BMW X5 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

How much does it cost to insure a BMW X5? Auto insurance for a BMW X5 costs $1,724 a year, or $143 a month. Read on to find out what drivers can do to save on BMW X5 insurance rates.

To start comparison shopping for everything from 2007 BMW X5 insurance costs to 2019 BMW X5 insurance costs, enter your ZIP code in our free tool above.

Average insurance prices for a BMW X5 are $1,676 every 12 months including full coverage. Comprehensive insurance costs an estimated $406, collision costs $714, and liability coverage costs $398. Buying just liability costs as little as $460 a year, with insurance for high-risk drivers costing $3,624 or more. Teenage drivers receive the highest rates at $6,040 a year or more.

Average premium for full coverage: $1,676

Rate estimates broken down by individual coverage type:

Price estimates include $500 physical damage deductibles, 30/60 bodily injury liability limits, and includes additional medical/uninsured motorist coverage. Rates are averaged for all 50 U.S. states and for different X5 trim levels.

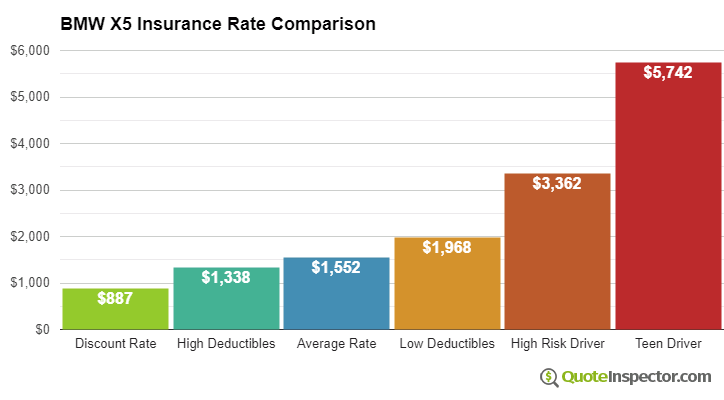

Price Range by Coverage and Risk

For the average 40-year-old driver, prices range go from the cheapest price of $460 for just the minimum liability insurance to a much higher rate of $3,624 for a driver who requires high-risk insurance.

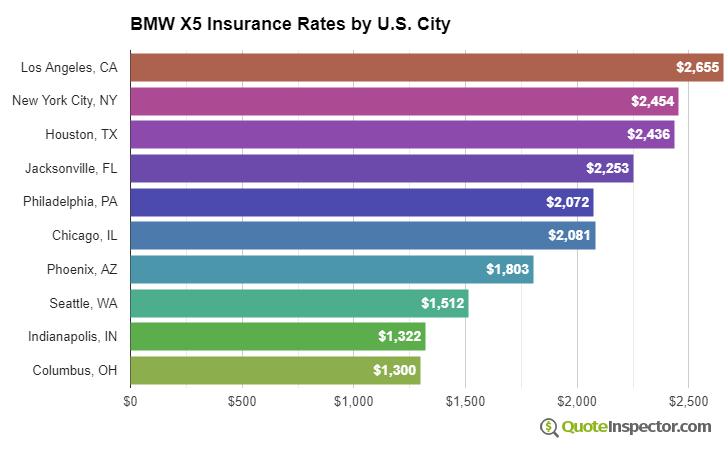

Price Range by Location

Your location has a large influence on the price of auto insurance. More rural locations tend to have more infrequent comprehensive and collision claims than densely populated cities.

The price range example below illustrates the difference location can make on insurance prices.

These examples highlight why anyone shopping for car insurance should compare rates for a targeted area and their own driving history, rather than using average rates.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Additional Rate Analysis

The chart below breaks down estimated BMW X5 insurance rates for other coverage scenarios.

- The best discount rate is $951

- Drivers who choose higher $1,000 deductibles will pay approximately $252 every year

- The average price for a 40-year-old driver who has $500 deductibles is $1,676

- Using more expensive low deductibles for comprehensive and collision insurance costs an extra $496 each year

- High-risk insureds who are prone to accidents and violations could pay up to $3,624 or more

- The cost to insure a teenage driver with full coverage can cost as much as $6,040 a year

Auto insurance rates for a BMW X5 can also vary considerably based on policy deductibles and limits, your driving characteristics, and the model year and trim level.

