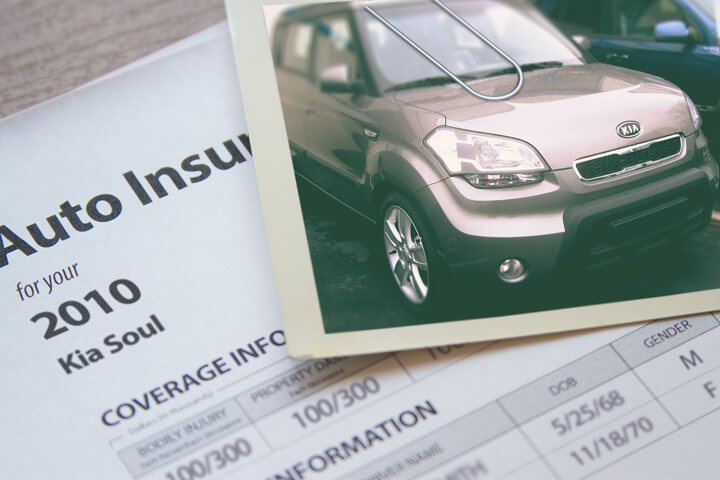

Cheapest 2010 Kia Soul Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Trying to find cheaper insurance coverage rates? Buyers have many options when searching for low-cost Kia Soul insurance. They can either spend hours struggling with agents to get rate comparisons or utilize the internet to find the lowest rates. There are more efficient ways to compare insurance coverage rates so we’re going to tell you the best way to quote coverages for your Kia and obtain the lowest price from both online companies and local agents.

It’s important to price shop coverage before your policy renews because prices change regularly. Despite the fact that you may have had the lowest price for Soul insurance a few years ago the chances are good that you can find a lower rate today. There is a lot of bad advice regarding insurance coverage online but with this article, you’re going to get some solid techniques on how to buy insurance coverage cheaper.

If you have a current auto insurance policy or need new coverage, you can follow these tips to get lower rates and still get good coverage. The purpose of this post is to let you in on the most effective way to quote insurance. Vehicle owners just need to learn the proper way to compare prices online.

How to Buy Car Insurance Online

Most companies such as State Farm and Allstate allow you to get prices for coverage on the web. The process is quite easy as you simply enter the coverage amounts you desire as detailed in the form. Upon sending the form, the system automatically retrieves your driving record and credit report and returns pricing information based on these and other factors.

Online price quotes makes comparing rates easy, but the process of having to visit each company’s website and repetitively complete many quote forms is repetitive and time-consuming. But it’s absolutely necessary to get many rate quotes if you are searching for the lowest possible prices on car insurance.

A more efficient way to compare rates makes use of a single form that gets price quotes from several companies at one time. It saves time, helps eliminate repetitive entry, and makes price shopping online much simpler. As soon as you send your information, it gets priced and you are able to buy any of the price quotes you receive. If a lower price is quoted, you can simply submit the application and buy the policy. It can be completed in less than 10 minutes and can result in significant savings.

If you want to find out if lower rates are available, click here to open in a new tab and input your coverage information. If you have a policy now, it’s recommended you enter the coverage information exactly as shown on your declarations page. Doing this assures you’re receiving a rate comparison for similar insurance coverage.

Cut prices on Kia Soul insurance

Companies offering auto insurance don’t always advertise every discount very clearly, so the following is a list of some of the more common and also the lesser-known insurance savings. If you’re not getting every credit possible, you’re just leaving money on the table.

- One Accident Forgiven – Some insurance companies will forgive one accident before raising your premiums if your claims history is clear for a particular time prior to the accident.

- Resident Student – Kids in college living away from home attending college and do not have access to a covered vehicle can receive lower rates.

- Low Mileage Discounts – Fewer annual miles on your Kia could be rewarded with lower rates on the low mileage vehicles.

- E-sign – Some insurance companies give back up to $50 for buying a policy and signing up online.

- Good Student – This discount can get you a discount of up to 25%. Earning this discount can benefit you up to age 25.

- Drivers Education – Cut your cost by having your teen driver complete a driver education course in school.

- Auto/Life Discount – Larger companies have lower rates if you buy life insurance.

- Pay Upfront and Save – By paying your policy upfront rather than paying monthly you could save up to 5%.

Keep in mind that most credits do not apply the whole policy. Most only apply to specific coverage prices like collision or personal injury protection. So despite the fact that it appears you can get free auto insurance, it just doesn’t work that way.

