Honda Accord Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Apr 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Are you wondering why Honda Accord insurance is so expensive? The truth is, it doesn’t have to be. The average Honda Accord car insurance rates are $109 per month or $1,310 annually.

However, many factors impact your Honda Accord auto insurance quotes, like the age of your model. For example, the 2017 Honda Accord insurance costs will be lower than the 2005 Honda Accord insurance costs.

How do the 2019 Honda Accord Sport 2.0T insurance costs compare to the 2002 Honda Accord insurance rates? Read through our brief guide to have these questions and more answered as you search for an affordable Honda Accord car insurance company.

The Honda Accord has consistently been one of the best selling cars in America, with only the Toyota Corolla, Toyota Camry, and Honda Civic having more models on the road. The Honda Accord model options now include the 2.0L turbo model, a 1.5L turbo model, the Accord Hybrid, and various other trims.

Read through our complete Honda Accord insurance guide to better understand how your rates are calculated. We’ll also review a few car insurance basics, like what does liability insurance cover, and is it enough to fully protect your Honda Accord?

When buying an Accord, the cost of car insurance should always be considered in the overall cost of ownership. Honda includes a lot of standard features on its Accord model that help keep insurance costs down.

Let’s take a look at the overall insurance rate summary and dive into some of the factors that can influence how much insurance is going to cost you after you sign on the dotted line.

Can’t wait to get started? Enter your ZIP code into our free quote comparison tool above to find cheap Honda car insurance near you.

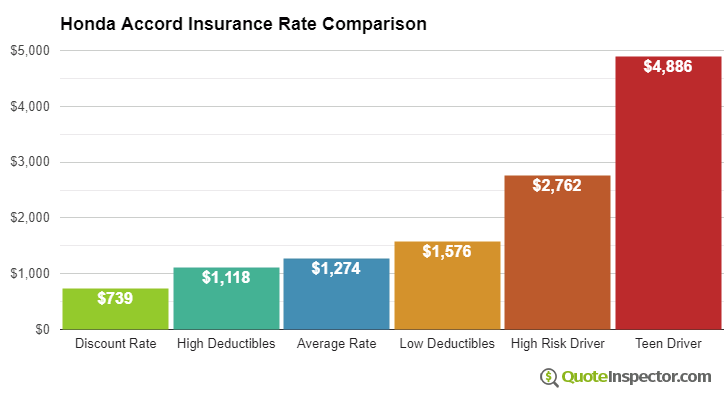

U.S. average insurance prices for a Honda Accord are $1,290 every 12 months for full coverage insurance. Comprehensive costs around $256 a year, collision costs $478, and liability coverage is estimated at $398. Liability-only insurance costs approximately $460 a year, with high-risk driver insurance costing around $2,796. Teen drivers pay the highest rates at $4,886 a year or more.

Average premium for full coverage: $1,290

Price estimates for individual coverage:

Includes $500 comprehensive and collision deductibles, minimum liability limits, and includes both medical and uninsured motorist insurance. Estimates are averaged for all 50 states and Accord trim levels.

Price Range from Low to High

For a driver around age 40, Honda Accord insurance prices go from the cheapest price of $460 for minimum levels of liability insurance to a high of $2,796 for high-risk insurance.

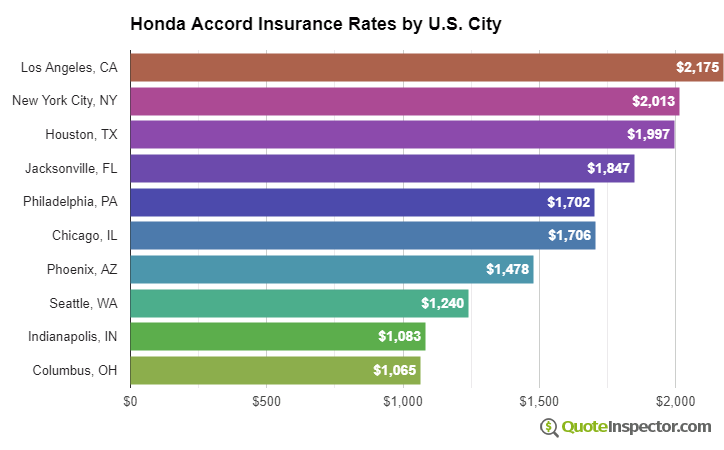

Geographic Price Range

Living in a larger city has a large influence on car insurance rates. Areas with sparse population have more infrequent physical damage claims than larger metro areas.