Using high physical damage deductibles could save up to $750 a year, while increasing your policy's liability limits will increase premiums. Changing from a 50/100 liability limit to a 250/500 limit will cost as much as $358 extra every year. View Rates by Deductible or Liability Limit

An older driver with a good driving record and higher deductibles may only pay around $1,500 per year on average for full coverage. Rates are much higher for teen drivers, since even excellent drivers will have to pay at least $6,000 a year. View Rates by Age

If you like to drive fast or you were responsible for an accident, you are likely paying $2,000 to $2,700 in extra premium per year, depending on your age. High-risk driver insurance can cost around 45% to 134% more than a normal policy. View High Risk Driver Rates

Where you live makes a big difference in BMW X5 insurance rates. A 40-year-old driver could pay as low as $1,290 a year in states like Vermont, New Hampshire, and Missouri, or be forced to pay as much as $2,390 on average in Louisiana, New York, and Michigan.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,518 | -$158 | -9.4% |

| Alaska | $1,288 | -$388 | -23.2% |

| Arizona | $1,394 | -$282 | -16.8% |

| Arkansas | $1,676 | -$0 | 0.0% |

| California | $1,912 | $236 | 14.1% |

| Colorado | $1,602 | -$74 | -4.4% |

| Connecticut | $1,726 | $50 | 3.0% |

| Delaware | $1,898 | $222 | 13.2% |

| Florida | $2,100 | $424 | 25.3% |

| Georgia | $1,550 | -$126 | -7.5% |

| Hawaii | $1,206 | -$470 | -28.0% |

| Idaho | $1,136 | -$540 | -32.2% |

| Illinois | $1,252 | -$424 | -25.3% |

| Indiana | $1,264 | -$412 | -24.6% |

| Iowa | $1,132 | -$544 | -32.5% |

| Kansas | $1,594 | -$82 | -4.9% |

| Kentucky | $2,292 | $616 | 36.8% |

| Louisiana | $2,484 | $808 | 48.2% |

| Maine | $1,038 | -$638 | -38.1% |

| Maryland | $1,384 | -$292 | -17.4% |

| Massachusetts | $1,344 | -$332 | -19.8% |

| Michigan | $2,916 | $1,240 | 74.0% |

| Minnesota | $1,404 | -$272 | -16.2% |

| Mississippi | $2,012 | $336 | 20.0% |

| Missouri | $1,490 | -$186 | -11.1% |

| Montana | $1,804 | $128 | 7.6% |

| Nebraska | $1,324 | -$352 | -21.0% |

| Nevada | $2,014 | $338 | 20.2% |

| New Hampshire | $1,212 | -$464 | -27.7% |

| New Jersey | $1,876 | $200 | 11.9% |

| New Mexico | $1,488 | -$188 | -11.2% |

| New York | $1,768 | $92 | 5.5% |

| North Carolina | $968 | -$708 | -42.2% |

| North Dakota | $1,376 | -$300 | -17.9% |

| Ohio | $1,160 | -$516 | -30.8% |

| Oklahoma | $1,726 | $50 | 3.0% |

| Oregon | $1,538 | -$138 | -8.2% |

| Pennsylvania | $1,602 | -$74 | -4.4% |

| Rhode Island | $2,240 | $564 | 33.7% |

| South Carolina | $1,522 | -$154 | -9.2% |

| South Dakota | $1,418 | -$258 | -15.4% |

| Tennessee | $1,470 | -$206 | -12.3% |

| Texas | $2,024 | $348 | 20.8% |

| Utah | $1,244 | -$432 | -25.8% |

| Vermont | $1,148 | -$528 | -31.5% |

| Virginia | $1,004 | -$672 | -40.1% |

| Washington | $1,298 | -$378 | -22.6% |

| West Virginia | $1,540 | -$136 | -8.1% |

| Wisconsin | $1,162 | -$514 | -30.7% |

| Wyoming | $1,494 | -$182 | -10.9% |

With so much variability in rates, the best way to figure out which company is cheapest is to compare rates and see how they stack up. Every company uses a different method to calculate rates, and quoted rates can be significantly different.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| BMW X5 3.0I AWD | $1,508 | $126 |

| BMW X5 3.5D AWD | $1,594 | $133 |

| BMW X5 4.8I AWD | $1,636 | $136 |

| BMW X5 M AWD | $1,890 | $158 |

Rates assume 2023 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 BMW X5 | $424 | $720 | $390 | $1,692 |