Companies that possibly offer these discounts are:

- GEICO

- Mercury Insurance

- Farmers Insurance

- Auto-Owners Insurance

- Liberty Mutual

- SAFECO

- Progressive

- USAA

Double check with all companies you are considering how you can save money. Some discounts might not be offered in every state.

Your Kia Soul insurance rate is a complex equation

Consumers need to have an understanding of some of the elements that play a part in calculating your auto insurance rates. Understanding what controls the rates you pay helps enable you to make changes that will entitle you to better auto insurance rates.

Shown below are some of the factors that factor into prices.

- Multi-policy discounts can save money – Some companies give discounts to people who carry more than one policy, otherwise known as a multi-policy discount. If you currently are using one company, you may still want to compare rates to ensure the best deal. Drivers may still find a better deal by buying auto insurance from a different company.

- Lower rates come with age – Young drivers are known to get distracted easily when behind the wheel so auto insurance rates are higher. Older insureds are more responsible, statistically cause fewer accidents and are safer drivers.

- Better credit scores mean better rates – Having a bad credit rating is a large factor in calculating your auto insurance rates. Drivers who have high credit scores tend to be better drivers and file fewer claims as compared to drivers with lower credit scores. So if your credit history can use some improvement, you could be paying less to insure your 2010 Kia Soul by spending a little time repairing your credit.

- A clean driving record saves money – Your driving citation history has a huge affect on how much you pay. Just one ticket may increase your cost by twenty percent. Drivers with clean records have lower premiums compared to drivers with tickets. Drivers who have flagrant citations such as hit and run, DWI or reckless driving convictions may need to submit a SR-22 or proof of financial responsibility with the DMV in their state in order to keep their license.

- Liability coverage protects you – Liability coverage is the coverage that protects you when a court rules you are at fault for damages caused by your negligence. Liability provides legal defense starting from day one. Liability insurance is quite affordable when compared with rates for comp and collision, so drivers should carry high limits.

Tailor your coverage to you

When it comes to buying proper insurance coverage for your personal vehicles, there isn’t really a best way to insure your cars. Every situation is different.

For example, these questions can help discover if your insurance needs could use an agent’s help.

- Is there coverage for injuries to my pets?

- Does insurance cover damages from a DUI accident?

- If my 2010 Kia Soul is totaled, can I afford another vehicle?

- If I drive on a suspended license am I covered?

- Is a blown tire covered by insurance?

- Do I pay less for low miles?

- Can I get a multi-policy discount for packaging my home and auto coverage?

- How can I find cheaper teen driver insurance?

If it’s difficult to answer those questions but one or more may apply to you, you might consider talking to an agent. To find an agent in your area, fill out this quick form. It’s fast, doesn’t cost anything and can provide invaluable advice.

Coverages available on your policy

Understanding the coverages of your policy helps when choosing appropriate coverage and the correct deductibles and limits. Insurance terms can be impossible to understand and coverage can change by endorsement.

Comprehensive or Other Than Collision – Comprehensive insurance coverage covers damage OTHER than collision with another vehicle or object. You first must pay your deductible and then insurance will cover the rest of the damage.

Comprehensive coverage protects against things such as hitting a deer, falling objects, a broken windshield and hail damage. The maximum amount a insurance company will pay at claim time is the cash value of the vehicle, so if your deductible is as high as the vehicle’s value consider dropping full coverage.

Collision – Collision coverage pays for damage to your Soul resulting from a collision with another car or object. A deductible applies and the rest of the damage will be paid by collision coverage.

Collision coverage pays for things such as driving through your garage door, sideswiping another vehicle, damaging your car on a curb and crashing into a building. This coverage can be expensive, so analyze the benefit of dropping coverage from older vehicles. Another option is to increase the deductible in order to get cheaper collision rates.

Liability coverages – This coverage provides protection from damages or injuries you inflict on other’s property or people by causing an accident. This insurance protects YOU against other people’s claims, and doesn’t cover your own vehicle damage or injuries.

Split limit liability has three limits of coverage: bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You might see values of 25/50/25 that means you have $25,000 in coverage for each person’s injuries, a limit of $50,000 in injury protection per accident, and $25,000 of coverage for damaged property.

Liability coverage pays for things such as legal defense fees, medical services and funeral expenses. How much coverage you buy is a personal decision, but buy as high a limit as you can afford.

UM/UIM Coverage – This gives you protection when other motorists either are underinsured or have no liability coverage at all. This coverage pays for medical payments for you and your occupants as well as your vehicle’s damage.

