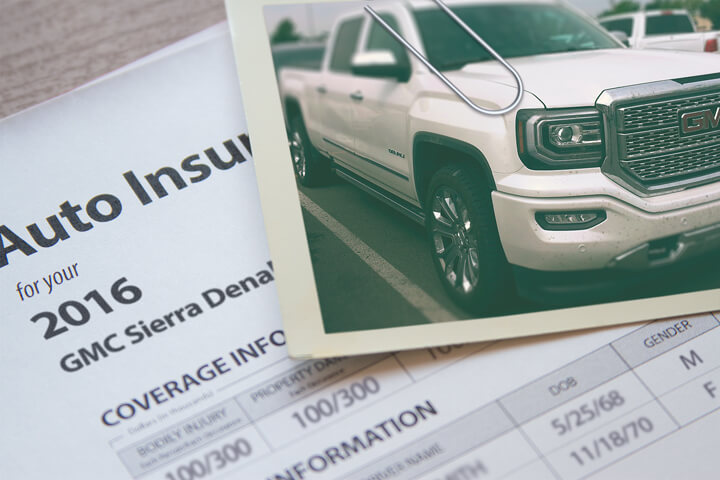

Cheapest 2016 GMC Sierra 1500 Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Trying to find better auto insurance rates for your GMC Sierra 1500? Getting discount auto insurance may at first seem to be somewhat difficult for consumers new to buying their auto insurance on the web. With so many insurance agents and companies competing online, how can anyone have time to compare every auto insurance company to find the cheapest available price?

The most recommended method to compare policy rates is to take advantage of the fact most insurance companies will pay a fee to compare rate quotes. All consumers are required to do is spend a couple of minutes providing details such as what you do for a living, if you lease or own, an estimate of your credit level, and if you are currently licensed. Your insurance information is instantly sent to multiple companies and you get price estimates almost instantly.

Lower rates by qualifying for discounts

Some companies don’t always list every disount available very well, so we researched a few of the more common and the harder-to-find discounts that you may qualify for. If you do not check that you are getting every discount available, you could be getting lower rates.

- Seat Belts Save more than Lives – Drivers who always wear seat belts and also require passengers to buckle up can save up to 10 percent (depending on the company) off the medical payments premium.

- Distant Student Discount – Any of your kids who are enrolled in higher education away from home and do not take a car to college could get you a discount.

- Clubs and Organizations – Having an affiliation with certain professional organizations is a good way to get lower rates on your next insurance statement.

- Defensive Driver – Taking part in a course that instructs on driving safety could earn you a small percentage discount and make you a better driver.

- Early Payment Discounts – If you pay your entire premium ahead of time rather than paying in monthly installments you could save 5% or more.

- Accident Waiver – Not necessarily a discount, but some companies like State Farm and GEICO will allow you to have one accident before they charge you more for coverage if your claims history is clear for a specific time period.

- Telematics Devices – Policyholders that allow data collection to track vehicle usage by using a telematics device in their vehicle like Allstate’s Drivewise could save a few bucks as long as they are good drivers.

- E-sign – A few insurance companies will give a small break for completing your application on your computer.

- Theft Deterent Discount – Vehicles that have factory alarm systems and tracking devices prevent vehicle theft so companies will give you a small discount.

A little note about advertised discounts, many deductions do not apply to all coverage premiums. The majority will only reduce specific coverage prices like liability and collision coverage. If you do the math and it seems like it’s possible to get free car insurance, you’re out of luck. Any amount of discount should definitely cut the amount you have to pay.

A list of companies and some of the discounts are included below.

- State Farm offers premium reductions for defensive driving training, driver’s education, passive restraint, accident-free, and safe vehicle.

- GEICO discounts include seat belt use, multi-policy, federal employee, membership and employees, air bags, anti-lock brakes, and daytime running lights.

- Liberty Mutual offers discounts including newly married, newly retired, new vehicle discount, exclusive group savings, teen driver discount, and new graduate.

- The Hartford policyholders can earn discounts including vehicle fuel type, air bag, driver training, good student, bundle, and defensive driver.

- MetLife may include discounts for claim-free, good driver, good student, accident-free, defensive driver, multi-policy

- Progressive includes discounts for multi-vehicle, homeowner, online signing, multi-policy, good student, and continuous coverage.

When getting a coverage quote, ask all the companies which discounts you may be entitled to. Savings may not apply to policyholders in every state. For a list of providers that offer multiple discounts, click this link.

Auto insurance is unique, just like you

When it comes to buying the best auto insurance coverage, there really is no “best” method to buy coverage. Every situation is different.

For instance, these questions can aid in determining if you could use an agent’s help.

- Why is insurance for a teen driver so high?

- Is business property covered if stolen from my car?

- What are the best liability limits?

- I have a DUI can I still get coverage?

- I have health insurance so do I need medical payments coverage?

- Why am I required to get a high-risk car insurance policy?

- Am I covered if I hit a deer?

- Will my rates increase for filing one claim?

- Does my policy pay for OEM or aftermarket parts?

- What is UM/UIM insurance?

If you can’t answer these questions but a few of them apply then you might want to talk to a licensed insurance agent. If you don’t have a local agent, simply complete this short form.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Car insurance coverages for a GMC Sierra 1500

Having a good grasp of your car insurance policy aids in choosing which coverages you need and the correct deductibles and limits. The coverage terms in a policy can be ambiguous and even agents have difficulty translating policy wording.