The diagram below illustrates the difference between rural and urban areas on auto insurance rates.

The ranges above illustrate why it is important to get quotes for a specific zip code and their own driving history, rather than using price averages.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Additional Rate Details

The chart below illustrates estimated Honda Accord insurance rates for additional coverage choices and driver risks.

- The lowest rate with discounts is $746

- Choosing higher $1,000 deductibles can save about $1,124 each year

- The average price for the average middle-age driver using $500 deductibles is $1,290

- Choosing low $100 deductibles for comp and collision coverage increases the price to $1,614

- Drivers with multiple violations and an at-fault accident could pay at least $2,796 or more

- The price to insure a teenage driver can be $4,886 each year

Car insurance prices for a Honda Accord are also quite variable based on deductibles and policy limits, your risk profile, and the trim level and model year.

Choosing high deductibles can save as much as $490 a year, while buying higher liability limits will increase prices. Switching from a 50/100 liability limit to a 250/500 limit will increase prices by as much as $405 extra every 12 months. View Rates by Deductible or Liability Limit

Older drivers with no driving violations and higher deductibles may only pay around $1,200 annually on average for full coverage. Prices are highest for teenage drivers, since even excellent drivers will be charged as much as $4,800 a year. View Rates by Age

If you have some driving violations or you were responsible for an accident, you are probably paying at least $1,500 to $2,100 extra each year, depending on your age. A high-risk auto insurance policy ranges around 43% to 130% more than average. View High Risk Driver Rates

The state you live in plays a big part in determining prices for Honda Accord insurance rates. A good driver about age 40 could pay as low as $850 a year in states like Vermont, Wisconsin, and North Carolina, or as much as $1,740 on average in Michigan, New York, and Florida.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,168 | -$122 | -9.5% |

| Alaska | $990 | -$300 | -23.3% |

| Arizona | $1,070 | -$220 | -17.1% |

| Arkansas | $1,290 | -$0 | 0.0% |

| California | $1,470 | $180 | 14.0% |

| Colorado | $1,234 | -$56 | -4.3% |

| Connecticut | $1,328 | $38 | 2.9% |

| Delaware | $1,460 | $170 | 13.2% |

| Florida | $1,614 | $324 | 25.1% |

| Georgia | $1,190 | -$100 | -7.8% |

| Hawaii | $926 | -$364 | -28.2% |

| Idaho | $874 | -$416 | -32.2% |

| Illinois | $964 | -$326 | -25.3% |

| Indiana | $972 | -$318 | -24.7% |

| Iowa | $872 | -$418 | -32.4% |

| Kansas | $1,228 | -$62 | -4.8% |

| Kentucky | $1,762 | $472 | 36.6% |

| Louisiana | $1,910 | $620 | 48.1% |

| Maine | $796 | -$494 | -38.3% |

| Maryland | $1,064 | -$226 | -17.5% |

| Massachusetts | $1,034 | -$256 | -19.8% |

| Michigan | $2,242 | $952 | 73.8% |

| Minnesota | $1,080 | -$210 | -16.3% |

| Mississippi | $1,548 | $258 | 20.0% |

| Missouri | $1,146 | -$144 | -11.2% |

| Montana | $1,386 | $96 | 7.4% |

| Nebraska | $1,018 | -$272 | -21.1% |

| Nevada | $1,548 | $258 | 20.0% |

| New Hampshire | $930 | -$360 | -27.9% |

| New Jersey | $1,444 | $154 | 11.9% |

| New Mexico | $1,144 | -$146 | -11.3% |

| New York | $1,360 | $70 | 5.4% |

| North Carolina | $744 | -$546 | -42.3% |

| North Dakota | $1,056 | -$234 | -18.1% |

| Ohio | $894 | -$396 | -30.7% |

| Oklahoma | $1,328 | $38 | 2.9% |

| Oregon | $1,184 | -$106 | -8.2% |

| Pennsylvania | $1,232 | -$58 | -4.5% |

| Rhode Island | $1,722 | $432 | 33.5% |

| South Carolina | $1,170 | -$120 | -9.3% |

| South Dakota | $1,088 | -$202 | -15.7% |

| Tennessee | $1,130 | -$160 | -12.4% |

| Texas | $1,556 | $266 | 20.6% |

| Utah | $956 | -$334 | -25.9% |

| Vermont | $884 | -$406 | -31.5% |

| Virginia | $772 | -$518 | -40.2% |

| Washington | $998 | -$292 | -22.6% |

| West Virginia | $1,184 | -$106 | -8.2% |

| Wisconsin | $894 | -$396 | -30.7% |

| Wyoming | $1,148 | -$142 | -11.0% |

Since prices can be so different, the only way to figure out your exact price is to get quotes and see how they stack up. Each auto insurer uses a different rate calculation, so rate quotes may be quite different.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Honda Accord LX 4-Dr Sedan | $1,094 | $91 |