Because many people only purchase the least amount of liability that is required, their limits can quickly be used up. So UM/UIM coverage is important protection for you and your family.

Medical costs insurance – Coverage for medical payments and/or PIP pay for immediate expenses like funeral costs, ambulance fees, EMT expenses, rehabilitation expenses and pain medications. The coverages can be used to cover expenses not covered by your health insurance policy or if you do not have health coverage. They cover you and your occupants as well as getting struck while a pedestrian. Personal Injury Protection is not universally available but can be used in place of medical payments coverage

A little work can save a LOT of money

Throughout this article, we presented many ways to get a better price on 2010 Kia Soul insurance. The most important thing to understand is the more times you quote, the higher your chance of finding lower rates. Consumers could even find that the best prices are with some of the lesser-known companies.

Discount insurance can be bought both online as well as from independent agents, so you should compare both so you have a total pricing picture. Some car insurance companies don’t offer online quoting and most of the time these regional insurance providers sell through independent agents.

Insureds switch companies for any number of reasons including delays in responding to claim requests, high rates after DUI convictions, questionable increases in premium and being labeled a high risk driver. Whatever your reason, finding a great new company is not as hard as you think.

To learn more, take a look at the following helpful articles:

- Side Impact Crash Tests (iihs.org)

- Young Drivers: The High Risk Years Video (iihs.org)

- Get the Right Protection (InsureUonline.org)

- Speed and Speed Limit FAQ (iihs.org)

- Eight Auto Insurance Myths (Insurance Information Institute)

- Vehicle Insurance (Wikipedia)

Frequently Asked Questions

What factors can affect the insurance rates for a 2010 Kia Soul?

Several factors can influence the insurance rates for a 2010 Kia Soul. These may include the driver’s age, driving history, location, coverage options, deductible amount, and the level of insurance competition in your area.

Are there any specific safety features in the 2010 Kia Soul that could lower insurance rates?

Yes, the presence of certain safety features in the 2010 Kia Soul could potentially lower insurance rates. These safety features may include anti-lock brakes, airbags, stability control, and anti-theft devices. Insurance providers often consider these features when calculating premiums.

How can I find the cheapest insurance rates for a 2010 Kia Soul?

To find the cheapest insurance rates for a 2010 Kia Soul, consider following these steps:

- Shop around: Obtain quotes from multiple insurance providers to compare prices and coverage options.

- Maintain a good driving record: A clean driving history without accidents or traffic violations can help you secure lower insurance rates.

- Increase deductibles: Opting for a higher deductible can reduce your premium, but make sure you can afford the deductible amount in case of a claim.

- Bundle insurance policies: If you have other insurance policies, such as home or renter’s insurance, bundling them with your auto insurance may lead to discounts.

- Inquire about discounts: Ask the insurance company about any available discounts, such as safe driver discounts or discounts for taking defensive driving courses.

Are there any specific insurance providers known for offering affordable rates on a 2010 Kia Soul?

Insurance rates can vary significantly between providers and depend on various factors. It is recommended to obtain quotes from multiple insurance companies to determine which one offers the most competitive rates for a 2010 Kia Soul. Some well-known insurance providers that may be worth considering include GEICO, Progressive, State Farm, Allstate, and Farmers.

Does the color of a 2010 Kia Soul affect insurance rates?

No, the color of a vehicle, including a 2010 Kia Soul, does not typically impact insurance rates. Insurance companies base their rates on factors like the vehicle’s make, model, age, engine size, safety features, and the driver’s profile, but not the color of the car.

Is it possible to qualify for any loyalty or long-term customer discounts on insurance for a 2010 Kia Soul?

Many insurance providers offer loyalty or long-term customer discounts to encourage customer retention. If you have been insured with the same company for a significant period, it’s worth inquiring about any available loyalty discounts for your 2010 Kia Soul.

Can my insurance rates for a 2010 Kia Soul be affected by the area I live in?

Yes, the location where you live can impact insurance rates for a 2010 Kia Soul. If you reside in an area with higher crime rates or a higher number of accidents, insurance companies may perceive a greater risk, leading to higher premiums. Similarly, living in an area with a higher concentration of insured drivers and lower accident rates may result in lower insurance rates.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Hyundai Tucson Insurance

- Ford F-150 Insurance

- Honda Accord Insurance

- Nissan Rogue Insurance

- Ford Fusion Insurance

- Dodge Ram Insurance

- Kia Forte Insurance

- Toyota Camry Insurance

- Toyota Corolla Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area