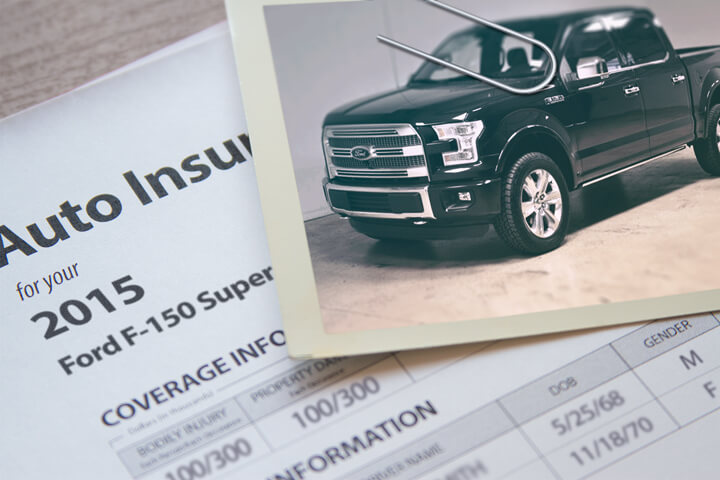

Cheapest 2015 Ford F-150 Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Searching for better car insurance rates for your Ford F-150? Expensive car insurance can dwindle your checking account and put the squeeze on your family’s finances. Comparing price quotes is a smart way to slash your bill and have more disposable income.

Many insurance companies compete for your insurance dollar, and it can be difficult to compare rates and get the definite best rate

If you currently have car insurance, you should be able to reduce your rates substantially using these methods. Buying car insurance is not rocket science. But car owners can benefit from knowing the way companies determine prices and take advantage of how the system works.

Comprehensive Auto Insurance Comparison

There are a lot of ways to shop for auto insurance, but some are less time-consuming than others. You could waste time discussing policy coverages with insurance agencies in your area, or you could use the internet to get pricing more quickly.

Many insurance companies belong to an insurance system that allows shoppers to submit one quote, and each participating company provides a quote determined by their information. This prevents consumers from doing quote forms to each company.

To fill out one form to compare multiple rates now click to open in new window.

The only drawback to using this type of system is you can’t choose which carriers to receive prices from.

It’s your choice how you get your quotes, but ensure you are comparing the exact same deductibles and coverage limits on every quote. If each company quotes mixed coverages you can’t possibly truly determine the lowest rate. Just a small difference in limits may cause a big price difference. And when price shopping your coverage, comparing more company’s prices helps you find better pricing.

Verify you’re getting all your discounts

Properly insuring your vehicles can get expensive, but you can get discounts to help bring down the price. Larger premium reductions will be automatically applied when you get a quote, but lesser-known reductions have to be asked about before you get the savings.

- Anti-theft Discount – Vehicles equipped with anti-theft or alarm systems are stolen less frequently and earn discounts up to 10%.

- One Accident Forgiven – Certain companies will forgive one accident before your rates go up as long as you don’t have any claims for a particular time prior to the accident.

- Safe Drivers – Drivers who don’t get into accidents can pay as much as 50% less on F-150 coverage than drivers with accident claims.

- Payment Discounts – If you pay your bill all at once instead of monthly or quarterly installments you could save up to 5%.

- Anti-lock Brake Discount – Cars that have steering control and anti-lock brakes are safer to drive and qualify for as much as a 10% discount.

- Homeowners Savings – Owning a home may trigger a insurance policy discount due to the fact that maintaining a home shows financial diligence.

- Life Insurance Discount – Companies who offer life insurance give a break if you buy a life insurance policy as well.

- Auto/Home Discount – When you combine your home and auto insurance with the same company you could get a discount of up to 20% off your total premium.

- Good Students Pay Less – A discount for being a good student can earn a discount of 20% or more. The discount lasts up until you turn 25.

- Student Driver Training – Require your teen driver to successfully complete driver’s ed class if offered at their school.

Keep in mind that most of the big mark downs will not be given to the overall cost of the policy. Most cut the cost of specific coverages such as collision or personal injury protection. Just because it seems like adding up those discounts means a free policy, you’re out of luck. Any amount of discount will cut your premiums.

When should I talk to an agent?

When it comes to buying the best insurance coverage coverage for your personal vehicles, there really is no single plan that fits everyone. Everyone’s needs are different so your insurance needs to address that. For example, these questions can help discover whether or not you would benefit from an agent’s advice.

- When does my teenage driver need to be added to my policy?

- Should I buy full coverage?

- What is UM/UIM insurance?

- Am I covered if I drive in a foreign country?

- Do I need replacement cost coverage?

- If my 2015 Ford F-150 is totaled, can I afford another vehicle?

- Can my teen driver be rated on a liability-only vehicle?

