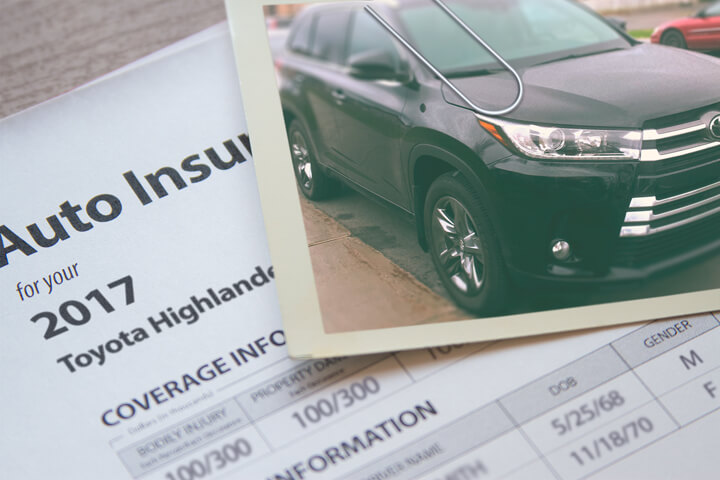

Cheapest 2017 Toyota Highlander Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Shopping for discount auto insurance online might seem overwhelming for vehicle owners that are relatively new to online price comparisons. With dozens of insurers available, how are vehicle owners able to efficiently compare every possible option in order to find the cheapest available price?

You should take the time to take a look at other company’s rates occasionally because prices go up and down regularly. Even if you got the lowest rate on Highlander coverage last year a different company probably has better premium rates today. There is too much inaccurate information about auto insurance on the web, but by reading this article, you’re going to learn some great ideas on how to slash your auto insurance rates.

If you currently have a car insurance policy, you should be able to save some money using these methods. Locating cheaper protection is not that difficult. But vehicle owners do need to learn how the larger insurance companies market insurance on the web and take advantage of how the system works.

Discounts for cheaper insurance coverage rates

Insurance coverage is neither fun to buy or cheap, but there could be significant discounts that you may not know about. Larger premium reductions will be automatically applied at the time of purchase, but a few must be manually applied before they will apply.

- Multiple Vehicles – Buying coverage for primary and secondary vehicles with the same insurance coverage company can get a discount for every vehicle.

- Own a Home – Owning a house can save a few bucks because owning a home shows financial diligence.

- Theft Prevention System – Cars optioned with advanced anti-theft systems have a lower chance of being stolen and qualify for as much as a 10% discount.

- Buy New and Save – Adding a new car to your policy can save up to 30% since newer models are generally safer.

- Pay Upfront and Save – If you can afford to pay the entire bill instead of paying each month you could save 5% or more.

- Responsible Driver Discounts – Insureds without accidents could pay up to 40% less on Highlander coverage than their less cautious counterparts.

It’s important to note that most of the big mark downs will not be given to your bottom line cost. Some only apply to individual premiums such as liability, collision or medical payments. So even though they make it sound like all those discounts means the company will pay you, nobody gets a free ride.

To choose companies with the best discounts, click here.

You may need specialized insurance coverage coverage

When it comes to buying coverage, there really is no “best” method to buy coverage. Coverage needs to be tailored to your specific needs.

Here are some questions about coverages that may help you determine whether or not you could use an agent’s help.

- Do I have coverage when using my vehicle for my home business?

- How much liability coverage do I need in my state?

- Can my babysitter drive my car?

- What is UM/UIM insurance?

- Do I need PIP coverage since I have good health insurance?

- Does having multiple vehicles earn me a discount?

- How much underlying liability do I need for an umbrella policy?

If you don’t know the answers to these questions but one or more may apply to you then you might want to talk to an agent. To find an agent in your area, fill out this quick form.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto insurance coverages

Knowing the specifics of your insurance policy helps when choosing which coverages you need and proper limits and deductibles. The terms used in a policy can be ambiguous and even agents have difficulty translating policy wording.

Collision coverages – Collision insurance will pay to fix damage to your Highlander resulting from colliding with another vehicle or an object, but not an animal. You will need to pay your deductible and then insurance will cover the remainder.

Collision insurance covers things like hitting a mailbox, rolling your car, colliding with another moving vehicle and hitting a parking meter. Collision coverage makes up a good portion of your premium, so analyze the benefit of dropping coverage from lower value vehicles. Drivers also have the option to bump up the deductible in order to get cheaper collision rates.

Comprehensive insurance – Comprehensive insurance coverage pays to fix your vehicle from damage caused by mother nature, theft, vandalism and other events. You first have to pay a deductible then your comprehensive coverage will pay.

Comprehensive insurance covers things like damage from getting keyed, a broken windshield, theft, fire damage and damage from flooding. The maximum payout you’ll receive from a claim is the market value of your vehicle, so if it’s not worth much more than your deductible consider removing comprehensive coverage.

Coverage for medical expenses – Personal Injury Protection (PIP) and medical payments coverage provide coverage for bills for EMT expenses, rehabilitation expenses, dental work, surgery and funeral costs. They are often used to cover expenses not covered by your health insurance policy or if you are not covered by health insurance. They cover both the driver and occupants as well as any family member struck as a pedestrian. PIP coverage is only offered in select states and may carry a deductible

Coverage for liability – This will cover damages or injuries you inflict on people or other property in an accident. This coverage protects you against other people’s claims, and doesn’t cover your injuries or vehicle damage.

Liability coverage has three limits: bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You commonly see values of 25/50/25 which stand for $25,000 in coverage for each person’s injuries, a per accident bodily injury limit of $50,000, and $25,000 of coverage for damaged property.