| 2023 BMW X5 | $406 | $714 | $398 | $1,676 |

| 2022 BMW X5 | $394 | $698 | $416 | $1,666 |

| 2021 BMW X5 | $380 | $668 | $430 | $1,636 |

| 2020 BMW X5 | $358 | $646 | $442 | $1,604 |

| 2019 BMW X5 | $344 | $598 | $452 | $1,552 |

| 2018 BMW X5 | $332 | $564 | $456 | $1,510 |

| 2017 BMW X5 | $318 | $506 | $460 | $1,442 |

| 2016 BMW X5 | $296 | $466 | $460 | $1,380 |

| 2015 BMW X5 | $286 | $436 | $464 | $1,344 |

| 2014 BMW X5 | $280 | $406 | $474 | $1,318 |

| 2013 BMW X5 | $258 | $378 | $474 | $1,268 |

| 2012 BMW X5 | $252 | $342 | $478 | $1,230 |

| 2011 BMW X5 | $234 | $314 | $474 | $1,180 |

| 2010 BMW X5 | $220 | $284 | $474 | $1,136 |

| 2009 BMW X5 | $214 | $256 | $468 | $1,096 |

| 2008 BMW X5 | $210 | $250 | $460 | $1,078 |

| 2006 BMW X5 | $190 | $226 | $446 | $1,020 |

Rates are averaged for all BMW X5 models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Shop for Cheaper BMW X5 Insurance

Saving money on auto insurance not only requires being a safe and courteous driver, but also having a good credit score, not filing small claims, and qualifying for all possible discounts. Make time to compare rates at every other renewal by requesting quotes from direct car insurance companies like GEICO, Progressive, and Esurance, and also from local insurance agencies.

Below is a condensed summary of the concepts that were touched on in this article.

- Drivers with multiple at-fault accidents may have to pay on average $1,950 more annually for auto insurance

- Teenage drivers are the costliest to insure, as much as $503 per month if comprehensive and collision insurance is included

- You may be able to save approximately $210 per year simply by shopping early and online

- Increasing deductibles could save as much as $750 each year

- You may be able to save approximately $210 per year simply by shopping early and online

Whether you are looking for 2008 or 2015 BMW insurance costs, shopping for quotes will help you find cheap insurance quotes for your BMW X5.

To jump right into finding insurance for everything from 2011 BMW X5 trim levels to 2001 BMW X5 price ranges, enter your ZIP code in our free tool below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the safety ratings of the BMW X5?

The safety ratings and features of the BMW X5 can affect BMW auto insurance rates. A BMW X5 that is old will have fewer safety features, which can mean higher rates. The BMW X5 has some great features, such as brake assist, night vision, blind-spot monitor, auto-leveling headlights, lane departure warning, lane-keeping assist, and cross-traffic alert.

The Insurance Institute for Highway Safety (IIHS) also gave the BMW X5 a 2019 Top Safety Pick award. Take a look at the ratings below.

- Small overlap front (driver-side): Good

- Small overlap front (passenger-side): Good

- Moderate overlap front: Good

- Side: Good

- Roof strength: Good

- Head restraints and seats: Good

The video below shows an example of one of the BMW X5 crash tests.

BMW X5 Compared Against Other Vehicles in the Same Class

The BMW X5 is a midsize luxury SUV. According to the IIHS, the BMW X5’s liability losses are average and better than average in comparison to other midsize luxury SUVs, which is good. It means the BMW X5’s liability rates should be reasonable.

Curious how other midsize luxury SUVs’ rates compare to the BMW X5’s, so you know how much does it cost to insure other SUVs? Take a look at the list below.

Frequently Asked Questions

- How much does it cost to maintain a BMW x5? According to RepairPal, “The annual maintenance cost of a BMW X5 is $1,166. Repair and maintenance costs vary depending on age, mileage, location and shop.”

Remember to use our free tool to shop around for rates, as BMW insurance for a 22-year-old will be different than BMW insurance for a 60-year-old. Enter your ZIP code in our free tool to start shopping for BMW X5 car insurance rates.

References

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $6,040 |

| 20 | $3,856 |

| 30 | $1,768 |

| 40 | $1,676 |

| 50 | $1,528 |

| 60 | $1,498 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $2,172 |

| $250 | $1,942 |

| $500 | $1,676 |

| $1,000 | $1,424 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,676 |

| 50/100 | $1,970 |

| 100/300 | $2,069 |

| 250/500 | $2,328 |

| 100 CSL | $2,009 |

| 300 CSL | $2,228 |

| 500 CSL | $2,388 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $8,664 |

| 20 | $6,130 |

| 30 | $3,724 |

| 40 | $3,624 |

| 50 | $3,456 |

| 60 | $3,426 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $91 |

| Multi-vehicle | $86 |

| Homeowner | $23 |

| 5-yr Accident Free | $129 |

| 5-yr Claim Free | $109 |

| Paid in Full/EFT | $81 |

| Advance Quote | $85 |

| Online Quote | $121 |

| Total Discounts | $725 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area