- Is extra glass coverage worth it?

- Can I afford to pay high deductible claims out of pocket?

- How much liability coverage do I need in my state?

If you’re not sure about those questions, you may need to chat with a licensed agent. If you want to speak to an agent in your area, take a second and complete this form.

Car insurance coverage specifics

Having a good grasp of car insurance can help you determine appropriate coverage at the best deductibles and correct limits. The coverage terms in a policy can be difficult to understand and even agents have difficulty translating policy wording. These are typical coverage types found on the average car insurance policy.

Coverage for collisions

This coverage pays to fix your vehicle from damage resulting from a collision with a stationary object or other vehicle. You have to pay a deductible then the remaining damage will be paid by your insurance company.

Collision coverage protects against things such as backing into a parked car, colliding with a tree and scraping a guard rail. This coverage can be expensive, so analyze the benefit of dropping coverage from vehicles that are older. Drivers also have the option to raise the deductible in order to get cheaper collision rates.

Uninsured/Underinsured Motorist coverage

Your UM/UIM coverage protects you and your vehicle’s occupants when the “other guys” do not carry enough liability coverage. Covered losses include hospital bills for your injuries as well as damage to your Ford F-150.

Since many drivers only carry the minimum required liability limits, their limits can quickly be used up. This is the reason having UM/UIM coverage is very important. Most of the time the UM/UIM limits are set the same as your liability limits.

Liability coverages

This provides protection from damage or injury you incur to other’s property or people in an accident. It protects you against claims from other people. Liability doesn’t cover damage to your own property or vehicle.

It consists of three limits, bodily injury per person, bodily injury per accident and property damage. You might see liability limits of 50/100/50 which means a limit of $50,000 per injured person, a limit of $100,000 in injury protection per accident, and a total limit of $50,000 for damage to vehicles and property. Alternatively, you may have a combined single limit or CSL that pays claims from the same limit with no separate limits for injury or property damage.

Liability can pay for claims like loss of income, repair costs for stationary objects, attorney fees and pain and suffering. The amount of liability coverage you purchase is a decision to put some thought into, but buy as large an amount as possible.

Comprehensive coverage

Comprehensive insurance coverage will pay to fix damage OTHER than collision with another vehicle or object. You first must pay your deductible then the remaining damage will be covered by your comprehensive coverage.

Comprehensive can pay for things like theft, rock chips in glass, damage from a tornado or hurricane, a tree branch falling on your vehicle and hail damage. The highest amount you’ll receive from a claim is the cash value of the vehicle, so if it’s not worth much more than your deductible it’s probably time to drop comprehensive insurance.

Medical payments coverage and PIP

Personal Injury Protection (PIP) and medical payments coverage kick in for short-term medical expenses for things like chiropractic care, ambulance fees and doctor visits. The coverages can be used in conjunction with a health insurance plan or if you lack health insurance entirely. Medical payments and PIP cover both the driver and occupants as well as being hit by a car walking across the street. PIP coverage is not available in all states but can be used in place of medical payments coverage

Frequently Asked Questions

What factors determine the cost of insurance for a 2015 Ford F-150?

The cost of insurance for a 2015 Ford F-150 is influenced by several factors, including the driver’s age, driving history, location, annual mileage, coverage options, deductibles, and the specific model and trim of the F-150.

Are there any specific features or modifications that can impact the insurance cost for a 2015 Ford F-150?

Yes, certain features or modifications on a 2015 Ford F-150 can affect insurance rates. Factors such as the vehicle’s engine size, safety features, anti-theft devices, and aftermarket modifications can influence insurance premiums.

Can I get a discount on insurance for my 2015 Ford F-150?

Yes, there are various discounts that may be available to help reduce the cost of insurance for your 2015 Ford F-150. Common discounts include multi-policy discounts, safe driving discounts, anti-theft device discounts, and discounts for bundling auto insurance with other policies.

What is the average cost of insurance for a 2015 Ford F-150?

The average cost of insurance for a 2015 Ford F-150 can vary significantly depending on multiple factors. On average, however, you can expect to pay around $1,200 to $1,500 per year for full coverage insurance on a 2015 Ford F-150.

Are there any specific insurance companies known for offering affordable rates for a 2015 Ford F-150?

Insurance rates can vary among different providers, so it’s essential to compare quotes from multiple companies to find the most affordable option for your 2015 Ford F-150. Some insurance companies that are known for competitive rates include GEICO, Progressive, State Farm, and Allstate.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Nissan Rogue Insurance

- Toyota Rav4 Insurance

- Honda Accord Insurance

- Jeep Grand Cherokee Insurance

- Dodge Ram Insurance

- Ford F-150 Insurance

- Honda Civic Insurance

- Toyota Camry Insurance

- Nissan Altima Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area