| Honda Accord EX 4-Dr Sedan | $1,136 | $95 |

| Honda Accord LX-P 4-Dr Sedan | $1,136 | $95 |

| Honda Accord EX 2-Dr Coupe | $1,436 | $120 |

| Honda Accord EX-L 4-Dr Sedan | $1,222 | $102 |

| Honda Accord LX-S 2-Dr Coupe | $1,436 | $120 |

| Honda Accord EX-L 2-Dr Coupe | $1,520 | $127 |

Rates assume 2023 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Honda Accord | $268 | $482 | $390 | $1,298 |

| 2023 Honda Accord | $256 | $478 | $398 | $1,290 |

| 2022 Honda Accord | $248 | $466 | $416 | $1,288 |

| 2021 Honda Accord | $240 | $446 | $430 | $1,274 |

| 2020 Honda Accord | $226 | $430 | $442 | $1,256 |

| 2019 Honda Accord | $218 | $400 | $452 | $1,228 |

| 2018 Honda Accord | $208 | $376 | $456 | $1,198 |

| 2017 Honda Accord | $200 | $338 | $460 | $1,156 |

| 2016 Honda Accord | $188 | $310 | $460 | $1,116 |

| 2015 Honda Accord | $180 | $292 | $464 | $1,094 |

| 2014 Honda Accord | $176 | $272 | $474 | $1,080 |

| 2013 Honda Accord | $164 | $252 | $474 | $1,048 |

| 2012 Honda Accord | $158 | $228 | $478 | $1,022 |

| 2011 Honda Accord | $148 | $210 | $474 | $990 |

| 2010 Honda Accord | $140 | $190 | $474 | $962 |

| 2009 Honda Accord | $134 | $170 | $468 | $930 |

| 2008 Honda Accord | $132 | $166 | $460 | $916 |

| 2007 Honda Accord | $130 | $160 | $452 | $900 |

| 2006 Honda Accord | $120 | $152 | $446 | $876 |

| 2005 Honda Accord | $116 | $144 | $442 | $860 |

Rates are averaged for all Honda Accord models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Shop for the Cheapest Honda Accord Insurance

Getting lower rates on auto insurance takes having a decent driving record, maintaining a good credit score, not filing small claims, and qualifying for all possible discounts. Set aside time to compare rates every couple of years by getting quotes from direct insurance companies like Progressive, GEICO, and Esurance, and also from your local independent and exclusive agents.

The following items are a recap of the material that was covered above.

- Consumers who may need additional liability coverage will pay about $440 annually to raise limits from a low limit to a 250/500 level

- 16 to 18-year-old drivers are the costliest to insure, as much as $407 a month if the policy includes full coverage

- Drivers that have major violations or accidents may pay on average $1,510 more every year than a driver with a clean driving record

- Increasing physical damage deductibles could save as much as $500 each year

So, are Honda Accords really expensive to insure? As you’ve learned from the previous information, many variables impact your Honda Accord insurance costs. Certain driver demographics, such as your age, your driving record, and where you live, can change your rates drastically.

However, variables about your actual vehicle also come into play. For example, the age of your Honda Accord model and the trim level you choose will influence your annual rates.

Older used Honda Accords will cost less to insure than newer models with more up-to-date technology and features. For example, the 2015 Honda Accord insurance costs are a bit lower than the 2016 Honda Accord insurance costs.

Similarly, various trims can change the safety ratings, fuel efficiency, and maintenance costs for your vehicle, which impact your overall costs. Therefore, the Honda Accord Hybrid insurance costs will be different than the Honda Accord Turbo rates.

No matter what model year or trim level you’ve chosen, comparing quotes from multiple companies is the best way to know you’re getting the lowest Honda Accord car insurance rates. Enter your ZIP code into our free tool below to start comparing cheap Honda Accord insurance quotes right now.

Compare Quotes From Top Companies and SaveFree Car Insurance Comparison

Secured with SHA-256 Encryption

What Honda Accord features help reduce insurance costs?