Liability insurance covers things like attorney fees, repair costs for stationary objects and loss of income. How much liability should you purchase? That is your choice, but you should buy higher limits if possible.

Coverage for uninsured or underinsured drivers – Your UM/UIM coverage protects you and your vehicle’s occupants from other motorists when they do not carry enough liability coverage. This coverage pays for medical payments for you and your occupants and also any damage incurred to your Toyota Highlander.

Because many people only purchase the least amount of liability that is required, it only takes a small accident to exceed their coverage. This is the reason having UM/UIM coverage is very important.

Make a quick buck

We’ve covered a lot of ways to shop for 2017 Toyota Highlander insurance online. The key concept to understand is the more times you quote, the higher the chance of saving money. You may be surprised to find that the biggest savings come from a lesser-known regional company.

Budget-friendly insurance is available online as well as from independent agents, so you should be comparing quotes from both in order to have the best chance of saving money. Some companies do not provide online price quotes and most of the time these regional carriers prefer to sell through independent agents.

When trying to cut insurance costs, it’s not a good idea to buy lower coverage limits just to save a few bucks. There are many occasions where someone dropped full coverage and discovered at claim time they didn’t have enough coverage. Your goal should be to buy enough coverage at the best cost.

Use our FREE quote tool to compare rates now!

More resources

- Five Steps to Filing an Auto Insurance Claim (Insurance Information Institute)

- Distracted Driving Extends Beyond Texting (State Farm)

- Credit Impacts Car Insurance Rates (State Farm)

- Side Impact Crash Tests (iihs.org)

Frequently Asked Questions

How can I find the cheapest insurance for my 2017 Toyota Highlander?

To find the cheapest insurance for your 2017 Toyota Highlander, you can follow these steps:

- Shop around: Compare quotes from multiple insurance providers to get an idea of the different rates available.

- Maintain a good driving record: A clean driving record with no accidents or traffic violations can help you secure lower insurance premiums.

- Increase your deductible: Opting for a higher deductible means you’ll pay more out of pocket in the event of a claim, but it can lower your insurance premium.

- Consider discounts: Inquire about any available discounts such as safe driver discounts, multi-policy discounts, or discounts for installing anti-theft devices in your vehicle.

- Evaluate coverage options: Review your coverage needs and consider adjusting your coverage limits and types to better suit your circumstances. However, be cautious not to compromise essential coverage for the sake of lower premiums.

Are there specific insurance providers that offer cheaper rates for a 2017 Toyota Highlander?

Insurance rates can vary between providers, so it’s recommended to obtain quotes from multiple insurance companies to compare their rates. Some well-known insurance providers that you could consider include GEICO, Progressive, State Farm, Allstate, and Farmers Insurance. However, it’s important to note that the specific rates you receive will depend on various factors, including your location, driving history, coverage needs, and personal circumstances.

What factors can affect the cost of insurance for a 2017 Toyota Highlander?

Several factors can influence the cost of insurance for a 2017 Toyota Highlander, including:

- Age and driving experience: Younger and less experienced drivers typically face higher insurance premiums.

- Location: Insurance rates can vary based on where you live, including factors like local crime rates and accident statistics.

- Driving record: A history of accidents or traffic violations may lead to higher premiums.

- Coverage and deductibles: The level of coverage you choose and the deductible amount can impact your insurance costs.

- Vehicle usage: How often you drive your Highlander and whether it’s for personal or business use can affect your rates.

- Credit history: In some states, insurance companies consider credit scores when determining premiums.

- Safety features: Vehicles equipped with safety features like anti-lock brakes, airbags, and anti-theft devices may qualify for discounts.

Are there any specific tips to lower insurance costs for a 2017 Toyota Highlander?

Yes, here are a few tips to help lower insurance costs for your 2017 Toyota Highlander:

- Opt for higher deductibles: Choosing a higher deductible can lower your premium but be sure to set it at a level you can comfortably afford.

- Bundle your insurance policies: If you have other insurance needs, consider bundling your auto insurance with home or renters insurance from the same provider. Many insurers offer multi-policy discounts.

- Inquire about discounts: Ask your insurance provider about any available discounts, such as safe driver discounts, multi-vehicle discounts, or discounts for installing anti-theft devices in your Highlander.

- Maintain a good credit score: In some states, insurance companies consider credit scores when determining premiums. Maintaining good credit can help you secure lower insurance rates.

- Consider usage-based insurance: Some insurance providers offer usage-based insurance programs where your premium is based on your driving habits. If you’re a safe driver, this could potentially lead to lower rates.

- Take advantage of safety features: Ensure your Highlander is equipped with safety features like anti-lock brakes, airbags, and anti-theft devices. These can not only provide added protection but may also qualify you for discounts on your insurance premiums.

Can I save money by reducing coverage on my 2017 Toyota Highlander?

While reducing coverage limits or removing certain coverage types may lower your insurance premium, it’s important to carefully consider the potential risks. Comprehensive and collision coverage, for example, provide protection for your vehicle in case of damage or theft. Reducing these coverages might result in greater out-of-pocket expenses if an incident occurs. It’s advisable to evaluate your personal circumstances and the value of your vehicle before deciding to reduce coverage. Additionally, you may want to consult with your insurance provider to understand the potential impact on your premium and coverage options.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Chevrolet Cruze Insurance

- Kia Optima Insurance

- Toyota Rav4 Insurance

- Ford F-150 Insurance

- Toyota Sienna Insurance

- Chevrolet Silverado Insurance

- Dodge Ram Insurance

- Chevrolet Impala Insurance

- Toyota Camry Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area