Comprehensive auto coverage

This coverage covers damage OTHER than collision with another vehicle or object. You first have to pay a deductible then your comprehensive coverage will pay.

Comprehensive insurance covers claims such as vandalism, fire damage, hitting a deer and damage from getting keyed. The maximum payout your car insurance company will pay is the cash value of the vehicle, so if your deductible is as high as the vehicle’s value consider removing comprehensive coverage.

Collision protection

This coverage pays for damage to your Sierra 1500 resulting from a collision with an object or car. You have to pay a deductible and then insurance will cover the remainder.

Collision coverage pays for things like rolling your car, sustaining damage from a pot hole, sideswiping another vehicle, hitting a parking meter and damaging your car on a curb. Collision coverage makes up a good portion of your premium, so you might think about dropping it from lower value vehicles. It’s also possible to choose a higher deductible to save money on collision insurance.

UM/UIM (Uninsured/Underinsured Motorist) coverage

Uninsured or Underinsured Motorist coverage gives you protection from other drivers when they are uninsured or don’t have enough coverage. It can pay for medical payments for you and your occupants as well as damage to your GMC Sierra 1500.

Since many drivers carry very low liability coverage limits, it doesn’t take a major accident to exceed their coverage limits. For this reason, having high UM/UIM coverages is a good idea. Frequently your uninsured/underinsured motorist coverages are identical to your policy’s liability coverage.

Liability

This coverage protects you from damage or injury you incur to other people or property by causing an accident. This coverage protects you from legal claims by others. Liability doesn’t cover your injuries or vehicle damage.

It consists of three limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. As an example, you may have liability limits of 100/300/100 which stand for a $100,000 limit per person for injuries, a limit of $300,000 in injury protection per accident, and a limit of $100,000 paid for damaged property. Occasionally you may see one number which is a combined single limit that pays claims from the same limit without having the split limit caps.

Liability coverage protects against claims like attorney fees, emergency aid, medical services, medical expenses and bail bonds. The amount of liability coverage you purchase is a personal decision, but you should buy as much as you can afford.

Medical payments and PIP coverage

Medical payments and Personal Injury Protection insurance provide coverage for immediate expenses such as doctor visits, chiropractic care, pain medications, prosthetic devices and dental work. They are utilized in addition to your health insurance program or if you do not have health coverage. It covers not only the driver but also the vehicle occupants and will also cover any family member struck as a pedestrian. PIP is not universally available but can be used in place of medical payments coverage.

Use our FREE quote tool to compare rates now!

Frequently Asked Questions

How can I find the cheapest auto insurance rates for my 2016 GMC Sierra 1500 in 2023?

To find the cheapest auto insurance rates for your 2016 GMC Sierra 1500 in 2023, the recommended method is to compare quotes from multiple insurance companies. You can use our free quote tool by entering your ZIP code to get price estimates instantly. By providing details such as your occupation, ownership status, credit level estimate, and current license status, your information will be sent to multiple companies, allowing you to compare rates and find the most affordable option.

What discounts are available to lower my auto insurance rates?

Many insurance companies offer various discounts that can help lower your auto insurance rates. Some of the more common discounts include safe driver discounts, multi-policy discounts (if you have multiple insurance policies with the same company), good student discounts, and discounts for having certain safety features in your vehicle. However, not all discounts may apply to every coverage premium. It’s important to ask each insurance company about the discounts you may be eligible for when obtaining a coverage quote.

How do I determine the car insurance coverages I need for my GMC Sierra 1500?

Understanding your car insurance policy and its coverages is crucial in determining the appropriate coverage options, deductibles, and limits for your GMC Sierra 1500. It’s recommended to familiarize yourself with the coverage terms and definitions in your policy, as they can sometimes be confusing. For instance, comprehensive coverage protects against damage other than collision, while collision coverage pays for damages resulting from a collision. Other essential coverages include liability coverage, which protects you from claims by others, and uninsured/underinsured motorist coverage, which provides protection when the at-fault driver is uninsured or underinsured. Assessing your specific needs and consulting with a licensed insurance agent can help determine the right coverages for your situation.

What is liability coverage, and why is it important?

Liability coverage is an essential component of car insurance that protects you from legal claims made by others for damages or injuries you cause in an accident. It consists of three limits: bodily injury per person, bodily injury per accident, and property damage. For example, if you have liability limits of 100/300/100, it means you have coverage up to $100,000 for injuries per person, $300,000 for injuries per accident, and $100,000 for property damage. Having sufficient liability coverage is crucial to protect your assets and ensure that you can meet your financial obligations if you’re found liable for an accident.

What is the difference between medical payments coverage and personal injury protection (PIP) insurance?

Medical payments coverage and personal injury protection (PIP) insurance provide coverage for immediate expenses resulting from injuries sustained in a car accident. Medical payments coverage can help cover costs such as doctor visits, chiropractic care, pain medications, and dental work. PIP insurance, on the other hand, is more comprehensive and can cover a wider range of expenses, including medical treatments, lost wages, and even funeral expenses. PIP insurance may also cover the driver, vehicle occupants, and pedestrians involved in the accident. It’s important to note that PIP insurance is not universally available, and its availability may vary by state.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Honda CR-V Insurance

- Ford F-150 Insurance

- Dodge Ram Insurance

- Chevrolet Impala Insurance

- Subaru Forester Insurance

- Honda Civic Insurance

- Toyota Camry Insurance

- Toyota Sienna Insurance

- Ford Fusion Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area