Honda offers an advanced safety suite that can help make your driving experience safer, preventing you from needing to file any insurance claims. Because your risks on the road are lowered, it could also help lead to lower car insurance rates.

Standard in all Honda Accord models, the Honda Sensing technology suite helps mitigate accidents and keeps the driver more aware of what is happening on the road around them.

Honda Sensing includes the following features:

- Collision Mitigation Braking System. When an accident is imminent, this feature applies the brakes to help prevent a collision.

- Road Departure Mitigation System. This feature detects when the car drifts too far to the side of the road and can steer the vehicle back into the lane.

- Adaptive Cruise Control. This is one of our favorite features, as it prevents the need to constantly monitor cruise control settings. As you approach a slower-moving vehicle, the system adapts your speed to maintain a safe distance behind the vehicle. After you signal to pass and are clear of the vehicle, the system will automatically speed up to the set cruise speed.

- Lane Keeping Assist System. This detects when the vehicle approaches a lane marking and will nudge the car back into the center of the lane if you have not signaled a lane change.

- Traffic Sign Recognition. New on 2018 models, this feature can detect speed limit signs and alert the driver of changes in speed.

The Honda Sensing suite does a fantastic job of helping reduce accidents and as a result, fewer accidents mean lower insurance rates. The technology does not entirely replace driver awareness and safe driving habits, but it can help reduce the chances of an accident or reduce the severity.

Many insurance companies also offer discounts to customers whose vehicles have some of these safety features, like adaptive cruise control. Inform your insurance provider about what technology your vehicle comes equipped with to see what discounts your Accord qualifies for.

Another new feature that is standard on the Accord Sport 2.0T, EX, EX-L, and Touring models is multi-angle awareness and cross-traffic monitoring built into the rearview camera.

This technology expands the sensor sensitivity to include a wider sensor field and also detects vehicles that may be approaching from the left or right behind your Accord. This can help reduce collisions that occur from backing out of your driveway or a parking stall.

What are the Honda Accord safety ratings?

Insurance providers will consider the Honda Accord safety ratings when determining your car insurance rates.

Check out the safety ratings for the 2021 Honda Accord as awarded by the Insurance Institute for Highway Safety (IIHS) below.

- Small overlap front (driver-side): Good

- Small overlap front (passenger): Good

- Moderate overlap front: Good

- Side: Good

- Roof strength: Good

- Head restraints and seats: Good

A rating of ‘Good’ is the highest possible score given by the IIHS. As you can see, this sedan received perfect marks. In fact, the 2020 and 2021 Honda Accord was named as one of the 2020 Top Safety Picks. Your car insurance rates will already reflect these great safety ratings.

Historically, different model years of the Honda Accord have performed consistently well in safety tests. The 2018 Honda Accord also received the Top Safety Pick award by earning good ratings for small overlap front, moderate overlap front, and side collision crashworthiness.

It also received a ‘Good’ rating for roof strength and head restraints. The Honda Sensing suite helped it earn a superior rating for front crash prevention, and the headlights were rated as acceptable.

The one improvement over the 2017 Accord safety ratings was the improvement of the child seat anchors. The 2018 model received a good rating, while the 2017 model only received an acceptable rating.

Since insurance rates correlate directly to the likelihood of occupant injury in an accident, the safety features built into the Honda Accord and the excellent ratings mean you won’t find a safer car for the money.

What are the Honda Accord crash test ratings?

Like safety ratings, insurance providers will also consider the Honda Accord crash test ratings when calculating your car insurance premiums. Customarily, good crash test ratings mean cheaper average rates.

Take a look at the table below to see the Honda Accord crash test results for various different model years and trim levels as scored by the National Highway Traffic Safety Administration (NHTSA).

Honda Accord Crash Test Ratings| Vehicle Tested | Overall Rating | Frontal Crash | Side Crash | Rollover |

|---|---|---|---|---|

| 2021 Honda ACCORD HYBRID 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Honda ACCORD SEDAN 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Honda ACCORD 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Honda ACCORD HYBRID 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Honda ACCORD 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Honda Accord Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Honda Accord Hybrid 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2017 Honda Accord 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2017 Honda Accord 2 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Honda Accord 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2015 Honda Accord 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2015 Honda Accord 2 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2015 Honda Accord Hybrid 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2014 Honda Accord Hybrid 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2014 Honda Accord 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2014 Honda Accord 2 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2013 Honda Accord 2 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2013 Honda Accord 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2013 Honda Accord 2 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2012 Honda Accord V6 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2012 Honda Accord 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2012 Honda Accord 2 DR FWD | N/R | N/R | N/R | 5 stars |

