as high as you can afford

- If your teen is a good driver and your car insurance company offers a telematics device, the company can track their driving habits and in return you canget save up to a 30% driver discount.

- Make sure your vehicle is rated for accurate annual mileage

- If your company uses driver averaging, which rates your teen across all vehicles, it may save money by moving your teen onto their own policy

- If you haven’t purchased a vehicle for your teen to drive, consider foregoing a newer, more expensive car and instead opt for an older, but still safe vehicle

- If you found out how much it’s going to cost to insure your 16-year-old and your jaw dropped, it might be a good time to shop around.

Comparing insurance rates should be a regular habit, and since it doesn’t cost anything to get a quote, it could be time well spent.

Frequently Asked Questions

What factors determine the cost of teen car insurance?

The cost of teen car insurance is determined by several factors, including the type of vehicle they drive, how it’s insured, their location, and their driving record. Factors such as the car’s age, value, and safety features can influence insurance rates.

Does the vehicle they drive factor in?

Yes, the vehicle your teen drives plays a significant role in determining insurance rates. Newer, more expensive vehicles generally have higher insurance rates due to their higher value and the need for full coverage. Older vehicles may have lower rates, especially if you opt for liability-only coverage.

What are the policy coverages and limits for teen drivers?

Teenage drivers typically require liability insurance, which can be expensive regardless of the vehicle they drive. Adding comprehensive and collision coverage can significantly increase rates. Older vehicles in the 10 to 15-year-old range often strike a balance between affordability and coverage.

What is your teenager’s driving record?

A teenager’s driving record can have a significant impact on insurance rates. Inexperienced drivers are more prone to accidents and traffic violations. Each citation or accident can result in higher insurance premiums. Clean driving records result in lower insurance costs.

How does your ZIP code affect insurance rates for teen drivers?

Your ZIP code plays a role in determining insurance rates for teen drivers. Rates can vary from state to state and even within different areas of a state. Factors such as the population density and the frequency of natural disasters in your area can influence insurance prices.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Subaru Forester Insurance

- Toyota Rav4 Insurance

- Toyota Camry Insurance

- Chevrolet Silverado Insurance

- Toyota Corolla Insurance

- Ford F-150 Insurance

- Toyota Highlander Insurance

- Ford Fusion Insurance

- Dodge Ram Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area