| 2012 Honda Accord V6 2 DR FWD | N/R | N/R | N/R | 5 stars |

| 2011 Honda Accord Sedan 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2011 Honda Accord 2 DR FWD | N/R | N/R | N/R | 5 stars |

| 2011 Honda Accord Crosstour SUV AWD | N/R | N/R | N/R | 4 stars |

| 2011 Honda Accord Crosstour SUV FWD | N/R | N/R | N/R | 4 stars |

None of the Honda Accord builds earned less than 4-star ratings, which is excellent. However, it is still worth looking at the details for your specific Honda Accord model year and trim level when estimating your potential insurance costs to ensure the most accuracy.

If you’re in the market for a new car and are considering the Honda Accord, you won’t be disappointed with its safety and reliability. Plus, you can expect to pay cheaper car insurance rates.

If you currently own and drive an Accord, your car insurance rates will already reflect these great crash-test results.

What is the Honda Accord insurance loss probability?

When you’re buying a new vehicle, it’s important to add car insurance rates to the overall total you’re willing to spend. But how do you know how much a car will cost to insure before you actually seek out quotes?

One easy way is to look at insurance loss probability details. Insurance loss probabilities give us important information about what insurance costs will be. High insurance loss probabilities equal high rates, while low insurance loss probabilities equal low rates.

Check out the Honda Accord insurance loss probability details as calculated by the Insurance Institute for Highway Safety (IIHS) in the table below.

Honda Accord Insurance Loss Probability| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | 4% |

| Property Damage | -40% |

| Comprehensive | 51% |

| Personal Injury | 29% |

| Medical Payment | 9% |

| Bodily Injury | -32% |

The insurance losses for comprehensive coverage and personal injury coverage are high, which means these coverages will likely be more expensive than average.

However, the property damage insurance losses are substantially better than average, which means property damage liability insurance for the Honda Accord will be more affordable. But the personal injury coverage, which has a worse than average loss ratio, will not be as competitively priced.

Should you compare the Honda Accord to other vehicles in the same car class?

Before taking the plunge and purchasing a Honda Accord, or any car for that matter, it is worth comparing the vehicle to other cars in the same class. Officially, the IIHS classifies the Accord as a midsize four-door car.

Check out other comparable midsize sedans in the list below and see how the car insurance rates vary.

Comparing the Honda Accord to similar vehicles can help you save money on car insurance, especially if the Honda Accord has better insurance loss ratios than other vehicles in the same class.

By comparing vehicles this way, you’ll be able to estimate which car is within your budget, meets your personal needs, and will not cost you an arm and a leg to insure.

What is the Honda Accord cost to own? The Honda Accord prices range from $23,570 for the LX model up to $29,970 for the EX-L model, with the Hybrid, Sport, and EX models priced in between.

The entry price for an Accord LX is lower than the Toyota Camry LE but is slightly higher than both the Nissan Altima 2.5 S and the Hyundai Sonata SE. Fortunately, the overall economical Honda prices will help keep your insurance rates low.

You are now an expert on securing affordable Honda Accord insurance rates. If you are on the hunt for a good looking sedan that offers a top-notch suite of safety features and is affordable to insure, the Honda Accord should be at the top of your list.

Before you buy Honda Accord car insurance, make sure to shop around. We can help you find cheap Honda Accord car insurance quotes from multiple companies near you.

Find your cost to insure a Honda Accord right now by entering your ZIP code into our FREE quote tool.

References:

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $4,886 |

| 20 | $2,990 |

| 30 | $1,342 |

| 40 | $1,290 |

| 50 | $1,180 |

| 60 | $1,156 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,614 |

| $250 | $1,464 |

| $500 | $1,290 |

| $1,000 | $1,124 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,290 |

| 50/100 | $1,610 |

| 100/300 | $1,723 |

| 250/500 | $2,015 |

| 100 CSL | $1,655 |

| 300 CSL | $1,903 |

| 500 CSL | $2,083 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $6,956 |

| 20 | $4,756 |

| 30 | $2,852 |

| 40 | $2,796 |

| 50 | $2,670 |

| 60 | $2,646 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $68 |

| Multi-vehicle | $68 |

| Homeowner | $19 |

| 5-yr Accident Free | $94 |

| 5-yr Claim Free | $83 |

| Paid in Full/EFT | $58 |

| Advance Quote | $63 |

| Online Quote | $91 |

| Total Discounts | $544 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area